What Comes After Black Friday

October 20, 2025

Market Roundup for the Week

Following the major sell-off on "Black Friday" (Oct 17th), the week of Oct 13th-17th was a turbulent and volatile one for Wall Street. The markets rebounded on Monday but were then pegged back on Tuesday amid escalating trade developments between the world's two largest economies. President Donald Trump and his administration had taken issue with China's strict rare earth export controls.

On Thursday, regional banks grabbed the spotlight when the disclosure of bad loans by Zions Bancorporation (ZION) and Western Alliance Bancorporation (WAL) sent ripples through the industry.

All week long, traders navigated a complex market environment... digesting ongoing trade tensions between the U.S. and China, dealing with the effects of a government shutdown that showed no sign of ending, and a scare over the health of regional banks.

Still the three major averages managed to post solid gains.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

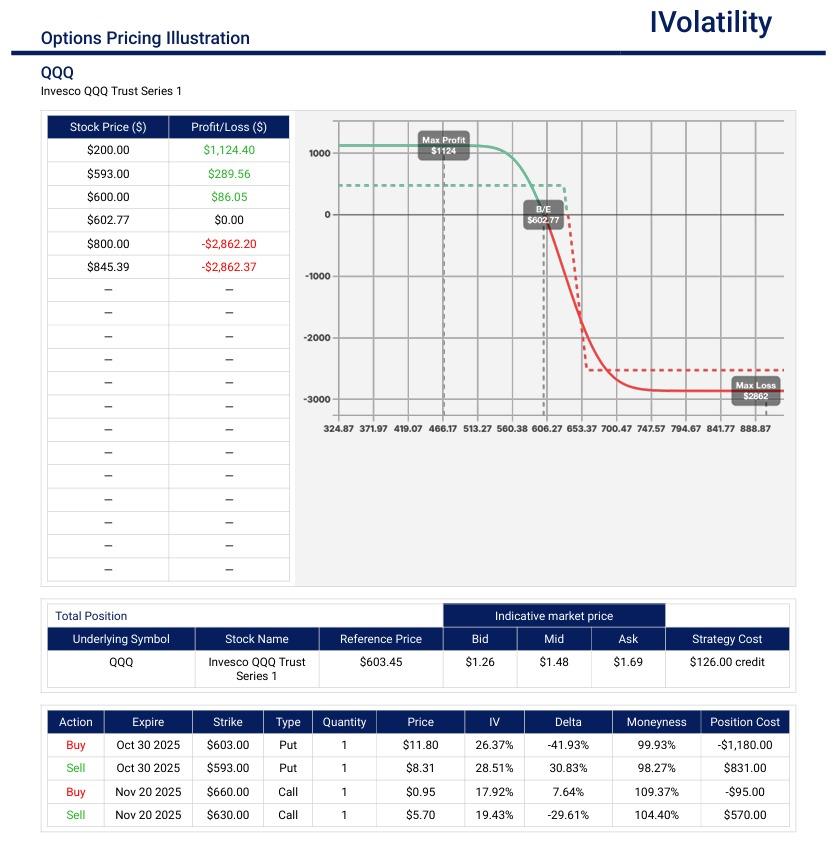

- QQQ (closed around 604 on Friday, Oct 17th)

QQQ is an etf that tracks the 100 largest non-financial companies that trade on the Nasdaq stock exchange. QQQ is up around 17% year-to-date. So, if an investor would like to be bearish over the next few weeks and add a few short deltas to the portfolio, a Long Delta Buster strategy could be employed.

For October 31st expiration, buy an ATM put spread and finance the purchase with the sale of a call (or call spread) in the November 21st expiration.

An example would be to buy a $10-wide oct 31st 603/593 put spread and sell the Nov21 630/660 call spread.

Premium collected: $1.30 which more than covers the cost of the long put spread.

Buying power: $2471 and risk is above 631

Max potential profit = premium collected + width of long put spread.

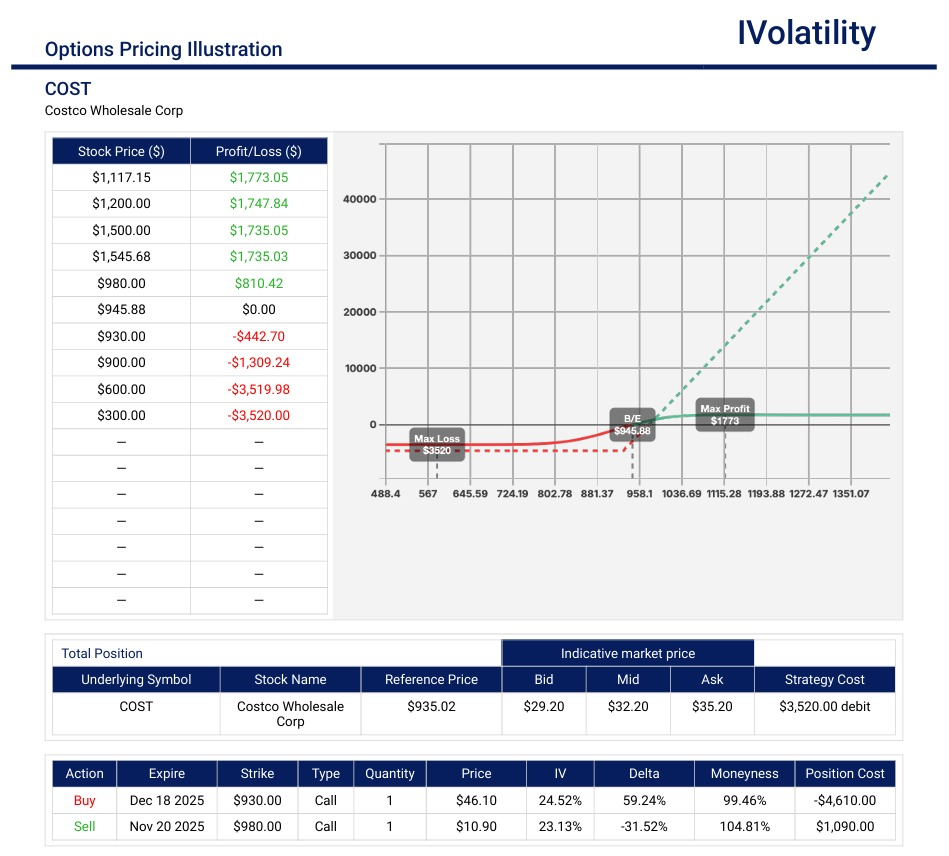

PnL Calculator from the IVolLive Web - COST (closed around 936 on Friday, Oct 17th)

The company, Costco, operates large warehouse clubs where members pay an annual fee to shop for goods – typically in bulk – at low prices. The company's income is mainly derived from its membership fees.

If an investor would like to be bullish in this UL, then a call diagonal might serve as a profitable strategy.

Buy one Dec 19th 930call / Sell one Nov21st 980call.

Debit paid about $3500 for this $50 wide call spread.

There are many expirations in between to roll out the short call, collect more premium and further reduce the cost basis of the spread.

PnL Calculator from the IVolLive Web

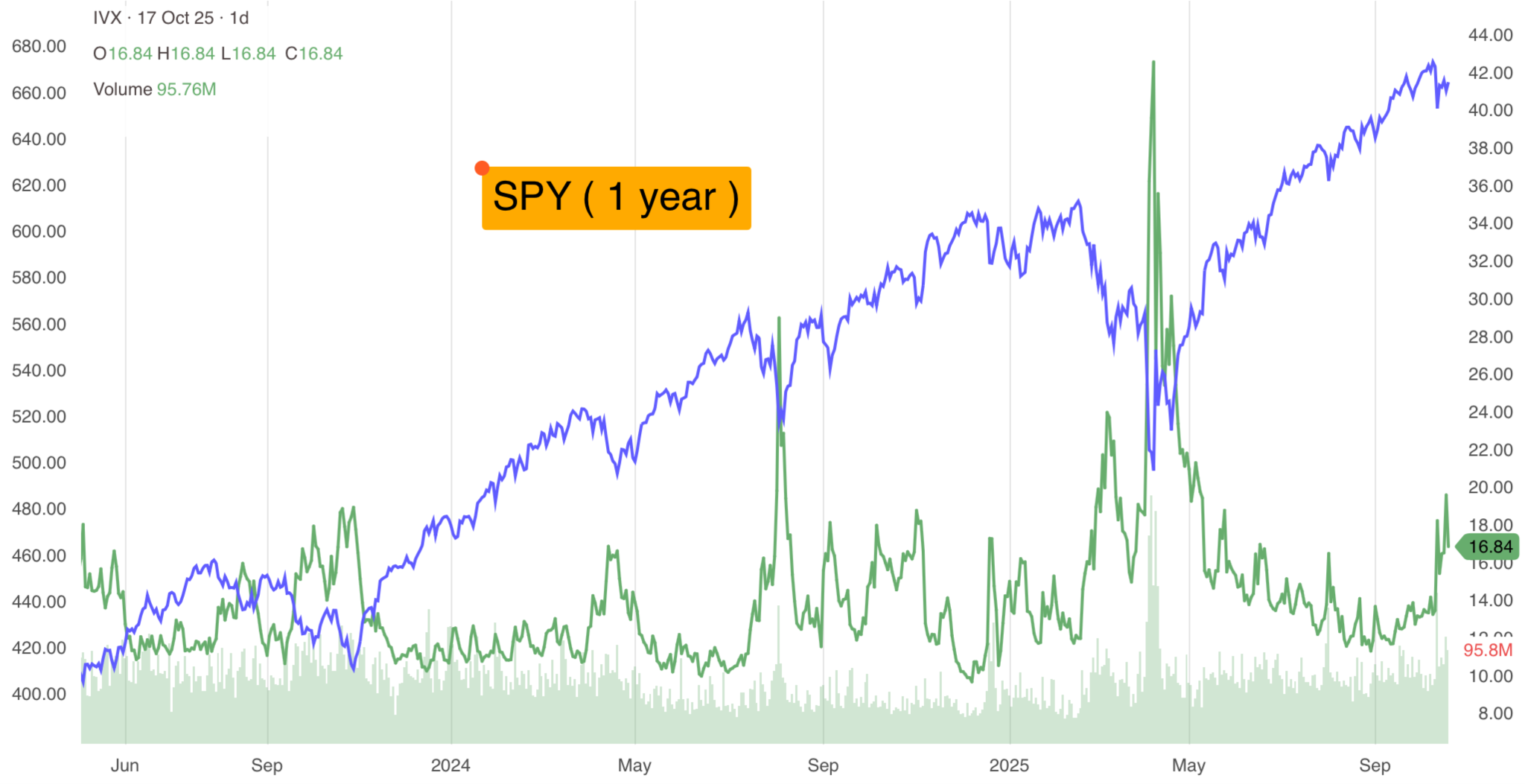

Movement of the Major Indeces:

These numbers are reporting the tradable activity from the opening on Monday to the closing on Friday (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | .54% | |

| QQQ | .78% | |

| IWM | 1.2% | |

| DIA | -2.70% | |

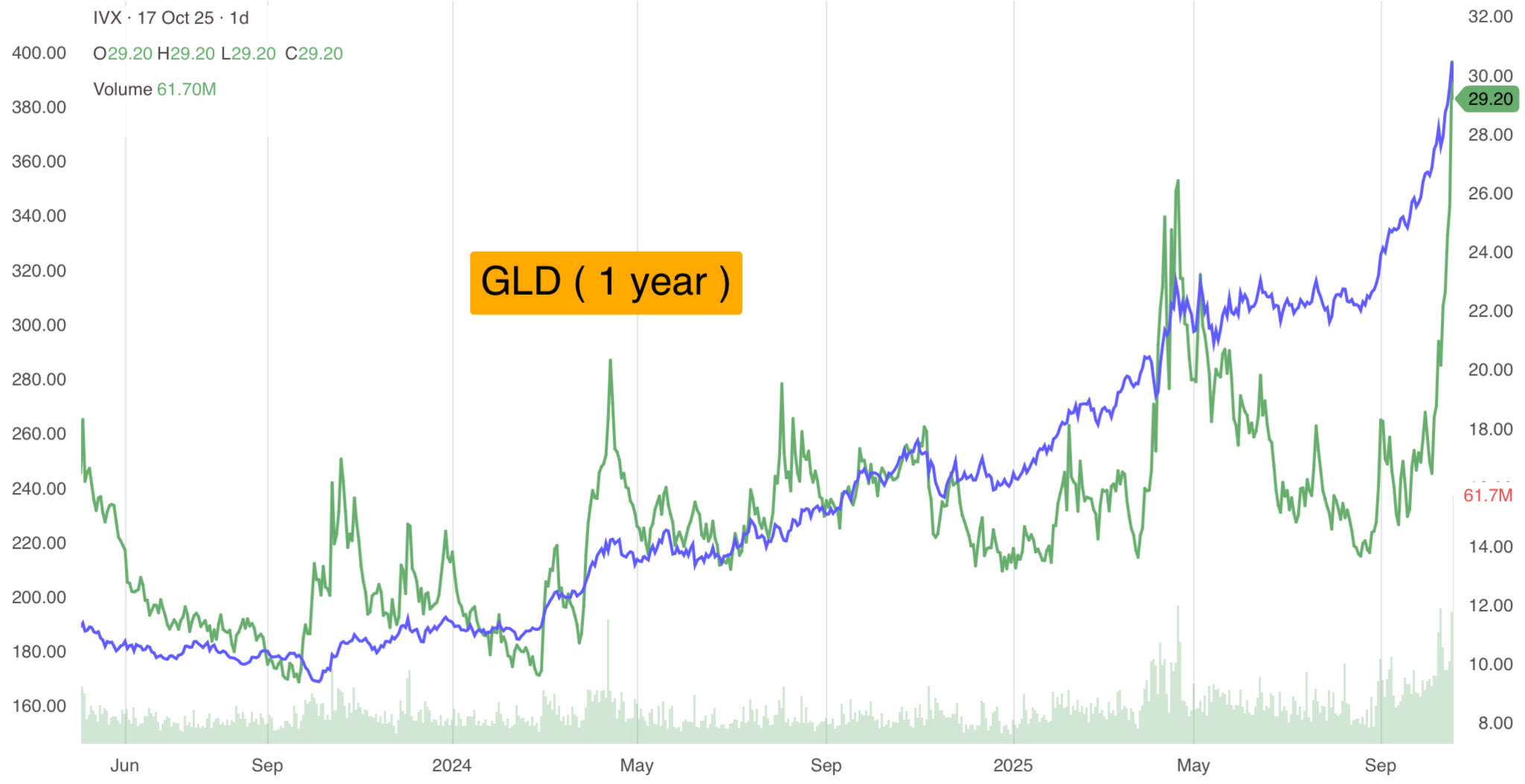

| GLD | 5.61% | |

| BTC/USD | -7.91% | |

| TLT | 1.02% | |

| Crude Oil | -2.95% | |

| VIX | 7.87% |

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | .10% | |

| QQQ | .78% | |

| XLF | -0.7% | |

| XLV | 1.09% | |

| XLY | 1.55% | |

| XLI | .48% | |

| XLP | 2.57% | |

| XLE | 0.03% | |

| XLU | 1.45% | |

| XLB | -.17% | |

| XLRE | 3.32% |

Notable S&P gainers for the week of Oct 13th-17th:

Bloom Energy (BE) surged up over 28% following a $5 Billion AI Infrastructure Deal with Brookfield Asset Management, positioning the company as a key power provider for new AI data centers.

Liberty Energy (LBRT) surged up over 28% following a strong and sustained rally in the energy sector.

J.B. Hunt Transport Services (JBHT) jumped up over 20% following very strong earnings and a major business update.

SanDisk ($SNDK) rose up nearly 20% for the week following analyst upgrades and price target increases.

Polaris ($PII) climbed by over 18% following positive earnings forecasts and analyst upgrades.

Ericsson ($ERIC) gained nearly 16% on stronger than expected earnings and strong future guidance.

Notable S&P losers for the week of Oct 13th - 17th:

Zions Bancorporation, N.A. (ZION) plunged approximately over 13% after disclosing a charge to cover bad loans related to two auto industry-related companies that went bankrupt.

Jefferies Financial Group Inc. (JEF) fell about nearly 11% after disclosing its exposure tied to one of the bankrupt auto industry-related companies (First Brands).

Western Alliance Bancorporation (WAL) dropped approximately nearly 11% following the same auto industry bankruptcies and the bank's mention of a fraud-related lawsuit with one of its borrowers.

F5 (FFIV) plummeted nearly 11% after the cybersecurity firm disclosed it had been the target of a major cyberattack.

Review selected market indices below:

Daily Notable Price Action

Monday's Markets:

Stocks rebounded from "Black Friday"'s (Oct 10th) selloff following the announcement by President Trump that relations with China "will all be fine".

Nearly four out of every five S&P 500 components traded higher on Monday, signaling a broad-based recovery. Nasdaq popped over 2% on the promise that Trump may not follow through on his threat to post massive increase of tariffs on China.

The bond market was closed due to the Columbus Day holiday.

Gold hit a new record above the 4125 level.

Monday's Movers to the Upside:

- Broadcom (AVGO) jumped nearly 10% following an announcement that the company and OpenAI are building 10 gigawatts of custom AI accelerators together. This formalizes an 18-month collaboration that had been under wraps.

- Bloom Energy (BE) surged over 26% after the news that it landed a $5 billion partnership with Brookfield Asset Management (BAM) to power AI data centers with fuel cells.

- Warner Bros (WBD) rose over 4% after rejecting a takeover proposal from Skydance.

Monday's Movers to the Downside:

- Beyond Meat (BYND) plunged nearly 50% after announcing a debt exchange involving over 300 million new shares, massively diluting shareholder values.

- Fastenal (FAST) fell 7.5% after missing earnings expectations.

- Casino Operators, Las Vegas Sands (LVS) and Wynn Resorts (WYNN) were notable decliners, down around 6.3% and 6.2% respectively, due to poor earnings announcements.

- Tvardi Therapeutics, Inc. (TVRD) plummeted by over 83% on the Nasdaq, marking one of the biggest individual decliners of the day.

Tuesday's Markets:

The tariff spat reignited after China placed sanctions on five US subsidiaries of South Korean firm Hanwha Ocean this morning. Today also kicks off tariffs on timber and certain wood products, as well as new tit-for-tat fees for US and Chinese cargo ships.

It's day 14 of the US government shutdown, and a funding bill is up for a vote for the 8th time in two weeks. A combination of political gridlock and mounting global trade tensions pushed major indexes lower overnight, but the Dow was able to claw its way into positive territory.

Gold hit another all-time high, silver pulled back after hitting its first new all-time high since 1980 yesterday, bitcoin continued to fade following a massive liquidation event, and oil tumbled after the IEA said its record oversupply of crude is bigger than previously thought.

Tuesday's Movers to the Upside:

- Nova Minerals (NVA) exploded 110.3% on news that the Trump administration may be interested in taking a stake in a company subsidiary.

- Domino's Pizza (DPZ) delivered a 3.91% gain today after reporting US same-store sales rose 5.2%, the fastest rate since Q1 2024.

- BlackRock (BLK) rose 3.39% thanks to a healthy quarter in which assets under management rose 17% to a record $13.46 trillion.

- Albertsons rallied 13.63% on strong earnings, including an impressive 23% increase in digital sales.

- Polaris (PII) popped 13.87% after the specialty vehicle manufacturer announced it's shedding its iconic Indian Motorcycle business.

- Ericsson (ERIK) jumped 20.56% after the Swedish telecom giant reported strong earnings in spite of tariffs.

- Navitas Semiconductor soared 26.08% after it unveiled new power chips designed specifically for supporting Nvidia AI data centers.

Tuesday's Movers to the Downside:

- Johnson & Johnson (JNJ) ended the day about flat after announcing plans to spin off its orthopaedics business into a company called DePuy Synthes.

- Robinhood Markets (HOOD) dropped 4.07% on a Reuters report that the company is open to selling its prediction market business.

- Crypto stocks continued to struggle following a massive liquidation event over the weekend. Coinbase Global (COIN) lost 4.33%, while Strategy dropped 4.69%.

Wednesday's Markets:

Stocks indices were on track for a solid day until a sudden mid-afternoon drop derailed stocks. The sell-off turned out to be a blip on the radar and they recovered from their losses, though the Dow remained in the red.

Gold can't be stopped, rising above $4,200 to another new all-time high. Meanwhile, oil fell yet again to nearly a five-month low as trade tensions raised the specter of slowing economic growth.

Bitcoin, ethereum, and altcoins of all shapes and sizes remain repressed after a massive selloff last weekend erased billions in crypto positions (more on that below).

Wednesday's Movers to the Upside:

- Bank of America (BAC) rose 4.37% thanks to a 43% increase in investment banking revenue, while Morgan Stanley gained 4.71% after beating analyst expectations by the largest margin in half a decade.

- Dutch semiconductor maker ASML beat earnings expectations but missed on revenue. Investors were in a forgiving mood, and shares rose 2.71%.

- Nuclear power provider NuScale (SMR) rallied 16.68% thanks to a US Army initiative to deploy small reactors.

- Papa John's International (PZZA) popped 9.39% on reports that Apollo Global Management has offered to take the pizza chain private at $64 per share.

Wednesday's Movers to the Downside:

- Abbott Laboratories (ABT) lost 2.43% after the nutrition products maker reported softer baby formula sales than anticipated.

- Progressive (PGR) tumbled 5.78% thanks to a tough quarter for the insurer, due in part to a new law in Florida capping personal auto insurance profits.

- PNC Financial Services (PNC) beat expectations on both the top and bottom lines, but shares fell 3.9% after investors worried that the bank's financial outlook was soft.

- F5 (FFIV) fell 3.62% after the cybersecurity firm revealed that a nation-state actor had breached its systems.

- Sable Offshore (SOC) dropped 20.12% thanks to a ruling from a California judge against the oil and gas company's request to restart a pipeline.

Thursday's Markets:

A strong start to the day fizzled out as a government shutdown, a trade war, and the effects of two auto industry bankruptcies took their toll on investor sentiment. The CBOE Volatility Index, a measure of market fear, rose to its highest point since May.

The 10-year Treasury yield fell below 4% to its lowest level since April, while the 2-year yield briefly dropped to its lowest level since September 2022.

Another day, another new record for gold, which topped $4,300 for the first time ever.

Thursday's Movers to the Upside:

- Praxis Precision Medicines (PRAX) exploded 183.71% after its treatment for essential tremor dramatically outperformed expectations.

- J.B. Hunt Transport Services (JBHT) soared 22.14% thanks to a strong quarter for the logistics company, due mostly to cost control from management.

- Salesforce (CRM) jumped 3.97% after the software giant raised revenue forecasts through 2030.

- Micron Technology (MU) got a nice 5.52% boost from analysts at UBS and Citigroup, both of whom raised their price targets on the chipmaker.

- Triumph Financial gained 7.51% thanks to its new $30 million share repurchase program, as well as reassurances from the CEO that the bank won't be affected by the Tricolor bankruptcy.

Thursday's Movers to the Downside:

- Travelers Cos. sank 2.88% after the insurer beat Wall Street's profit expectations for a sixth quarter in a row but forecast lower net premiums written than analysts wanted to see.

- United Airlines lost 5.63% after it missed Wall Street revenue expectations for a third quarter in a row, though the company expects big things this quarter.

- Hewlett-Packard Enterprise dropped 10.14% after the server maker issued much weaker fiscal guidance than analysts were anticipating.

- Cybersecurity company F5 fell another 10.70% a day after revealing a breach in its systems.

- Jefferies lost 10.62% while regional bank stocks like Zions Bancorporation and Western Alliance Bancorp lost 13.14% and 10.81%, respectively, as the contagion of the First Brands and Tricolor bankruptcies spread across the financial sector.

Friday's Markets:

Investors turned those frowns upside down and decided that the disruptions in the Regional Banks (including Tricolor and First Brands bankruptcies) won't cause the financial sector to collapse after all.

Gold gave up some ground as traders took profits, but the hot commodity still capped off its biggest week of gains since 2020.

Bitcoin's week was a lot less enjoyable, with the crypto crumbling to its lowest level since June as the digital asset selloff wiped out an estimated $600 billion in crypto market value in just one week.

Friday's Movers to the Upside:

- CSX Corp (CSX) gained 1.69% after the railroad company beat profit expectations last quarter, though margins and sales fell.

- Kenvue (KVUE) popped 8.36%, only days after dropping after a lawsuit was filed in the UK alleging the company knowingly sold baby powder contaminated with asbestos.

- Intuitive Machines (LUNR) rallied 4.82% thanks to an upgrade from Deutsche Bank analysts, who say the space company has strong commercial catalysts ahead.

- Truist Financial (TFC) added 3.79% as solid earnings and reassurances that the bank isn't exposed to the Tricolor bankruptcy let shareholders breathe a sigh of relief.

- Several small pharma companies popped after the FDA began handing out fast-track vouchers for various treatments in clinical trials. Revolution Medicines (RVMD) jumped 8.9%, while Disc Medicine (IRON) soared 20.95%.

Friday's Movers to the Downside:

- Interactive Brokers (IBKR) sank 3.34% despite a strong quarter for the brokerage, including a 67% increase in trading volume for stocks.

- Oracle (ORCL) dropped 6.93%, capping off a whipsaw week as management defended the software company's profit margins.

- AST SpaceMobile (ASTS) lost 6.72% after Barclays analysts downgraded the satellite operator, citing its excessively high valuation.

- Hims & Hers Health (HIMS) ost 15.84% after CEO Andrew Dudum revealed that he sold $11 million worth of company stock.

- CoreWeave (CRWV) sank 3.44% and Core Scientific (CORZ) fell 3.41% after the companies' planned acquisition was called into question by shareholders.

Notable Economic Data due week of Oct 20th - 24th:

Please note that the ongoing federal government shutdown which began on October 1st, 2025 has resulted in cancellation of some (or all) economic reports. The shutdown has led to the furlough of approximately 800,000 federal employees and the suspension of various government services. As a result, several key economic data releases, including the monthly jobs report from the Bureau of Labor Statistics, have been delayed or canceled. These data points can be crucial for assessing the current economic landscape and can influence market sentiment and Federal Reserve policy decisions.

This disruption hampers policymakers' ability to assess the economy accurately, especially as signs of a weakening labor market emerge. With the potential delay or absence of crucial economic data, markets may also experience increased volatility.

Notable Earnings due week of Oct 20th - 25th:

The actual day may vary, so do consult with your broker to confirm the actual date.

With economic data releases dried up because of the government shutdown, investors will focus on the new earnings season. This week features several high-profile earnings reports that could influence market sentiment, particularly in the banking, technology, and energy sectors.

Monday: none

Tuesday: KO / GM / MAT / NFLX / ISRG / TXN

Wednesday: TSLA / IBM / ORLY

Thursday: DECK / F / INTC / NOK / NEM

Friday: none

Closing Thoughts

This week, gold climbed above $4,000 for the first time ever and continues to hover around that impressive new benchmark. And, if central banks around the world keep buying bullion gold, the run up could continue.

Gold's been rallying all year long as traders rattled by tariffs seek stability, but this week it went into overdrive. The hot commodity's latest surge was thanks to the debasement trade, which is when investors flee to hard assets like gold after they lose faith in fiat currencies such as the US dollar, in this case due to mounting debt and a government shutdown.

Thanks to central banks around the world, there has been a stocking up on gold for years now as the banks also lose faith in the US dollar. US Treasuries have been ignored and gold has been purchased en masse, with the buying spree not showing any signs of a slowdown. In fact, earlier this month the World Gold Council declared that central banks now hold about a fifth of all the gold that's ever been mined in human history.

Central banks are using gold to hedge against geopolitical uncertainty: Poland, a neighbor of Russia, is a massive buyer, while China has been pouring money into bullion as well while its trade spat with the US heats up. Global tensions don't seem likely to end anytime soon... so the gold rally continues?

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.