Dancing With the Fed: Markets Waltz Into Record Highs

September 15, 2025

Market Roundup for the Week

Rate cuts by the Federal Reserve Bank dominated expectations all week long. Weak labor market data along with super soft job growth appeared to confirm to investors that the Federal Reserve Bank will announce a lowering of rates at its September meeting. There are predictions of a definite 25 basis point cut, though a 50 basis point cut does look on the horizon as well.

Inflation stayed above target with CPI higher due to housing and food costs. However, labor markets are showing signs of strain with higher than expected unemployment claims and weakening job growth. The latter has investors leaning more towards easing despite the tug-of-war between a sticky inflation and worsening job markets.

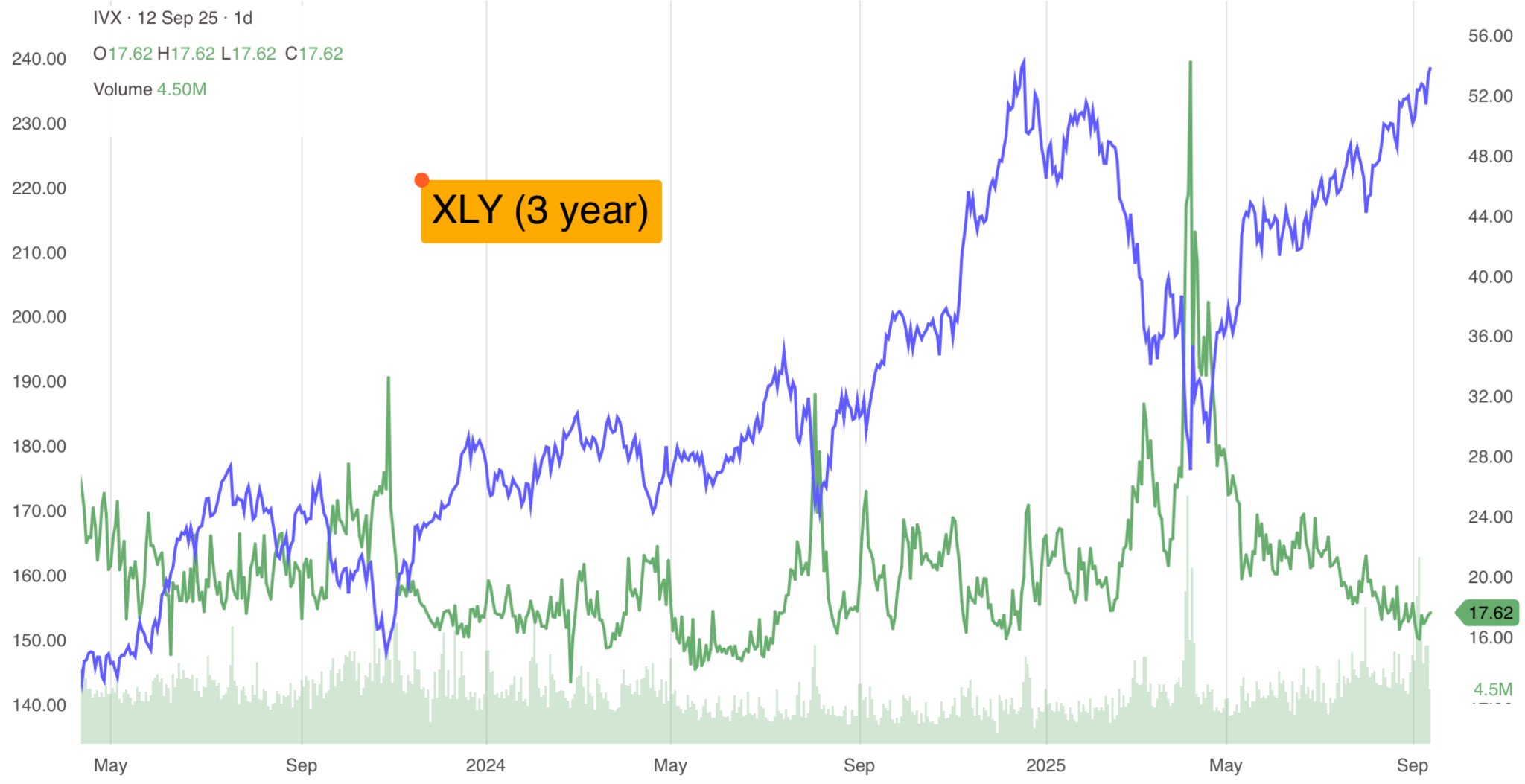

Technology stocks continued to maintain upward momentum and push up markets with continuing strong demand in general and AI-related guidance in particular.

The S&P was also higher though not uniformly across all sectors. In addition, a certain sense of fatigue appeared to be creeping in with investors as gains were less broad as the week progressed.

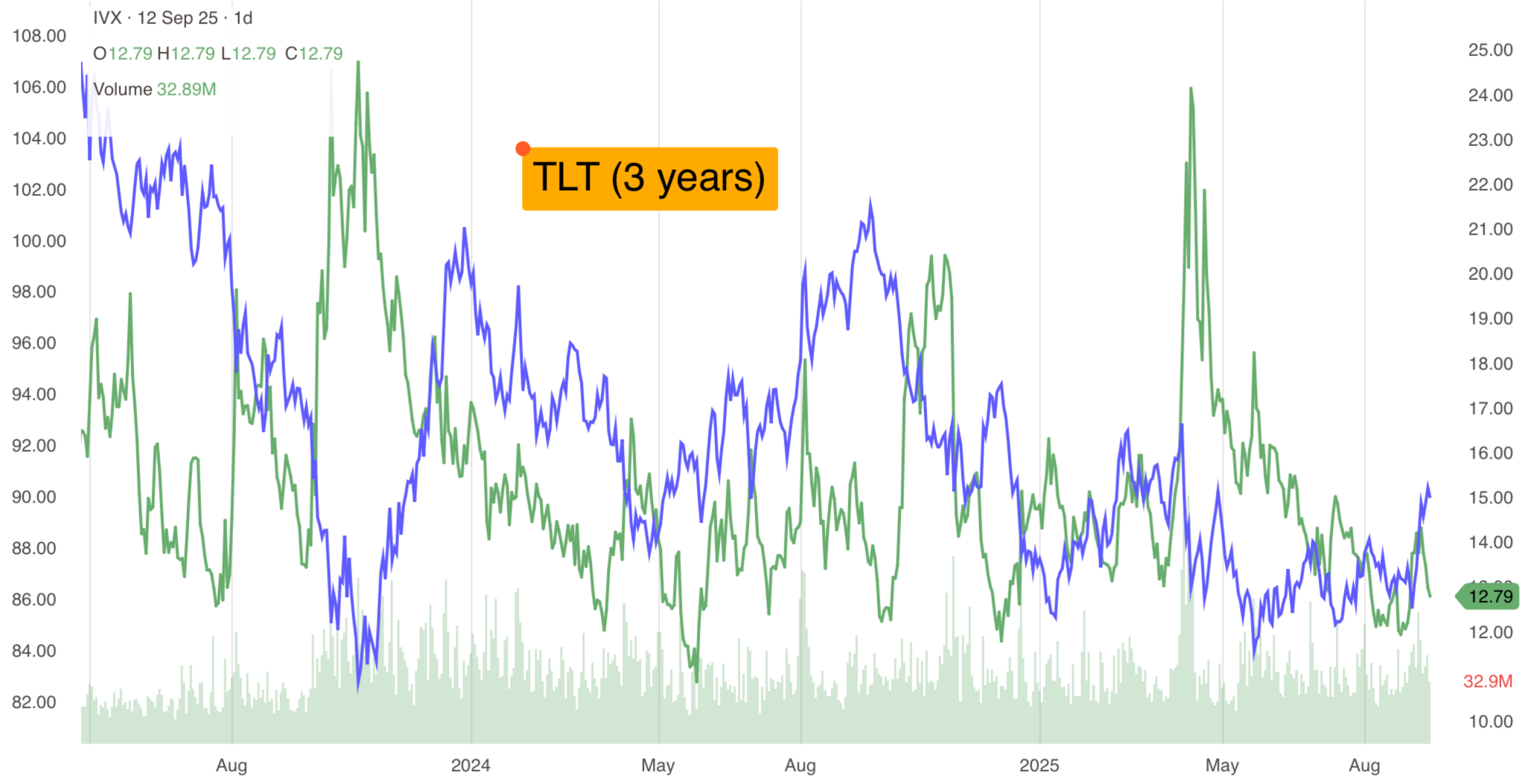

Fixed income investments were boosted by the expectations of rate cuts and, of course, the dollar continued to weaken against major currencies.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

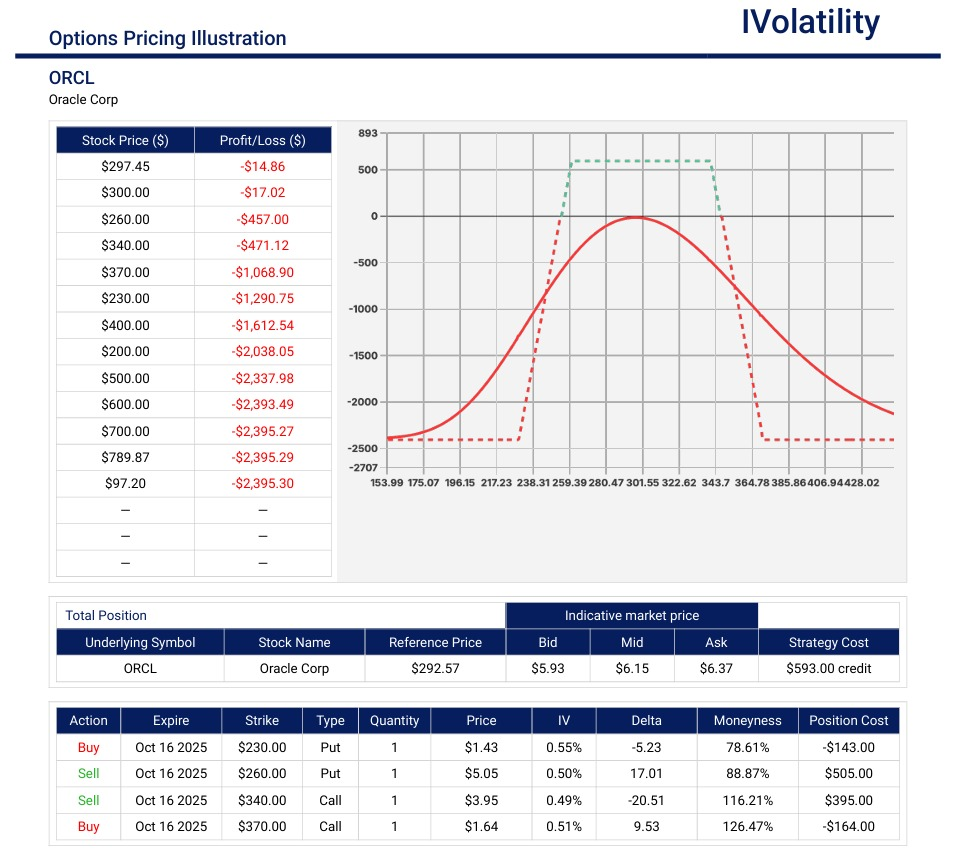

- ORCL (closed around 292.10 on Friday, Sep 12th)

Despite delivering mixed earnings, this stock experienced a significant surge in price. Following that, if a trader is neutral on ORCL for the next 33 days, then an Iron Condor strategy could be a profitable trade.

For Oct 17 expiration, sell the 260/340 strangle and buy the 230put and 370call to bring in the buying power

Premium collected: $614 / Buying power deployed: $2400

Probability of profit: 68%

Breakevens at around 254 and 346

If ORCL expires:

– between 230 and 260, the profit would be positive but less than 614

– between 340 and 370, the profit would be positive but less than 614

– anywhere between 260 and 340, the profit would be about 614

– below 31, the position would need to be closed or managed by rolling out in time or rolling down the call spread

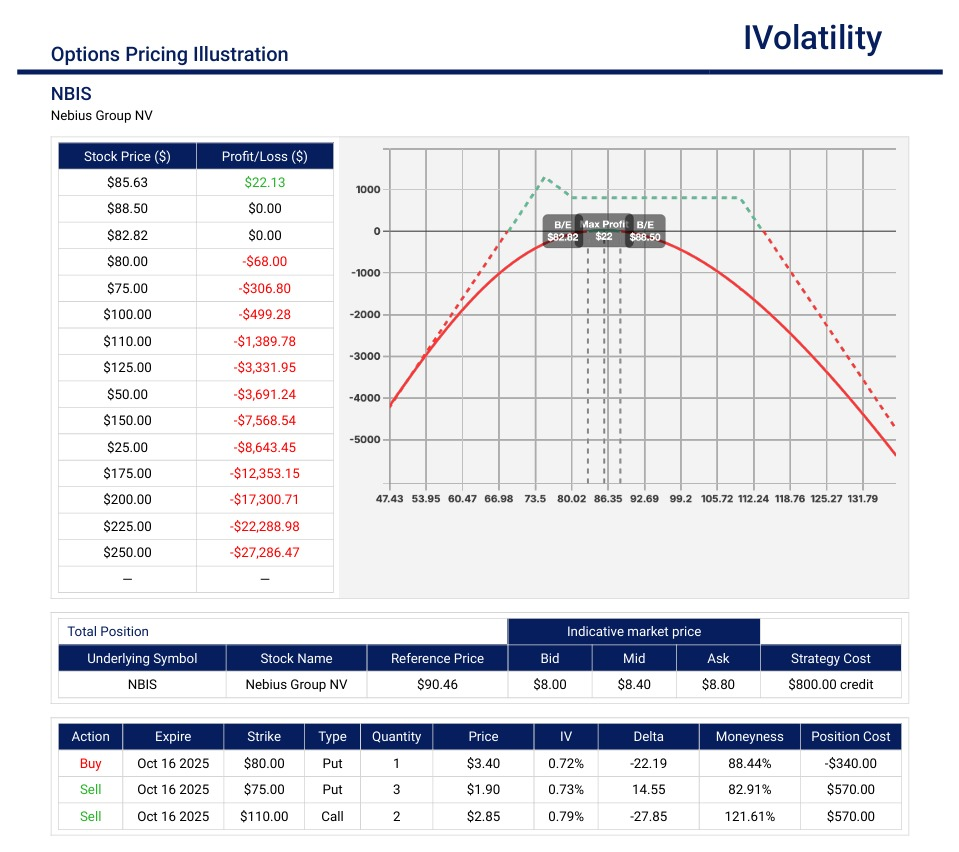

PnL Calculator from the IVolLive Web - NBIS (closed around 90.45 on Friday, Sep 12th)

This stock experienced a significant surge in its stock price during the week of September 8-12, 2025, primarily due to a landmark artificial intelligence (AI) infrastructure deal with Microsoft.

If a trader is neutral on NBIS but would like to sacrifice some credit received and capture some downside movement in case of a big drop, a ratioed strangle could be a profitable trade.

For Oct 17 expiration, sell three 75puts / buy one 80 put / sell two 110calls

Premium collected: $840 / Buying power deployed: $1937

Risk to both sides with breakevens around 62 and 118; max potential profit $1339

If NBIS expires:

– at sweetspot of 75, profit would be $1340

– anywhere between 80 and 110, profit would be between $840

– beyond the breakevens, the position would need to be closed or managed by adding duration

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

| INDEX | UP | DOWN |

| SPY | 1.16% | |

| QQQ | 1.84% | |

| IWM | -.1% | |

| DIA | .96% | |

| GLD | .15% | |

| BTC/USD | 3.94% | |

| 30-year US treasury bond | 1.57% | |

| Crude Oil | -1.16% | |

| VIX | -.73% |

Top S&P 500 Gainers:

Warner Bros Discovery (WBD) jumped 56% primarily due to reports that Paramount Skydance is preparing a majority-cash acquisition bid for the company.

Oracle (ORCL) jumped 26% primarily driven by a strong earnings report and the announcement of substantial AI-driven cloud infrastructure contracts.

Paramount Skydance (PSKY) jumped 25% primarily due to market speculation regarding a potential acquisition of Warner Bros. Discovery (WBD).

Micron Technology (MU) jumped 20% primarily due to analyst upgrades and price target increases.

EchoStar (SATS) jumped about 20% after it agreed to sell wireless spectrum licenses to SpaceX for its Starlink project.

AppLovin (APP) jumped about 19% following the announcement of their planned inclusion in the S&P index.

Robinhood (HOOD) jumped about 14% following announcement of its planned inclusion in the S&P index.

Broadcom (AVGO) jumped 7.5% helped by positive AI-related revenue outlooks.

Top S&P 500 Losers:

Synopsys (SNPS) dropped 29% primarily due to disappointing third-quarter earnings and concerns over geopolitical factors affecting its business.

The Trade Desk (TTD) dropped 13% primarily due to intensifying competition and analyst downgrades.

Humana (HUM) dropped 10% primarily due to concerns over upcoming Medicare Advantage (MA) quality ratings.

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

Notable movers to the upside:

- EchoStar (SATS) popped nearly 20% on news that it's selling $17 billion worth of spectrum licenses to Elon Musk's SpaceX. That's bad news for EchoStar competitors like T-Mobile (TM) and SpaceX competitors like AST SpaceMobile (ASTS)

- Planet Labs (PL) soared nearly 50% after the satellite company posted better-than-expected earnings and raised its fiscal guidance

- QuantumScape (QS) jumped over 21% thanks to a demonstration of its solid-state lithium battery powering an EV at a car show in Munich

- Cloud software company Nutanix (NTNX) rose over 7% and consumer credit reporting agency TransUnion (TRU) gained nearly 4% after both stocks were admitted to the S&P MidCap 400

- Sphere Entertainment (SPHR) gained over 11% on reports of some serious hype for the entertainment venue's showing of the Wizard of Oz

- Alibaba (BABA) popped over 4% on reports it led a $100 million funding round for Chinese startup X Square Robot

- Chinese EV maker XPeng (XPEV) will launch its mass-market Mona brand of vehicles in Europe next year, news that pushed shares up nearly 4%

Notable movers to the downside:

- Tesla (TSLA) fell nearly 1.5% on reports that the EV maker's share of the US market dropped to its lowest level since 2017

- Biopharma company Summit Therapeutics (SMMT) plunged over 25% after Phase 3 trial results from its new lung cancer treatment fell short of expectations

- CVS Health (CVS) dropped nearly 5% after management refused to provide guidance about forthcoming government quality ratings

Tuesday:

Notable movers to the upside:

- UnitedHealth (UNH) popped over 8.5% after the health insurance giant reported that 78% of its membership could be enrolled in lucrative Medicare Advantage plans in 2027

- Wolfspeed (WOLF) soared nearly 50% after the chipmaker's plan to restructure the bankrupt company was approved by a judge

- Tourmaline Bio (TRML) exploded nearly 60% on news that Novartis will purchase the biopharma company for $1.4 billion

Notable movers to the downside:

- Fox Corp. (FOX) fell nearly 7% after the Murdoch clan finally buried the hatchet, with Executive Chairman Lachlan Murdoch remaining in control

- Cybersecurity provider SailPoint (SAIL) beat Wall Street's expectations last quarter, but shares still dropped nearly 8% blamed mostly on lower earnings guidance ahead

- Lithium miners tumbled on the news that China's Contemporary Amperex Technology will resume operations at its Yichun mine, juicing the global supply of lithium. Albemarle (ALB) lost about 11.5%, Lithium Americas (LAC) fell nearly 4.5%, and Sociedad Química y Minera de Chile S.A (SQM) dropped 8.84%

- Core & Main (CNM), a drainage and wastewater parts supplier, saw its shares tumble over 25% after the company cut its fiscal forecast

- Eightco (OCTO) rocketed 3,000% higher on Monday after Wedbush analyst Dan Ives took the helm of the small crypto treasury company and bought a bunch of Worldcoin. Shares fell nearly 11% today as the hype faded

Wednesday:

Notable movers to the upside:

- Buy now, pay later platform Klarna (KLAR) popped nearly 16% during its first day of trading on the NYSE

- AeroVironment (AVAV) rose 6.95% after the drone maker reported mixed earnings

- GameStop (GME) popped nearly 3.5% after the gaming retailer/meme stock beat top- and bottom-line earnings expectations last quarter

- Oracle's big day propelled fellow AI cloud companies higher as well: CoreWeave (CRWV) rose nearly 17%, Arista Networks (ANET) added over 6%, Broadcom (AVGO) rallied nearly 10%, and Advanced Micro Devices (AMD) gained nearly 2.5%

Notable movers to the downside:

- Synopsys (SNPS) plummeted over 35% after the chip design company missed earnings expectations last quarter thanks to lower sales within its IP business segment

- Rubrik (RBRK) sank over 18% even though the data security company's revenue rose 51% last quarter to beat analyst expectations

- Online pet products seller Chewy (CHWY) dropped over 16% after failing to live up to investors' high hopes

- Bankrupt chip maker WolfSpeed (WOLF) rose 48% on Tuesday on news of its restructuring plan, but fell over 18% today as it was recalled that the company is indeed in bankruptcy

Thursday:

Notable movers to the upside:

- Oxford Industries, parent company of fashion icon Tommy Bahama, rallied 27.5% on projections that tariffs won't hurt as much as previously thought

- Figure (FIGR) soared nearly 25% on the blockchain company's first day of trading

- Health insurer Centene (CNC) popped over 9% on better-than-expected earnings guidance and good government ratings for its Medicare plans

- Micron Technology (MU) jumped over 7.5% after Citi analysts bumped up their price target for the chip manufacturer, citing high data center demand

- Revolution Medicines (RVMD) rallied over 14% on strong trial data for its new pancreatic cancer treatment

- Alibaba (BABA) gained nearly 8% on reports that the Chinese e-commerce giant has raised $3.2 billion in convertible bonds this year to fund its focus on AI technology

- Synopsys (SNPS) recovered nearly 13% a day after the semiconductor tool supplier plunged 35% following a rough earnings report

Notable movers to the downside:

- Delta Airlines dropped over 1.5% after the company reiterated its ho-hum third-quarter earnings guidance and noted that demand for economy seats has sunk

- Netflix sank over 3.5% on news that the Chief Product Officer Eunice Kim has resigned

Friday:

Notable movers to the upside:

- Tesla (TSLA) climbed 7.36% on hopes that Elon Musk is pivoting the EV company to robotics

- Super Micro Computer (SMCI) rallied nearly 2.5% on the news that it has begun shipping Nvidia's Blackwell Ultra solutions chips in volume to customers around the globe

- BigBear.ai (BBAI) jumped nearly 4% on the announcement that the AI security company's technology helped speed up arrivals at Nashville International Airport

- Quantum computing stocks got a boost after UK regulators allowed IonQ to buy Oxford Ionics. IONQ gained nearly 20%, while Rigetti Computing (RGTI) rose 14.38% and D-Wave Quantum (QBTS) added 7.51%

- Black Rock Coffee Bar (BRCB) popped nearly 40% on its first day of trading as a public company

- Six Flags Entertainment (FUN) enjoyed a rare win, rising nearly 8% on reports of rising attendance at its theme parks

- The FAA announced a new pilot program to speed up the rollout of air taxis, helping Archer Aviation (ACHR) rise over 3% and Joby Aviation (JOBY) gain nearly 2.5%

Notable movers to the downside:

- Restoration Hardware (RH) tumbled nearly 5% after the furniture retailer fell short of analyst expectations this quarter and cut its fiscal forecast due to tariffs and a weak housing market

- Boeing (BA) fell nearly 2% after striking workers turned down a contract offer from the troubled aircraft manufacturer

- Rent the Runway (RENT) plummeted nearly 40% following a much worse than expected earnings report

- Freeport-McMoRan (FCX) lost over 2.5% as a key copper mine in Indonesia remained shut down following a massive mudslide

- News that the Trump administration will link Covid vaccines to the deaths of 25 children. Pfizer fell nearly 4% Moderna lost almost 7.5%, and BioNTech dropped over 7%

Notable Economic Data due week of Sep 15th-19th:

Fed meeting (Sept 16-17) will be the major event of the week. Markets will move based on the size of the cut, the number of cuts priced in for end-of-year and forward guidance provided by the Fed.

CPI, PPI, unemployment claims and non-farm payrolls will be deeply scrutinized for signs the Fed can comfortably ease.

Earnings updates, guidance (especially from big tech / AI / semiconductors companies) and forward outlooks will help investors decide whether recent gains are sustainable.

Trade and tariff developments, regulatory decisions, energy prices and supply chain disruptions could feed into inflation or risk sentiment.

Notable Earnings Reports due week of Sep 15th-19th:

The actual day may vary, so do consult with your broker to confirm the actual date.

Monday: HAIN / PLAY

Tuesday: FERG

Wednesday: CBRL / GIS / BLSH

Thursday: DRI / FDX / FDS

Closing Thoughts

What should one think when a crypto company would prefer to invest in "natural bitcoin?"

In an interesting turn of events, Tether, the world's largest stablecoin company, held talks with gold miners last week to discuss investing in the gold supply chain. The Financial Times reported that Tether already has $8.7 billion in bullion locked in a vault in Zurich as collateral for its stablecoin, and that this may be a move to increase the company's exposure to gold.

Last Friday, Goldman Sachs proclaimed that gold miners were one of the Wall Street titan's favorite investments through the rest of 2025. "Our commodity strategists anticipate gold prices will rise by 14% through 2026 due to strong central bank and ETF demand. Gold mining stocks should rally alongside the underlying commodity", Kostin wrote.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.