Do We Hear Faint Santa Bells

December 22, 2025

Market Roundup for the Week

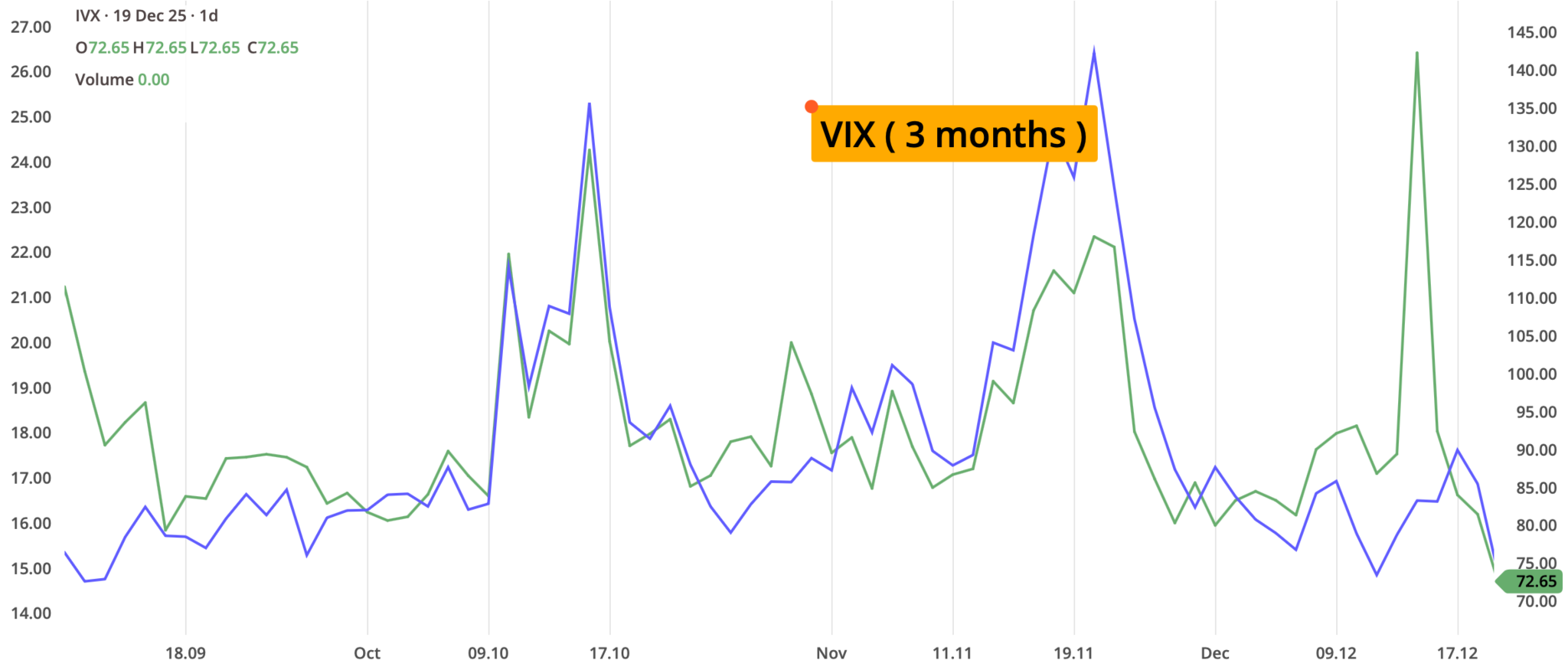

Market sentiment for the week of December 15–19, 2025, can best be described as a "tale of two halves". The week began with a distinct "risk-off" mood as investors worried about high AI valuations and the final batch of economic data for the year. However, a late-week surge in consumer optimism and cooler inflation data triggered a powerful relief rally by Friday.

Equities appeared to swing from anxiety to relief. The major indices opened the week under pressure, particularly tech stocks, which were hit by "AI bubble" fears and a rotation into value. Sentiment shifted sharply on Thursday and Friday following a better-than-expected Consumer Price Index (CPI) report and a surprising jump in the University of Michigan Consumer Sentiment index.

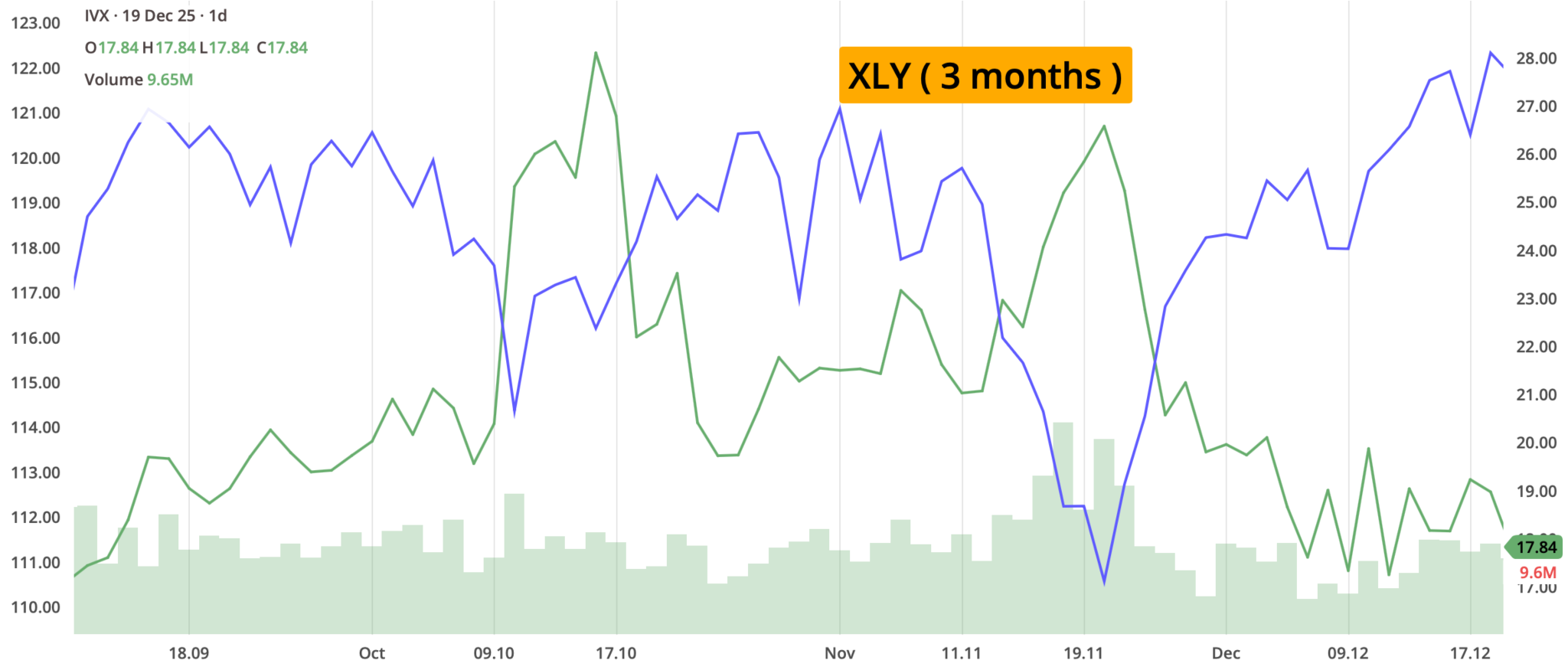

The week was largely mixed to modest for U.S. equities. Large-cap indices held steady, tech rebounded late, small caps lagged, and energy and real estate sectors underperformed. highlighting a generally cautious, low-volatility market environment ahead of the holiday week.

Gold edged higher and hit an 8-week high, closing near $4,361. Sentiment was bolstered by easing price pressures and expectations for Fed rate cuts in early 2026.

Bitcoin edged lower, facing heavy selling pressure mid-week before recovering as the broader "risk-on" mood returned Friday.

Crude Oil sentiment was dominated by a global supply glut and weak demand outlooks, which overshadowed geopolitical tensions in Venezuela.

The week concluded with renewed optimism for a "soft landing". With inflation expectations for the year ahead falling to 4.2%, market sentiment shifted toward a belief that the Federal Reserve will have more "breathing room" to cut rates in early 2026. This forward-looking hope helped the markets end the final full trading week of 2025 on a high note.

Friday, December 19, was a "Quadruple Witching" day—the simultaneous expiration of daily, weekly, monthly and quarterly options on stocks and stock index futures. Trading volume reached record-breaking levels, with an estimated $7 trillion in notional value expiring.

While the indices ended the day relatively stable, individual stocks saw "choppy" price action in the final 30 minutes as institutional investors rushed to close out or roll over their positions.

In essence, the week was a two-sided market – extreme disappointment and selling in the narrow group of AI leaders, offset by strength and enthusiasm across a much broader base of traditional American companies, driven by dovish Fed expectations.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

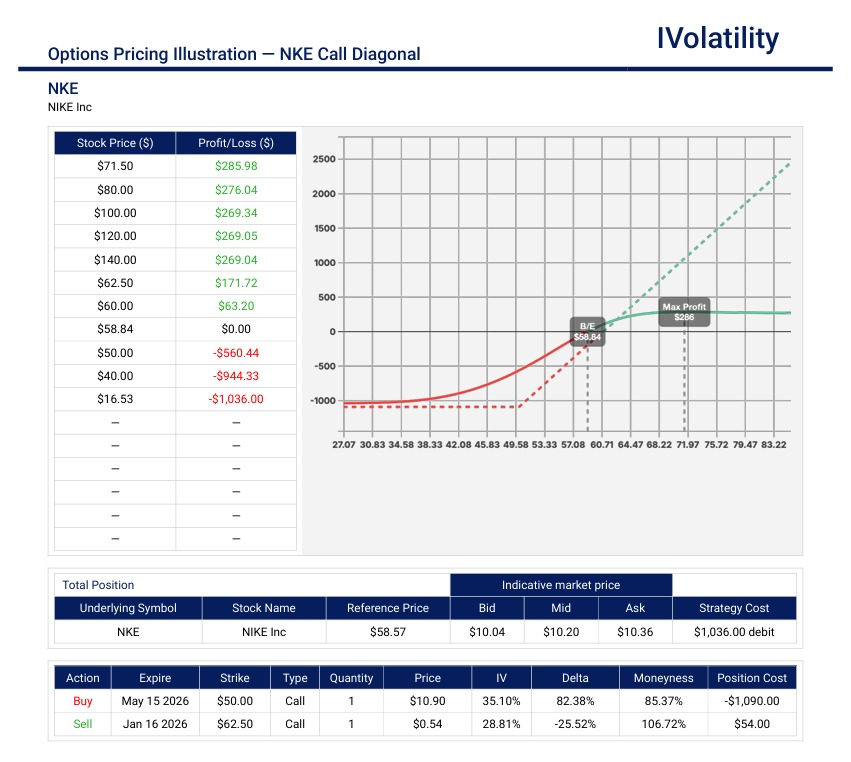

- NKE (closed around 58.71 on Friday, Dec 19th)

This underlying released earnings on December 18th and despite beating on earnings and revenue expectations, Nike's stock dropped sharply (≈10%) after the release, mainly due to shrinking profit margins and cautious commentary on international demand.Some analysts cut price targets while still rating the stock overweight/positive, though sentiment is cautious. Investors are watching whether Nike's strategic "turnaround" under the new CEO is gaining traction, particularly in China and digital channels. Management described the company as being in the "middle innings" of its turnaround, emphasizing:

- Rebalancing product portfolio

- Strengthening wholesale partnerships

- Reducing excess inventory

Given all this, a trader could get bullish on NKE. With IVR so low, it may make better sense to buy a position. Selling a position may not compensate the investor for the risk assumed.

Buy the May15 50call / Sell the Jan16 62.5 call Call Diagonal for approximately $1000

There are multiple weekly expirations to to roll out the covering call and further reduce cost basis of the diagonal.

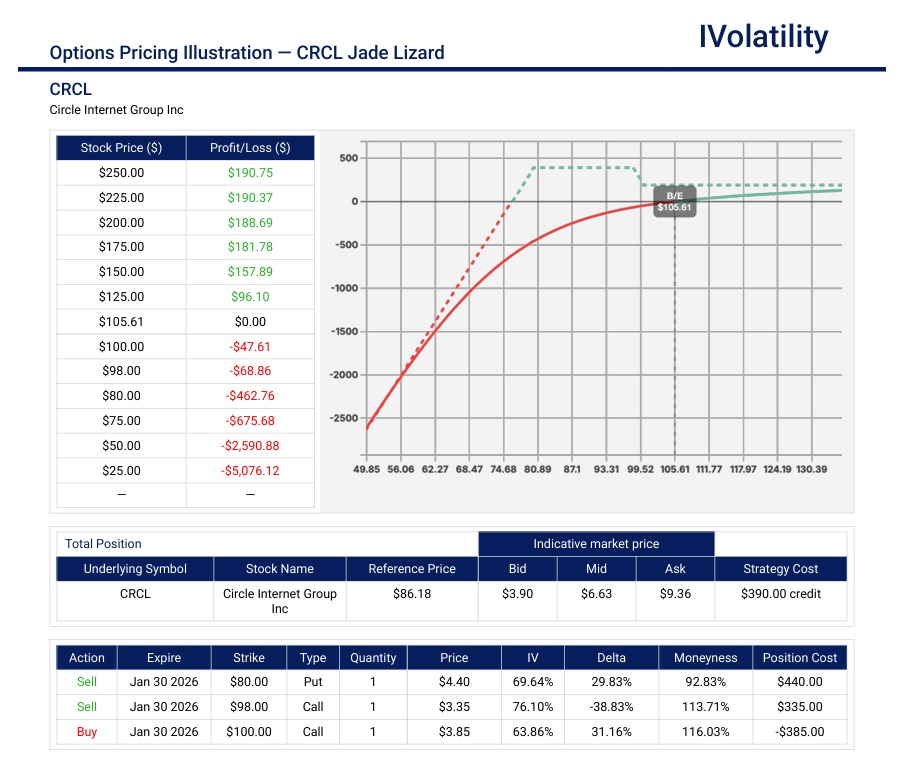

PnL Calculator from the IVolLive Web - CRCL (closed around 86.17 on Friday, Dec 19th)

This underlying has been scraping the lower end of its 6-month value. An investor could take a bullish position by selling a Jade Lizard.

For the Jan30th expiration, sell the 80put and the 998/100 call spread. To reduce buying power, a trader could buy an inexpensive long put as long as the credit collected exceeds the width of the short call spread.

Credit collected: approximately $6.50

No upside risk since the credit collected covered the $2 wide call spread.

Downside breakeven is around 74 (80put less credit collected of $6)

Probability of profit: approximately 71%

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

| INDEX | UP | DOWN |

| SPY | 0.1% | |

| QQQ | 0.5% | |

| IWM | -0.9% | |

| DIA | -0.7% | |

| GLD | 0.81% | |

| BTC/USD | -0.45% | |

| TLT | -0.48% | |

| Crude Oil | -0.56% | |

| VIX | -9.64% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | 0.21% | |

| FINANCIALS (XL) | -0.04% | |

| INDUSTRIALS (XLI) | -0.49% | |

| ENERGY XLE | -3.24% | |

| HEALTHCARE (XLV) | 0.77% | |

| UTILITIES (XLU) | 0.19% | |

| MATERIALS (XLB) | 0.78% | |

| REAL ESTATE (XLRE) | -0.90% | |

| CONSUMER STAPLES (XLP) | -0.62% | |

| CONSUMER DISCRETIONARY (XLY) | 1.36% |

Notable gainers for the week of Dec 15th - 19th:

This week's gains were stock-specific and catalyst-driven, rather than broad market rallies, as U.S. indices showed mixed performance early, then rebounded late. Technology and healthcare sectors were among the relative outperformers.

Rivian Automotive (RIVN) rose nearly 21% and led large-cap gainers as the company expanded hands-free driving features and rolled out new software updates. Positive analyst actions also helped fuel the rally.

Moderna (MRNA) climbed nearly 10%, boosted by vaccine funding news and broader healthcare sector resilience.

BioMarin Pharmaceutical (BMRN) experienced a significant 18% upside after announcing a major acquisition.

Oracle (ORCL) gained nearly 7% following news of a strategic joint venture tied to TikTok's U.S. operations.

Micron Technology (MU) rose nearly 10% following strong earnings results.

Advanced Micro Devices (AMD) rose over 6%, benefitting from a tech rebound.

Notable losers for the week of Dec 15th - 19th:

Decliners outpaced advancers on major U.S. exchanges during the week, particularly mid-week, reflecting pressure on growth and tech shares.

Nike (NKE) dropped a sharp 10% over the week following its earnings report and guidance weakness, particularly driven by expected sales declines in China.

Lamb Weston Holdings (LW) fell about 26%, making it the largest single stock decliner among notable US equities.

Iron Disc Medicine (IRON) dropped nearly 12% Significant share sales by company insiders were reported during the week, which put selling pressure on the stock. A report circulated that U.S. FDA skepticism emerged about the accelerated approval pathway for Disc Medicine's lead experimental drug bitopertin (for rare blood disorder EPP), with some analysts and commentators questioning elements of the review process. This regulatory uncertainty additionally weighed on investor sentiment.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

The last full trading week of the year got off to a rough start as investors braced for the delayed November jobs report tomorrow. Fed governor Stephen Miran argued that the central bank shouldn't be scared of "phantom inflation", but NY Fed President John Williams says monetary policy is now "well positioned" heading into 2026.

Copper keeps hitting new highs, and analysts expect more record-breaking growth next year.

Bitcoin tumbled back to just above $85,000 as investors took a risk-off stance to start a week filled with economic data.

In other news:

- traders were shifting out of AI stocks and into value picks after the Fed cut rates.

- The FDA approved a luxurious $250,000 Singapore work trip for employees during the government shutdown.

- Consulting titan McKinsey announced plans to cut thousands of jobs after years of stalling revenue growth.

- There were ripples that the Trump administration is expected to hire 1,000 engineers and other experts to build an AI-focused "Tech Force".

Monday's Movers to the Upside:

- Tesla rose over 3.5% to an all-time high after CEO Elon Musk said the company's robotaxis are moving into their next testing phase.

- Oncology company Immunome jumped over 15% after reporting positive Phase 3 results for its treatment targeting desmoid tumors.

- Good day for retailers such as Abercrombie & Fitch who climbed another 6% following a recent Buy rating from Goldman Sachs, while American Eagle gained over 6% based on similar vibes.

Monday's Movers to the Downside:

- The AI trade selloff punished stocks like Broadcom (down over 5.5%), Oracle (down over 2.5%), and CoreWeave (down nearly 8%).

- Uber sank nearly 4% and Lyft dropped over 6% on news that Tesla is making strides in getting its robotaxis on the road without a human driver.

- Zillow tumbled nearly 8.5% on worries that Google may become a major rival after the search giant began testing real estate listings on its search results pages.

- Strategy sank over 8% as bitcoin fell below $86,000, a drop that hit hard after the fund added nearly $1 billion worth of the token to its holdings last week.

- ServiceNow fell over 11.5% after reports that it's in advanced talks to acquire cybersecurity startup Armis in a deal that could reach $7 billion.

- Chinese tech stocks slid thanks to weak economic data and President Xi Jinping's warning against "reckless" growth. Alibaba fell over 3.5%, Baidu lost nearly 5%, and JD.com sank 2%.

- Tilray Brands dropped over 10% amid uncertainty over whether President Trump will actually move to loosen federal marijuana restrictions.

- Luminar Technologies plunged 60%% after filing for Chapter 11 bankruptcy, following the loss of a major contract with car maker Volvo.

Tuesday's Markets and News:

Investors spent the day digesting a mixed jobs reports though the QQQs enjoyed a late rally that pushed it into the green, ending a three-day losing streak.

US retail sales were flat in October, below analyst expectations, in yet another sign that the economy may not be as sturdy as it seems.

Oil futures fell below $55 per barrel at one point for the first time since 2021 thanks to renewed hopes for peace in Ukraine, sky-high domestic supply, and low demand from China.

In other news:

- CEOs are starting to reluctantly embrace President Trump's version of state capitalism.

- Ford is taking a steep $19.5 billion hit in charges tied to its EV business.

- PepsiCo worked to spike prices of soda and other products to help Walmart, the FTC alleged in a recently unsealed lawsuit that had been dismissed by the Trump administration.

Tuesday's Movers to the Upside:

- Pot stocks jumped after President Trump said he's "very strongly" considering an executive order to reschedule marijuana. Curaleaf rose over 22%, Tilray Brands popped over 27%, and Canopy Growth surged over 10%.

- IonQ rose nearly 8% after Jefferies initiated coverage on the quantum computing stock with a Buy rating and a $100 price target.

- Estée Lauder gained nearly 3.5% after Bank of America named it their top beauty pick for 2026, citing confidence in the company's turnaround.

- Elanco Animal Health moved 3.69% higher following a spate of insider buying activity.

- Circle Internet Group climbed nearly 10% after Visa said US partners can now settle transactions in USDC.

Tuesday's Movers to the Downside:

- Pfizer fell nearly 3.5% after forecasting 2026 profit below expectations on weaker COVID product sales.

- Humana dipped over 6% after announcing the retirement of its president, despite reiterating full-year guidance.

- Navan sank nearly 12% on a third-quarter loss and disclosed its CFO will step down in January.

- Duluth Holdings plunged nearly 30% after posting a narrower-than-expected Q3 loss, but still missing revenue estimates.

- Halliburton fell over 4% and APA sank over 5% after crude prices tumbled.

Wednesday's Markets and News:

All three indexes were dragged lower as the AI trade continued to lose steam, putting the Nasdaq and the S&P 500 on track for their worst month since March.

Treasury yields stayed steady all day long while traders awaited Thursday's CPI report.

Lithium popped after Chinese authorities revealed plans to revoke 27 local mining licenses. Meanwhile, silver hit yet another new record high, breaking above $66 for the first time.

Wednesday's Movers to the Upside:

- Hut 8 surged nearly 9% after signing a $7 billion deal to lease a Louisiana data center, marking its next step in pivoting from crypto mining to AI infrastructure.

- Spirit Airlines popped 15% after it revived merger talks with Frontier Group, a deal that would create the fifth-largest U.S. airline by passenger miles.

- Texas Pacific Land gained over 7.5% after announcing a partnership with Bolt Data & Energy to develop AI-focused data centers on its West Texas acreage, backed by a $50 million investment.

- Udemy soared nearly 13% following news of its $2.5 billion merger agreement with Coursera, combining two major players in online education.

- DBV Technologies jumped over 25% on positive Phase 3 trial results for its peanut-allergy treatment in children.

- Medical product maker Medline skyrocketed over 41% after its IPO, one of the biggest market debuts in years.

Wednesday's Movers to the Downside:

- Oracle slid nearly 5.5% after Blue Owl Capital pulled out of a planned $10 billion OpenAI data center project, reportedly over concerns about Oracle's rising debt load.

- Brown-Forman dipped over 5% after Citigroup downgraded the stock to Sell and cut its price target.

- Lennar dropped over 4.5% following a Q4 earnings miss and softer-than-expected guidance for new orders and deliveries in the first quarter.

- Paramount Skydance fell nearly 5.5% after Warner Bros. Discovery's board urged shareholders to reject Paramount's offer and proceed with a competing deal from Netflix.

Thursday's Markets and News:

All three major indices jumped after CPI came in lower than expected, with the AI trade regaining some lost ground and helping the S&P 500 snap a four-day losing streak.

Initial jobless claims fell by 13,000 last week, giving the labor market a bit of good news to offset Tuesday's rough employment report.

Oil kept climbing, while gold hovered near recent highs as investors digested a week of big economic data.

Thursday's Movers to the Upside:

- Lululemon jumped nearly 3.5% after activist investor Elliott Management disclosed a $1 billion stake, and is reportedly eyeing a new CEO to revive the brand.

- SoFi rose 4% after launching SoFiUSD, its new stablecoin for commercial clients.

- Rocket Lab climbed over 11% after successfully launching the STP-S30 mission for the US Space Force.

- Rivian Automotive added 15% following an upgrade from Baird, which highlighted momentum around the upcoming R2 platform launching in 2026.

- Chipotle gained nearly 2% on news it's rolling out a High Protein Menu with grab-and-go chicken and steak cups.

Thursday's Movers to the Downside:

- In a buy-the-rumor, sell-the-news moment, pot stocks tumbled after President Trump signed an order to reclassify marijuana, loosening long-standing restrictions. Tilray Brands lost 4%, Canopy Growth fell 12%, and Aurora Cannabis sank nearly 3.5%.

- Instacart fell over 1.5% after reports that the FTC has opened an investigation into its pricing practices, with identical supermarket items allegedly varying by around 7% on the platform.

- Insmed slid 16% after discontinuing development of its drug for chronic rhinosinusitis following a mid-stage trial failure.

- Accenture dropped nearly 1.5% despite beating earnings estimates, as investors worried that AI is cannibalizing the IT and consulting sectors.

- Birkenstock sank over 11% after issuing FY26 revenue and profit projections that missed estimates amid tariff-related demand uncertainty.

- FactSet Research Systems declined over 7.5% after posting solid quarterly results but issuing guidance that fell short of expectations.

Friday's Markets and News:

The final full trading week of the year ended on a high note as the AI trade recovered some lost ground, pushing the Nasdaq and the S&P 500 back into positive territory for the week.

President Trump designated December 24 and 26 as federal holidays, but the US Treasury announced that auctions, maturities, and settlements won't be affected by the news (nor, for that matter, will trading hours at the NYSE or Nasdaq).

Consumer sentiment ticked up 1.9 points between November and December to 52.9. However the problem is it hit 74 last December—meaning sentiment is still nearly 30% lower year over year.

Friday's Movers to the Upside:

- Nine large pharma companies inked a deal with the White House to sell medications for less, in exchange for a three-year grace period from tariffs. Gilead Sciences gained over 2%, Amgen added nearly 1%, and Bristol Myers Squibb climbed over 1.5%.

- CoreWeave jumped nearly 23% after Citi resumed coverage with a Buy/High Risk rating, highlighting strong demand and capacity tracking into Q4.

- Carnival Corporation rose nearly 10% after beating fourth-quarter earnings expectations and issuing upbeat full-year guidance.

- Micron Technology extended its rally by 7% following a standout fiscal Q1driven by surging AI-chip demand.

- Amicus Therapeutics soared over 30% after BioMarin agreed to acquire the company for $4.8 billion. BioMarin shares climbed nearly 18% on the news.

- Winnebago Industries gained nearly 8.5% after reporting a robust fiscal Q1, with revenue up 12% vs. the 1% analysts expected.

- Trump Media continued its rally today, rising another 8% after surging yesterday on news of its merger with fusion-energy firm TAE Technologies.

Friday's Movers to the Downside:

- Target fell over 1% after a major outage hit its app and website during the peak holiday rush, disrupting online orders and some gift-card processing.

- Lamb Weston plunged over 25% despite solid Q2 results, as executives warned profits will be squeezed by heavy discounting and rising international manufacturing costs.

- Nike slipped 10.5% as strong fiscal Q2 results were overshadowed by margin pressure, with gross margins falling to 40.6% due to US tariffs.

Notable Earnings for week of Dec 22nd – 26th:

The official week of Dec 22–26 has no high-profile earnings scheduled. Most of the notable companies reported earlier in the month before the holidays.

Markets are open Monday, Tuesday, Wed (early close) and Fri and closed on Thursday, Christmas day. But liquidity tends to be light. Note that any unexpected earnings release or revision could still move thinly traded stocks.

Notable Economic Data for week of Dec 22nd - 26th:

Keep in mind that this is going to be a holiday-shortened and light calendar week. Volumes and liquidity are expected to be especially low this week due to the holidays but that can potentially amplify reactions even to smaller data prints.

Here is the schedule of notable economic data releases:

Monday: no major macro releases scheduled.

Tuesday:

- U.S. Q3 GDP (third estimate) – the big headline release for the week, postponed earlier due to shutdown delays. Markets will watch growth momentum ahead of year-end.

- Consumer Confidence (Dec) – sentiment indicator that can signal consumer spending trends.

Wednesday: Weekly Initial Jobless Claims – labor market signal for layoffs.

Thursday: Markets are closed for Christmas holiday.

Friday: Quiet data slate.

Closing Thoughts

What is the degenerate economy?

In today's markets, the term refers to the shift of investing toward speculation, gambling, and 24/7 digital connectivity. Coined and popularized by Stocktwits founder Howard Lindzon, it describes an era where:

- Speculation is Entertainment: Investing has moved from long-term "boring" savings to high-speed trading of crypto, meme stocks, and sports betting via mobile apps.

- The "Wallet on Your Phone": This economy is driven by the ease of moving money instantly through apps like Robinhood or crypto platforms.

- High-Risk Behavior: It is characterized by "degen trading," where retail investors take massive risks (often with leverage) for the chance of rapid, life-changing returns.

- Key Sectors: The "arms dealers" of this economy are brokerages, social networks (Twitter/X, Discord), and betting platforms.

There have always been investors who see stock picking as akin to gambling—but now the difference between going to the casino and logging into your brokerage app appears to be even more blurred.

Between meme coins, prediction markets, and triple-leveraged single-stock exchange-traded funds, it feels like we're slowly turning our financial markets into one giant slot machine. At the very same time young people feel like building wealth the old fashioned way is less possible than ever before.

Howard Lindzon, the co-founder of Stocktwits, the social networking platform is like honey to the retail trader bee, and his experiences there helped him coin the term "degenerate economy"—a colorful way to describe today's market.

"It's never been easier to be invested, but it's never been harder to stay invested—that's the thesis of the degenerate economy", he explains. "We're going to be inundated with products that will get us trading more, which is probably not smart, and betting more, which is probably not smart".

Case in point – Robinhood just announced a slew of prediction markets features yesterday, including parlay and prop bets on NFL games and players. And soon, traders will be able to combine up to 10 outcomes across NFL games into custom combos. Investing seems to be transforming and getting further away from profit numbers and balance sheets.

The jury is out on whether this transformation will ultimately be a good thing?

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.