No Santa Sighting Yet

December 15, 2025

Market Roundup for the Week

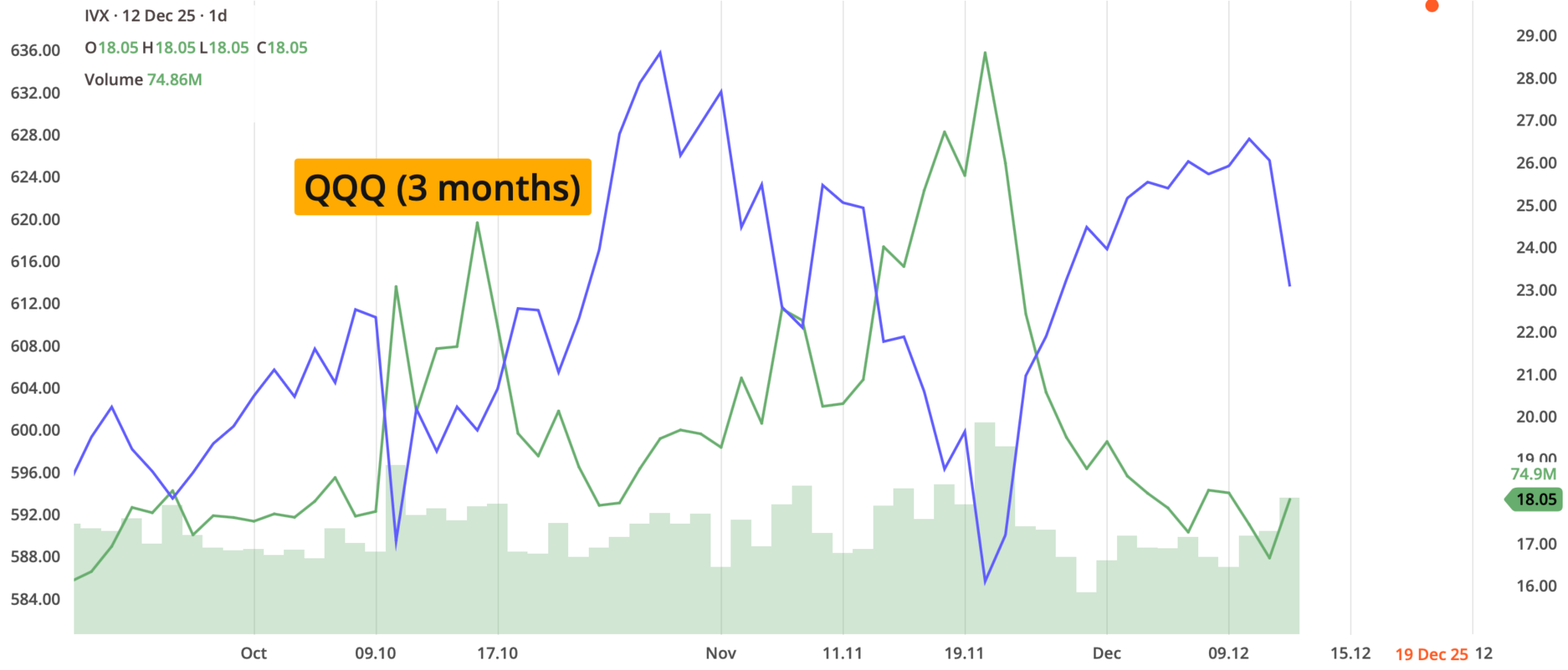

In the US capital markets, the week of Dec 8th-12th was characterized by a distinct sector rotation and heightened focus on monetary policy, culminating in the Federal Reserve's final decision of the year. The overall price action was mixed, with the Dow Jones Industrial Average rising to new highs, while the tech-heavy Nasdaq Composite struggling, highlighting the underlying shift in investor sentiment.

The defining theme of the week was a major shift in capital, often referred to as the "Great Rotation". This can be broken down into:

- Technology Sell-Off: Sentiment turned sharply against the mega-cap AI trade. Disappointing earnings and forward guidance from key chip and cloud players like Oracle (ORCL) and Broadcom (AVGO) raised concerns about the massive capital expenditure (CapEx) required for AI infrastructure and whether the returns would materialize fast enough. This led to significant declines in the Technology and Semiconductor sectors.

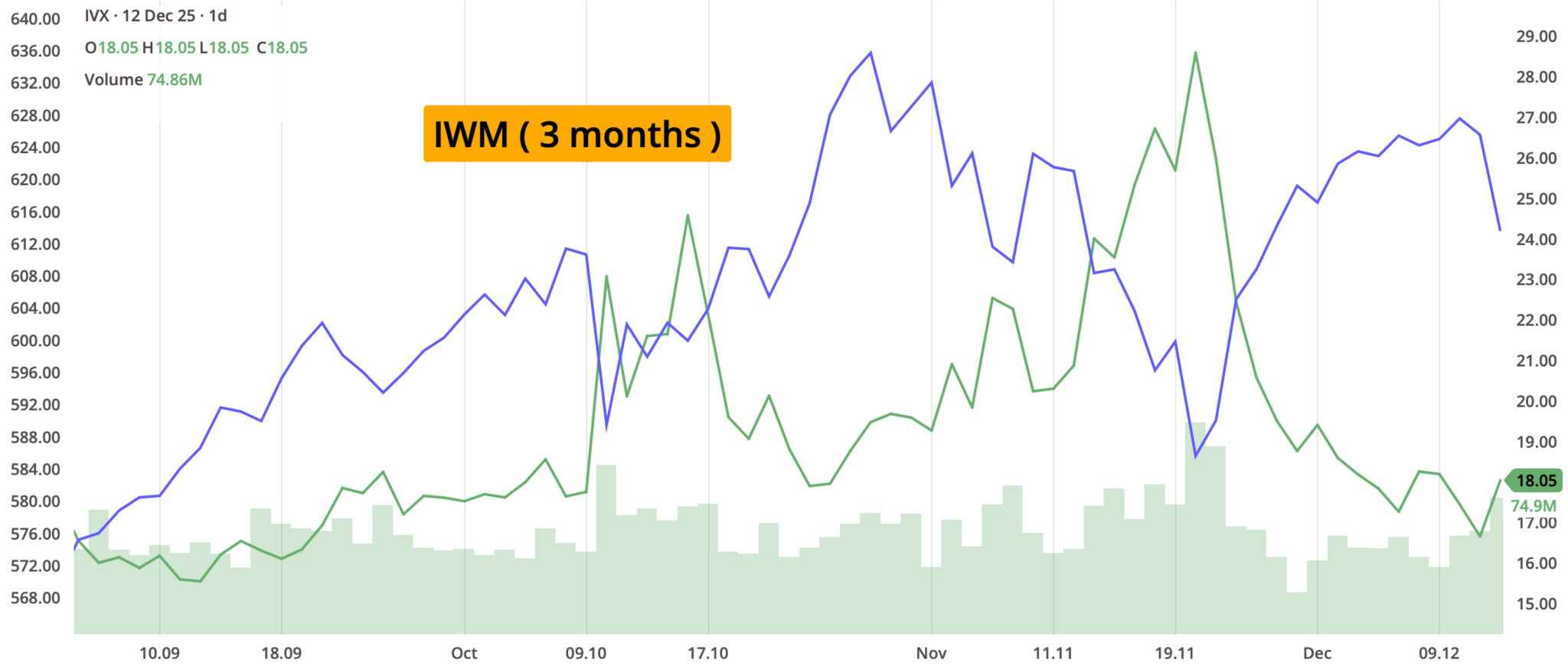

- Value/Cyclical Strength: Traditional, value-oriented sectors rallied. The Dow Jones hit new all-time highs as money flowed into Financials, Industrials, and some Basic Materials stocks. This rotation reflected investor confidence in the broader economy holding up and a preference for companies with more immediate, tangible cash flows.

- The Federal Reserve Rate Cut: The primary macroeconomic catalyst was the Federal Reserve's final FOMC meeting of the year.

The Fed followed through with a highly anticipated interest rate cut (the third one this year), moving the policy rate to the expected target range. While the cut itself was priced in, the market's focus immediately shifted to the Fed's commentary and economic projections. Investors viewed the continued easing as supportive of a soft landing, which helped fuel the rally in rate-sensitive sectors like small-caps (Russell 2000). - Notable Corporate News: The media sector saw high volatility driven by a hostile takeover bid for Warner Bros. Discovery (WBD) from Paramount Skydance, following WBD's previous agreement to be acquired by Netflix.

- AI Infrastructure Pain: Companies tied to the AI build-out, like Bloom Energy (BE), suffered steep declines as investors fled the sector following the disappointing earnings from major customers.

In essence, the week was a two-sided market – extreme disappointment and selling in the narrow group of AI leaders, offset by strength and enthusiasm across a much broader base of traditional American companies, driven by dovish Fed expectations.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

- COST (closed at about 884 on Friday, Dec 12th)

This underlying released good earnings but the stock struggled to maintain any upward move. So, if a trader would like to be neutral for the coming months, then an iron condor could be considered.

In the January expiration, sell the 810/850/940/980 iron condor.

Premium collected: about $950

Buying Power withheld: about $3000

Return on Capital: about 31%

Probability of profit: about 65%

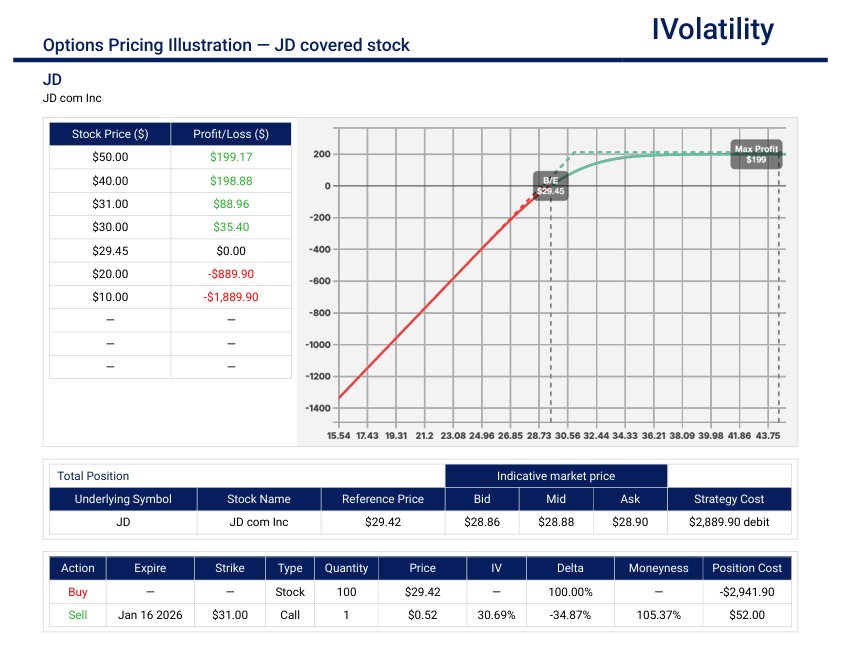

PnL Calculator from the IVolLive Web - JD (closed at about 29.44 on Friday, Dec 12th)

Some valuation models suggest the stock may be undervalued. The overall analyst consensus is a "Strong Buy", with a significant potential upside to the average 12-month price target. This suggests a bullish underlying sentiment.

So, if a trader would like to be bullish for the coming months, then a covered stock position could be considered.

In the January expiration, buy 100 shares of stock and sell the 30delta call (or the 31 strike).

Cost basis of position: about $1420

Maximum potential value: about $3100

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

| INDEX | UP | DOWN |

| SPY | -0.68% | |

| QQQ | -2.13% | |

| IWM | 0.49% | |

| DIA | 1.04% | |

| GLD | 2.18% | |

| BTC/USD | -0.11% | |

| TLT | 4.19% | |

| Crude Oil | -4.52% | |

| VIX | -5.52% |

Movement of the Major Sectors:

The trading week of December 8th through December 12th, 2025, was defined by a major sector rotation. Capital flowed decisively out of high-flying technology stocks and into defensive, value, and cyclical sectors, largely in response to disappointing AI-related earnings and the Federal Reserve's final rate cut of the year.

This movement resulted in a clear split between the winners and losers for the week.

| SECTOR | UP | DOWN |

| TECH (XLK) | -2.52% | |

| FINANCIALS (XL) | 1.20% | |

| INDUSTRIALS (XLI) | 1.55% | |

| ENERGY XLE | -1.05% | |

| HEALTHCARE (XLV) | 0.15% | |

| UTILITIES (XLU) | -0.20% | |

| MATERIALS (XLB) | 0.60% | |

| REAL ESTATE (XLRE) | 2.10% | |

| CONSUMER STAPLES (XLP) | 0.95% | |

| CONSUMER DISCRETIONARY (XLY) | -1.25% |

Notable gainers for the week of Dec 8th – 12th:

The week saw a rotation out of the high-flying tech sector and into more cyclical and value-oriented areas of the market.

Tilray Brands (TLRY): Cannabis/Consumer Staples spiked over 65% on news that President Trump planned to reclassify marijuana as a Schedule III drug.

EchoStar (SATS) Communication Services: This company was a top weekly performer, likely driven by sector strength and potentially M&A speculation or a post-earnings run-up.

Cogent Communications (CCOI): The company experienced over 18% gains, benefiting from the overall strength in the Communication Services sector.

Lululemon athletica (LULU): The company soared after reporting quarterly earnings that topped Wall Street's estimates for earnings per share and revenue.

Warner Bros Discovery (WBD): The company rose over 14% following news of a high-profile bidding war for the company, including a hostile takeover bid from Paramount Skydance.

Rivian Automotive (RIVN): This company saw a notable 12% rise as the market potentially rotated back into certain growth stocks late in the week.

Notable losers for the week of Dec 8th – 12th:

The week was largely characterized by a sharp pullback in the high-flying technology sector, driven by disappointing earnings and growing concerns about the profitability of the massive investments being made in Artificial Intelligence (AI) infrastructure.

Oracle dropped about 13%. The company missed revenue forecasts, issued a lower-than-expected revenue guidance, and significantly hiked capital expenditure for AI infrastructure, raising concerns about high spending and low profitability returns.

Broadcom (AVGO) dropped about 11% after the company's earnings report and outlook re-ignited investor concern about the margin pressure involved in the massive AI infrastructure build-out.

Bloom Energy (BE) fell about 20%, becoming the worst-performing stock of the week among those covered by major analysts. The sharp drop in BE stock was primarily due to its close tie to the Artificial Intelligence (AI) data center build-out theme, which experienced a major wave of negative sentiment triggered by news from one of its key customers.

The stock has had significant run-ups earlier in the year, and was trading at a premium to its fair value.

Vertiv (VRT) dropped about 15%, again perhaps to markets reassessing valuations for companies involved in the data center and AI infrastructure supply chain.

Marvell Technology (MRVL) fell about 15% on news that a key partner (Microsoft) was reportedly discussing custom chips with a rival (Broadcom), in addition to the broader pressure on chip stocks after the Oracle and Broadcom results.

NuScale Power (SMR) dropped nearly 14%. This stock was among the top losers of the week, with significant daily volume, likely due to company-specific news or broader risk-off sentiment in high-growth, pre-profit companies.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Markets meandered lower today as investors turned their attention to the FOMC meeting beginning tomorrow. Tech was the only sector of the S&P 500 to finish the day in positive territory.

Oil sank as Ukrainian peace talks continued, while gold crept lower as well.

Bitcoin rose as high as $92,000 today as the crypto king continued to experience some serious volatility.

Despite aggressive US tariffs, it appears that China's exports haven't slowed down—in fact, they've picked up the pace.

The country's customs agency just announced that its trade surplus rose to nearly $1.08 trillion through November, surpassing last year's record high in just 11 months. Shipments to the US plummeted this year, but more exports to regions like Southeast Asia and the EU offset the decline. Meanwhile, earlier today President Trump unveiled a $12 billion bailout package for US farmers hurt by China's refusal to buy US soybeans. If there was a trade war scoreboard, it does not appear to look pretty for team USA.

As if the race over storied entertainment conglomerate Warner Bros. Discovery wasn't already cinematic enough, a juicy plot twist was revealed.

Last Friday, Warner Bros. announced that Netflix had won the bidding war over parts of the company. But then, more drama came in the form of Paramount Skydance making a direct, hostile cash offer to Warner Bros. Discovery, thus undermining the Netflix deal. Rather than buy the company piecemeal, Paramount's offering to acquire the entirety of Warner Bros. Discovery, including TV networks like CNN. Paramount also said that their offer was more likely to win regulatory approval. Investors need to stay tuned...

In other news, Direct-to-patient services are booming in the healthcare industry right now and NextEra Energy will provide Meta Platforms with 2.5 gigawatts of clean energy, and will build new data centers with Alphabet.

Monday's Movers to the Upside:

- Confluent jumped nearly 30% after IBM announced it would acquire the data streaming company for $11 billion, a move aimed at bolstering IBM's AI software portfolio.

- Warby Parker popped over 13% on the news that it will help Alphabet develop new AI-powered glasses.

- Kymera Therapeutics rose over 40% on positive results for its KT-621 drug targeting Type 2 inflammatory diseases.

- Wave Life Sciences exploded nearly 150% after early trial data showed its RNA obesity therapy reduced fat while preserving muscle.

- Structure Therapeutics gained over 100% on promising trial results for its oral weight-loss drug, adding to a strong day for biotech names.

- Carvana climbed over 12% as the online retailer prepares to join the S&P 500 on Dec. 22.

Monday's Movers to the Downside:

- Tesla dipped over 3% after Morgan Stanley's Andrew Percoco initiated coverage at Hold, leaving the stock with Buy ratings from fewer than 40% of analysts.

- Lucid Group fell nearly 5% after Percoco downgraded the stock to Sell, warning that the EV "hangover" could extend into 2026.

- CoreWeave slipped over 2% on news of a $2 billion convertible bond offering.

- Fluence Energy retreated over 4.5% following a downgrade from Mizuho, which argued the stock's valuation has gotten ahead of fundamentals.

- Air Products & Chemicals edged nearly 9.5% lower amid plans for a major partnership with Norwegian chemical company Yara International.

- Marvell Technology sank nearly 7% after Benchmark downgraded the stock over the loss of Amazon's AI chip orders.

Tuesday's Markets and News:

Investors were too busy wondering what Jerome Powell and Co. are talking about in their two-day FOMC meeting to move markets very much today, though the Russell 2000 hit a new all-time high.

Kevin Hassett, the frontrunner to succeed Powell next year, said there's "plenty of room" for rate cuts of greater than 25 basis points next year.

Bitcoin briefly bounced above $94,000 as crypto traders banked on a rate cut on Wednesday that could provide a much-needed catalyst for cryptocurrencies.

Tuesday's Movers to the Upside:

- Ares Management jumped over 7% on news that it will join the S&P 500 on December 11.

- STAAR Surgical popped nearly 8% after eye-care giant Alcon raised its takeover offer to $30.75 per share in cash.

- Teleflex rose over 9.5% after announcing agreements to sell three businesses for a combined $2.03 billion in cash and launching a share buyback.

- Alexander & Baldwin climbed nearly 40% on the news that the Hawaiian grocery operator will go private in a $2.3 billion transaction.

- CVS Health gained nearly 2.25% after the company raised its 2025 adjusted EPS outlook and boosted its 2026 guidance.

Tuesday's Movers to the Downside:

- Toll Brothers fell nearly 2.5 % on mixed earnings, as the company said it won't be clear until late January whether the "choppy" housing market will improve.

- JPMorgan shed over 4.5% after the bank announced it will spend $105 billion next year, more than analysts were anticipating.

- AutoZone lost over 7% after reporting fiscal first-quarter earnings and same-store sales growth that came in below expectations.

- Campbell's Co. slipped over 5% as quarterly profit declined year over year, with the company citing tariff pressures.

- Inflight Wi-Fi provider Gogo dropped over 19% after William Blair downgraded the stock, pointing to rising Starlink competition and high debt levels.

- SLM tumbled nearly 15% after the student loan provider projected earnings would decline and not recover until 2028, missing investor expectations.

Wednesday's Markets and News:

Investors stood on the sidelines all morning as they waited for Jerome Powell to take the mic. But all three major indexes immediately popped once the Fed head gave another rate cut the green light, and the Russell 2000 closed at a new record high for a second day in a row.

Crude climbed after the US seized an oil tanker off the coast of Venezuela. And keep a close eye on your heating bill this winter—natural gas futures have soared 39% since the end of September.

The European Union has pledged to cut emissions 90% by 2040.

Gold's bull run has triggered an unintended consequence: A spike in illegal mining.

US labor costs rose at the slowest pace in four years—the latest consequence of the labor market softening.

Nvidia clapped back at reports that Chinese AI startup DeepSeek has been using smuggled Blackwell chips.

Wednesday's Movers to the Upside:

- Nextdoor jumped over 25% after a well-known investor who helped drive rallies in Opendoor and Better Home & Finance took a bullish position in the stock.

- GE Vernova rose over 15.5% after raising its 2026 outlook for revenue and EBITDA margins.

- EchoStar jumped over 11% as reports of a potential 2026 SpaceX IPO lifted expectations for the company's sizable stake in the rocket maker.

- Semiconductor supplier Photronics surged over 45% on stronger-than-expected quarterly results, helped by rising demand for advanced photomasks and edge-AI products in Asia.

- Micron climbed nearly 4.5% after several analysts raised their forecasts, citing a sharp rise in DRAM pricing heading into 2026.

- Palantir Technologies gained nearly 3.5% after securing a $448 million US Navy contract to overhaul supply-chain management for the nuclear-submarine fleet.

- Warby Parker climbed another 27% following several days of gains after revealing its new AI-powered glasses are coming in 2026.

Wednesday's Movers to the Downside:

- Cloud storage company Dropbox slipped over 7.5% following news that longtime CFO Timothy Regan will step down and be replaced by Avalara executive Ross Tennenbaum.

- Defense technology company AeroVironment fell nearly 13% as investors focused on an earnings miss despite a 150% increase in year-over-year sales.

- Vertical Aerospace declined over 17% even as the company unveiled plans for the UK's first electric air taxi network and signed a new aircraft pre-order agreement.

Thursday's Markets and News:

The Dow, the S&P 500, and the Russell 2000 all rose to new record highs, while an AI trade selloff tanked the tech-heavy Nasdaq.

Yields on short-term debt like one-month and six-month Treasury bills tumbled a day after the Fed revealed it will begin purchasing $40 billion in bills per month starting Friday.

Copper, the often-ignored metal, hit a new all-time high.

Thursday's Movers to the Upside:

- Eli Lilly jumped ove 1.5% after an experimental obesity shot cut body weight by 23% and slashed knee pain by 62%.

- Earth-imaging company Planet Labs soared over 35% on a strong Q3, higher guidance, and a shift toward government and defense contracts.

- Ciena gained over 9.25% after the network solutions company increased revenue 20% year over year, helping it beat earnings forecasts.

- Vail Resorts climbed over 9% as investors welcomed management's plan for a strategic commercial reset.

- Gemini Space Station advanced nearly 32% after winning CFTC approval to launch a new derivatives exchange, giving the Winklevoss twins a foothold in the booming prediction markets industry.

Thursday's Movers to the Downside:

- Rivian fell over 6% after the EV company revealed it's developing in-house AI chips to replace Nvidia's, an ambitious move investors saw as yet another costly hurdle.

- Coca-Cola fell over 1.5% on the news that CEO James Quincey will step down in March and be replaced by COO Henrique Braun.

- Apparel company Oxford Industries dropped over 21% on weak earnings and a reduced outlook, citing tariff-related product gaps in key seasonal categories.

- GE Vernova slipped over 2.5% from all-time highs after a Seaport analyst downgraded the stock.

- Rezolute plummeted over 87% after the biotech's late-stage sunRIZE trial failed to deliver.

- Robinhood Markets declined over 9% following reports of softer November metrics, including declines in funded accounts and trading activity.

Friday's Markets and News:

Tech continued to tumble as investors rotated away from the AI trade and into the Dow, pushing the index to a new intra-day record high.

Treasury yields popped after Federal Reserve Bank of Cleveland President Beth Hammack said she would prefer interest rates be slightly more restrictive in order to tame inflation.

Gold rose to a seven-week high but pared some gains late in the day, while oil dropped closer to its lowest level since October as traders fretted about oversupply.

President Trump said Kevin Warsh and Kevin Hassett are his top picks to replace Jerome Powell next year.

In crypto news, Interactive Brokers is now allowing retail investor accounts to be funded by stablecoin and US regulators gave crypto firms initial approval to establish national trust banks.

Friday's Movers to the Upside:

- Lululemon traded nearly 10% higher after boosting its full-year outlook and announcing its CEO will step down at the end of January.

- Quanex Building Products jumped over 9.5% after swinging to a Q4 profit despite lower sales and a flat 2026 outlook.

- UBS rose 1.25% after Swiss lawmakers proposed easing new capital rules.

- Energy company Vivopower International rallied over 13% after its digital-asset arm inked a $300 million joint venture with South Korea's Lean Ventures to acquire and hold Ripple Labs shares.

- Rivian Automotive rebounded over 12% as excitement returned around its custom AI chip and new autonomy features unveiled for future vehicles.

Friday's Movers to the Downside:

- Broadcom slipped over 11% despite strong Q4 results as its $73 billion AI backlog underwhelmed investors.

- Fermi plunged nearly 34% after a $150 million funding commitment for its AI-energy Project Matador collapsed.

- Oracle slid another 4.45% on reports that several OpenAI data centers will be delayed due to material and labor shortages, though the company disputed the claims.

- If SpaceX goes public and popularizes data centers in space, it could spell disaster for Earth-bound power providers like Bloom Energy, which fell 12.85%.

- Roblox declined over 6% after JPMorgan downgraded the stock on slowing bookings growth, rising margin pressure, and scrutiny from a child-safety lawsuit.

Notable Earnings for week of Dec 15th – Dec 19th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

Tuesday: LEN

Wednesday: MU / JBL / GIS

Thursday: NKE / FDX / ACL / KMX

Friday: CCL / PAYX

Notable Economic Data for week of Dec 15th – 19th:

The week is exceptionally heavy with key economic data, primarily because of a compressed release schedule catching up on delayed government data.

This makes it a high-stakes week for the market, as the data will be used to gauge the health of the economy and the Federal Reserve's next policy steps.

Here is the schedule of notable economic data releases:

Tuesday: Nonfarm Payrolls (October & November) and November Unemployment Rate

A major catch-up report. The market will look for signs of labor market cooling (a smaller NFP gain or higher unemployment) to support the recent Fed rate cut and ease wage inflation fears.

Wednesday: Advance Retail Sales (October)

Measures consumer health and demand. A strong number suggests resilience, potentially giving the Fed pause; a weak number suggests economic deceleration.

Thursday: Consumer Price Index (CPI)

The single most important inflation report of the week. The market will be hyper-focused on the month-over-month (MoM) and core (excluding food/energy) numbers to see if inflation is easing toward the Fed's 2% target.

Thursday: European Central Bank (ECB) Rate Decision

Widely expected to keep rates unchanged. Focus will be on new economic projections and any forward guidance regarding the timing of future policy moves.

Thursday: Bank of England (BoE) Rate Decision

Expected to keep rates steady. The BoE's tone on inflation and potential future rate cuts will be key, following the release of UK inflation data earlier in the week.

Friday: Bank of Japan (BoJ) Rate Decision

Expected to maintain its ultra-loose policy, keeping bond yield control parameters unchanged.

Closing Thoughts

A recent report card from an AI safety watchdog is one that tech companies might NOT want to stick on the fridge.

The Future of Life Institute's latest AI safety index found that major AI labs fell short on most measures of AI responsibility, with few letter grades rising above a C. The institute graded eight companies across categories like safety frameworks, risk assessment, and current harms. Perhaps most glaring was the "existential safety" line, where companies scored Ds and Fs across the board. While many of these companies are explicitly chasing superintelligence, they lack a plan for safely managing it, according to Max Tegmark, MIT professor and president of the Future of Life Institute.

"Reviewers found this kind of jarring", Tegmark told us.

The reviewers in question were a panel of AI academics and governance experts who examined publicly available material as well as survey responses submitted by five of the eight companies.

Anthropic, OpenAI, and Google DeepMind took the top three spots with an overall grade of C+ or C. Then came, in order, Elon Musk's Xai, Z.ai, Meta, DeepSeek, and Alibaba, all of which got Ds or a D-.

Tegmark blames a lack of regulation that has meant the cutthroat competition of the AI race trumps safety precautions. California recently passed the first law that requires frontier AI companies to disclose safety information around catastrophic risks, and New York is currently within spitting distance as well. Hopes for federal legislation are dim, however.

"Companies have an incentive, even if they have the best intentions, to always rush out new products before the competitor does, as opposed to necessarily putting in a lot of time to make it safe", Tegmark said.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.