Up Up and Away

June 30, 2025

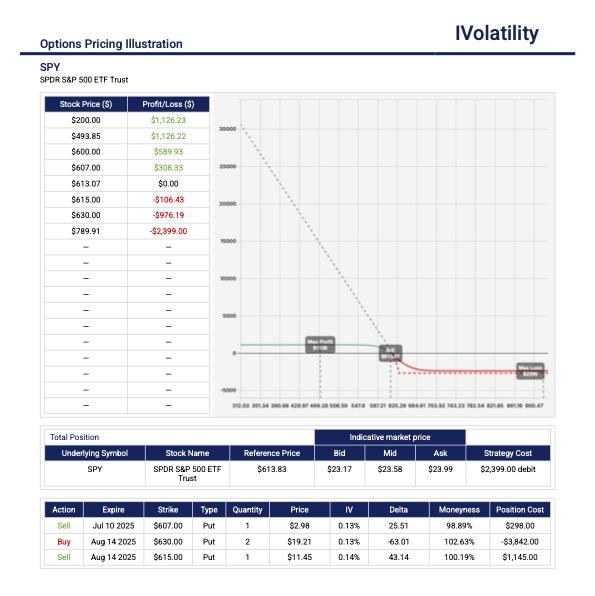

The week ended with the S&P 500 recording a new high for the first time since February. The Nasdaq Composite achieved a new high since December 2025.

Can the euphoria be attributed to the apparent end of the 12-day conflict between Israel and Iran? Oil prices dropped and tamed inflation fears and the finalization of a trade agreement between the US and China loomed on the horizon.

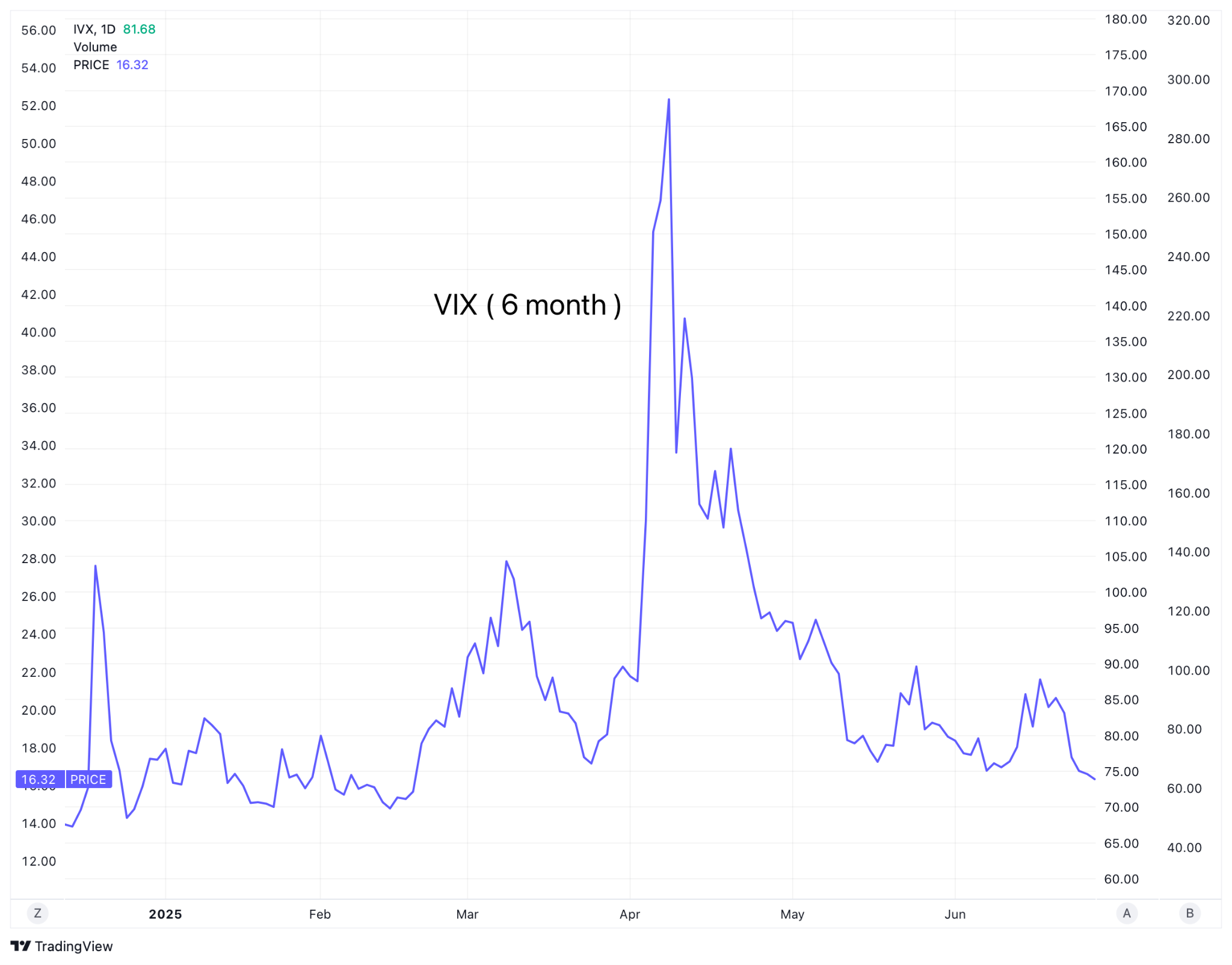

There appears to be a lot of confidence among traders recently, and nowhere is that more apparent than in the VIX, the CBOE Volatility Index, aka the Fear Index. The VIX is an indication of the market's expectation of volatility based on S&P 500 index options. When the VIX rises above 30, it's a sign of some serious trepidation in the market and, anytime it falls below 20, the market appears to be calm and positive. The VIX skyrocketed to over 50 on Liberation Day as investors worried over tariffs. However, the VIX has been gradually declining and recently fell below its key support level of 17 – a move that underlines investors' confidence that the markets will keep heading upwards for a while.

There could be a few canaries in the coal mine:

- A large part of the recovery since Liberation Day has been in big tech stocks that have boomed as AI demand increases. Sectors outside tech, such as consumer discretionary and healthcare, have had a far rockier 2025, while many small-cap stocks remain below their pre-tariff levels;

- There is a decline in consumer confidence that might indicate economic headwinds due to tariff issues and delicate ceasefires.

Major Indices for the Week

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

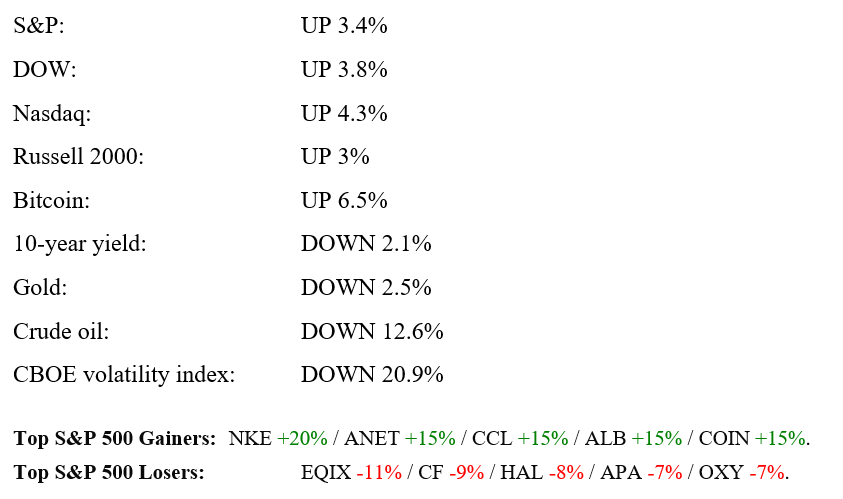

- USO (closed at 73.27 on Friday)

With monthly IVs above 40%, sell two staggered puts - one can be the Jul 73(ATM) and the other the sep70 put (or 30 delta); buy 2 Aug45puts to reduce the buying power required

Net position delta = 75 / Premium collected = $345

Buying power = $1960 / Breakeven is about 68.5

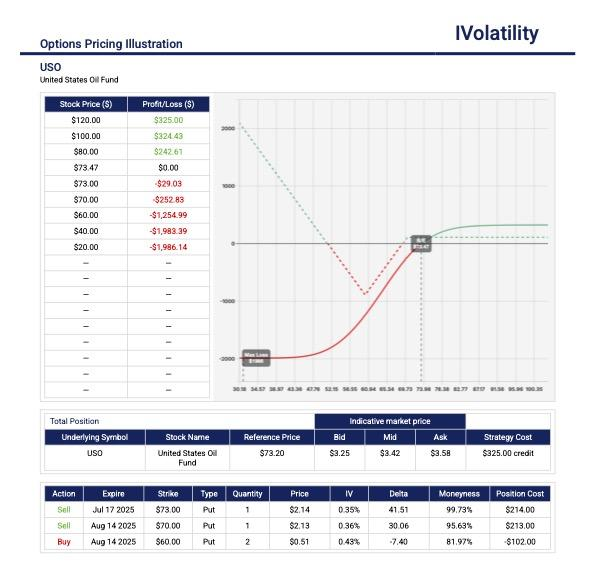

PnL Calculator from the IVolLive Web - HOOD (closed at 83.03 on Friday)

With monthly IVs above 60%, buy a call diagonal

Buy the ITM Dec 50call and Sell the Jul 90call (about 30delta)

Total cost = $3400 / Net position delta = 60 / Potential max value in excess of $4000 (multiple chances to roll out the short call in time)

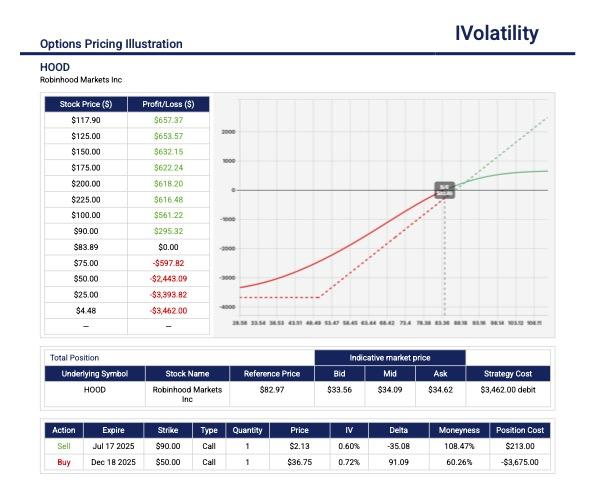

PnL Calculator from the IVolLive Web - SPY (closed around 615 on Friday)

With low monthly IV, buy a put zebra

Buy two aug630 puts and sell one Aug 615put, synthetically creating a dynamic short position of -100 delta in SPY

Sell one Jul11 607 put to cover and reduce cost (about 30delta)

Total cost = $2300 / Net position delta = -68 / Potential max value in excess of $3800 (multiple chances to roll out the short put in time)

PnL Calculator from the IVolLive Web

Review selected market profiles below:

Top Headlines this week

Monday's Recap:

On optimism that Iran's retaliation to US bombings would be limited to missile attacks, the US capital markets closed higher. Similarly, oil prices settled down assuming that the conflict would not extend to the Strait of Hormuz. The US dollar rose to its highest level in nearly a month from a three-year low as investors sought safety. Meanwhile gold inched higher confirming continuing investor unease. Bitcoin fell close to the key support level of $100,000 before recovering later in the day as traders took on more of a risk-off stance.

Notable movers to the upside:

- Tesla climbed nearly 10% following a successful robotaxi debut

- The stablecoin adoption wave continued to hit markets, with Fiserv up 4.38% after announcing it made deals with Circle and PayPal to roll out a stablecoin and digital-asset platform for banking clients

- Circle climbed almost another 10%

- Nuclear energy stocks climbed on the news that New York will build the first major new US nuclear plant in more than 15 years

Notable movers to the downside:

- HIMS, a telehealth and online pharmacy company, plunged nearly 35% after Novo Nordisk announced it is ending their partnership just two months after the competitors struck an alliance

- NVO, a Danish global healthcare company, lost over 5% after the pharma giant announced disappointing trial results for its newest weight-loss drug

- SMCI (Super Micro Computer), a seller of high performance server and storage systems, fell nearly 10% after announcing that the company will offer $2 billion in convertible senior debt in order to raise money

Tuesday:

Markets continued to gain steam upwards while oil continued to plummet as investors continued to believe that the ceasefire between Israel and Iran will stay in place.

Notable movers to the upside:

- Airline stocks rose as oil pulled back

- Semi-conductors outperformed as investor appetite for risk increased

- 18 stocks in the S&P traded at new 52-week highs. These include:

- NFLX trading at all-time high levels since its IPO in May 2002

- TTWO, trading at all-time high levels since its IPO in April 1997

- RCL, trading at all-time high levels since its IPO in April 1993

- JPM, trading at all-time highs since its IPO in 1983

- NDAQ, trading at all-time high levels back to April 2003

- AVGO, trading at all-time high levels back to its IPS in Aug 2009

- IBM, trading at all-time high levels back to Jan 1962

- MSFT, trading at all-time high levels back to its IPO in Mar 1986

Wednesday:

Stocks tried to eke out fresh all-time highs but the rally faded as the day progressed when the Fed Chair dashed any hopes of early rate cuts by declaring that tariff-based inflation was still an open question.

Notable movers to the upside:

- MU reported solid quarterly earnings and positive guidance for the future

- NKE pleased investors by reporting reallocation of supply to countries other than China. So while earnings were low, the low appears to be in and the future appears brighter

- NVDA received a higher price target of $250 and rose on that announcement

- COIN hit a 52-week high and earned the title of "one-stop Amazon" of all things crypto

Thursday:

It appeared that the US administration basically waved off the approaching July tariff deadlines and markets continued to push upwards for new record highs. In addition, there appeared to be a 25% chance of a rate cut, up from 12.5% a week ago. This shift may have been fueled by the US President considering an early Fed Chair appointment.

The Israel-Iran ceasefire continued to hold and oil prices continued to decline. This geopolitical calm further contributed to investor optimism. The markets continued to melt up with low volume and low volatility in place.

- CORZ jumped up over 30% after an article in the WSJ reported on acquisition talks with CRWV, the AI company

- NVDA rose to a new all-time high and became the world's largest company by market cap. The CEO commented on multi-trillion dollar opportunities in autonomous vehicles and robotics factories

Friday:

Both the S&P and the Nasdaq posted yearly highs. It appeared that the conflict between Israel and Iran had come to an end and the US and China had finalized their trade agreements, in particular regarding rare earth exports.

However, when President Trump announced termination of trade talks with Canada, there appeared to be some volatility and large drops in market direction. Not surprisingly, the Markets recovered in the last half hour of trading to close at fresh highs.

The S&P 500 dropped nearly 20% in the weeks following Liberation Day, but has pulled off an incredible comeback, capped off with today's record-breaking close. Here's a fun fact: a 20% recovery over two months has only occurred five other times since 1950 (according to Carson Research). But check this out: every time it happens, the S&P averages a 30% gain in the next 12 months!!!

Notable movers to the upside:

- NKE continued to move up post-earnings

- NVDA extended its winning streak to 5 days in a row

Notable movers to the downside:

- COIN tumbled over 5% as traders apparently paused to take profits ended

- CRCL tumbled over 15% ending its meteoric rise following its recent IPO

- Gold miners tumbled while the price of the precious metal fell as investors took a risk-on stance.

Considerations for the coming week

Economic Data Releases:

- The latest JOLTS reading along with construction spending and manufacturing PMI are scheduled to be released on Tuesday

- The June non-farm payroll report will be released on Thursday

Earnings Reports:

The calendar is light with Constellation Brands (STZ) perhaps being a notable one.

Closing Thoughts

This week, the Trump administration ordered mortgage finance firms Fannie Mae and Freddie Mac to include the crypto assets of loan applicants. The two government-controlled firms don't issue loans directly, but are responsible for guaranteeing over half of US mortgages. This order could be translated to mean that crypto is being recognized as a major source of wealth creation and advances President Trump's goal of establishing the US as "the crypto capital of the world."

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.