MBS Bonds: Model vs. Reality

April 28, 2025

The mortgage market is more complicated than other fixed-income markets because each mortgage borrower may behave differently – and this behavior changes over time. Therefore, sophisticated prepayment models are created to predict future mortgage behavior and, in turn, to price MBS bonds. These models benefit the MBS market greatly by allowing bonds to be analyzed quickly and systematically.

However, they have problems that are inherent to all types of models:

- If a model is too simple, it cannot be very accurate because it does not capture the complexity of the mortgage market.

- If a model is made more sophisticated, it becomes less transparent, more delayed, and less practical.

Every time I use a prepayment model, I remember what my high school geography teacher used to say:

"A model of the Earth is a globe. Small globes are too simplistic and inaccurate. But if we want to build the most accurate model, it would have to be a globe the size of the Earth – which is not very practical."

The most fundamental problem with prepayment models is that different models – and even different versions of the same model – often produce contradictory results. Given the complexity of these models, it is nearly impossible to determine which results, if any, are correct. So what do you do when one model tells you that a bond is too cheap and you should buy it, while another model tells you that the same bond is too rich and you should sell it?

We classified typical issues with prepayment models as follows:

- On-The-Run Collateral

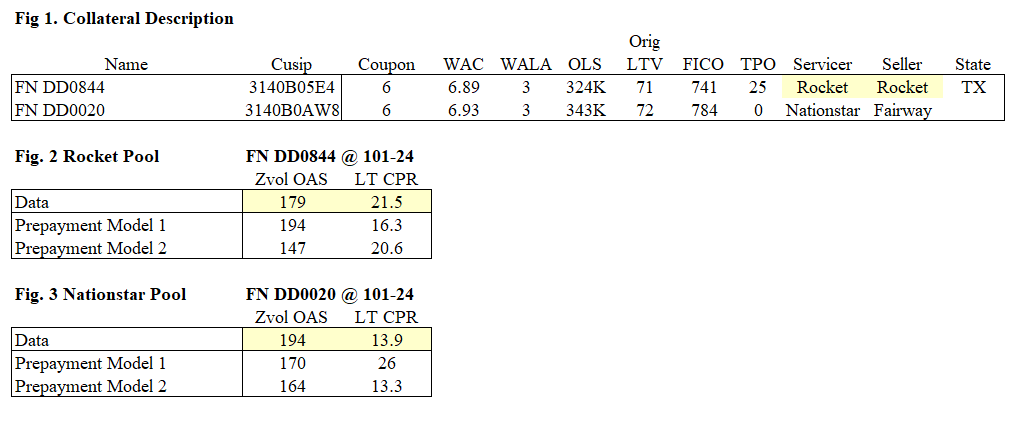

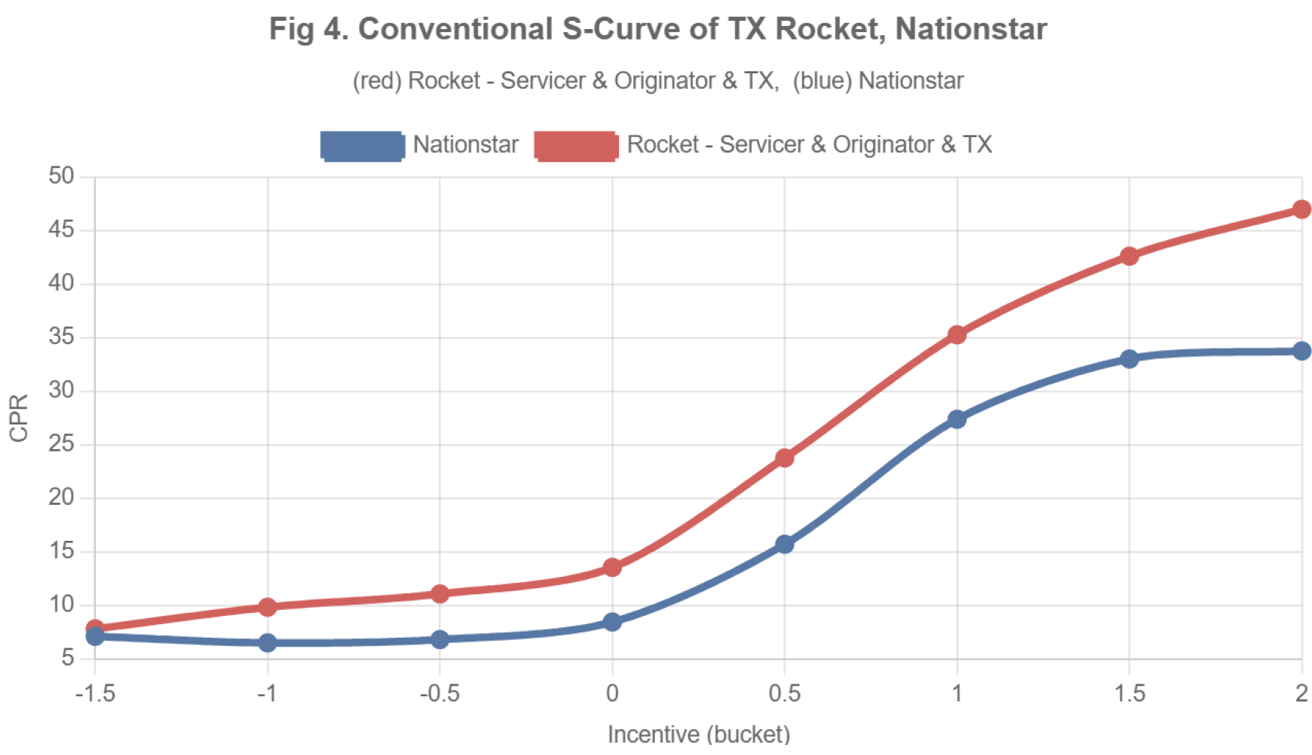

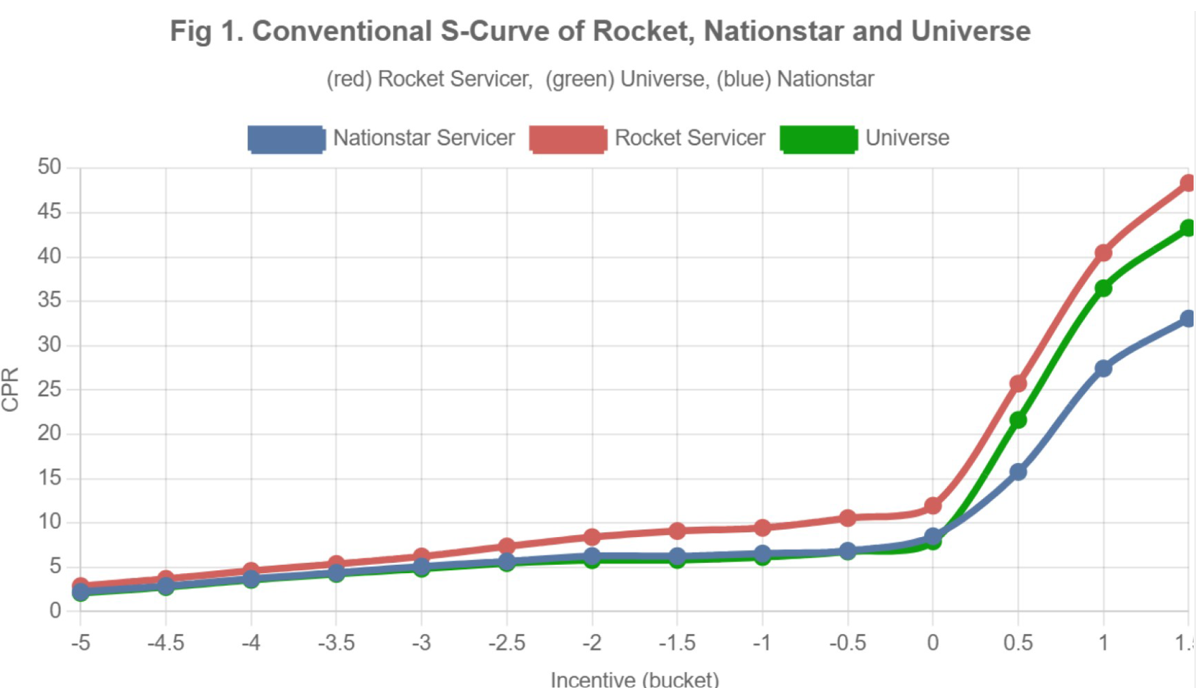

Prepayment models are most accurate for bonds backed by on-the-run collateral in stable interest rate environments and when there are no regulatory or other market changes. The less prepayment volatility, the better the accuracy, of course. But even for cases and bonds like these, the results are far from perfect (see Example 1): Prepayment Model 1 says that FN DD0844 (Rocket, TX) is cheaper than FN DD0020 (Nationstar, Generic) and Prepayment Model 2 says the opposite. Only when we look at the data we see that Rocket, TX prepays faster than Nationstar, Generic (see Fig 4), and, therefore, FN DD0020 is cheaper (which is what our No-Model Data-Driven result shows). - Market Rates Change

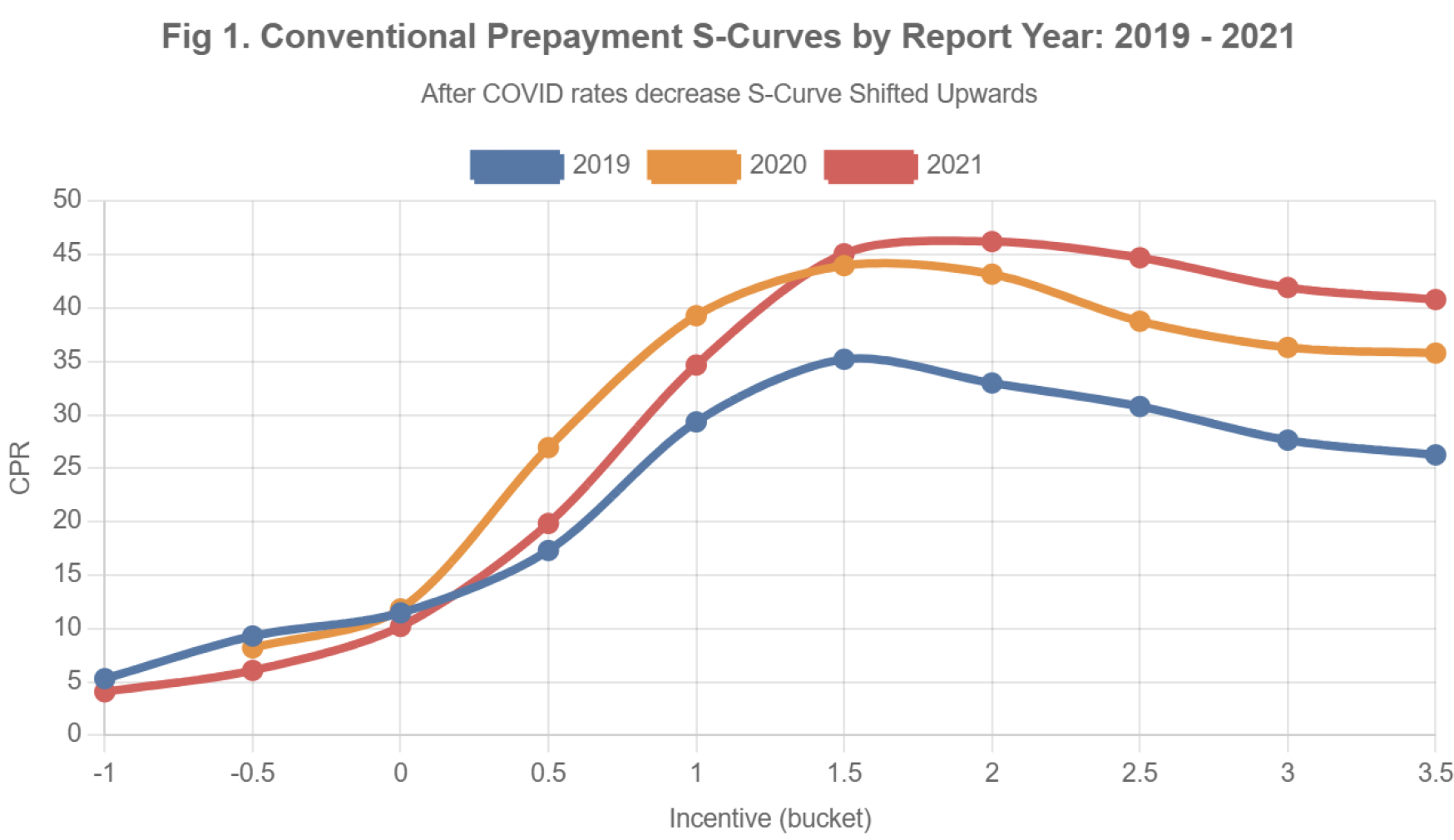

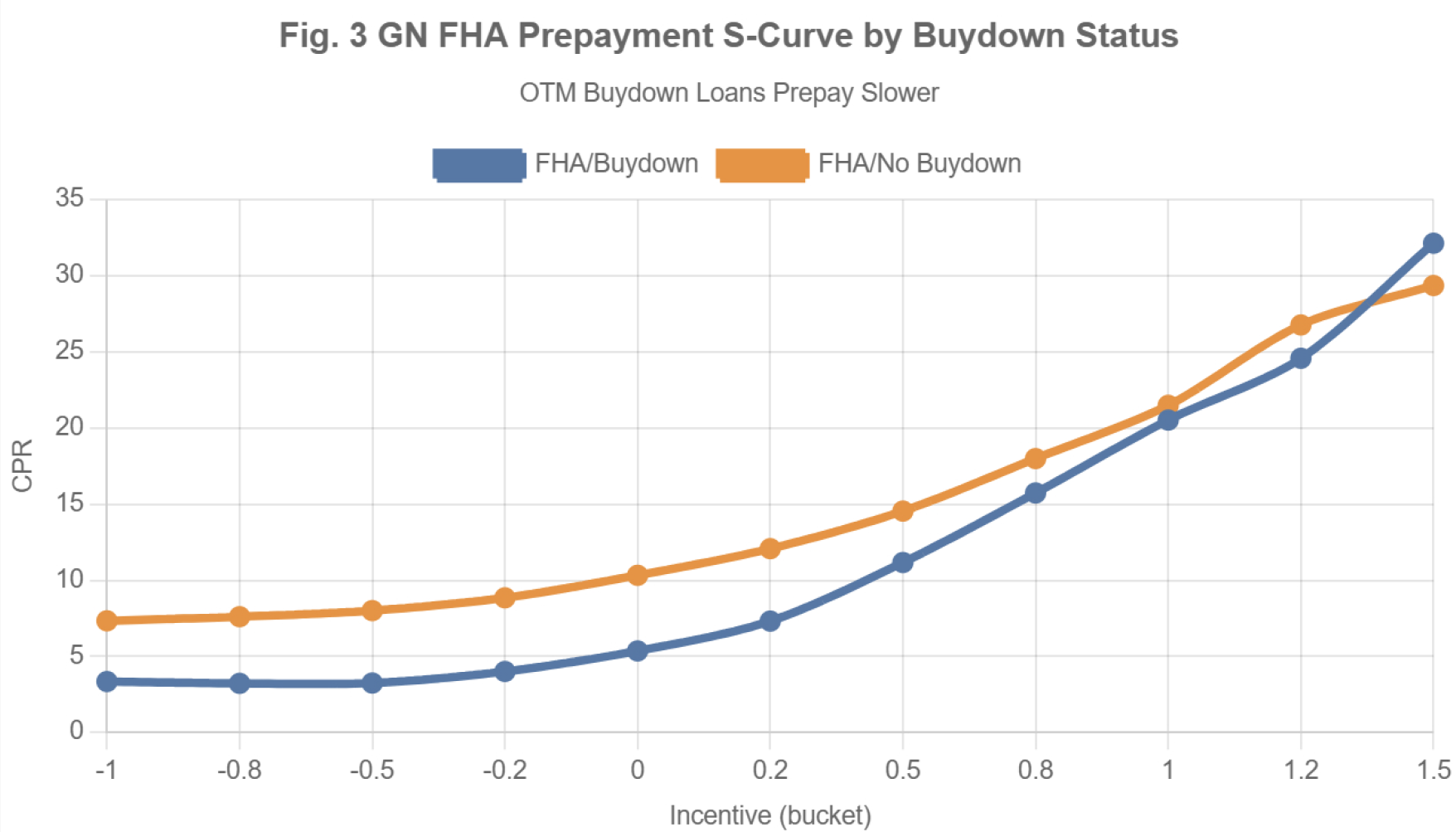

Prepayment models become less accurate when market rates move materially. The reason for this is that S-Curves shift over time and should be monitored monthly (see Example 2). For example, during the COVID-era rate rally, the S-Curve shifted upward every month, resulting in a cumulative shift between the 2019 and 2020 S-Curves of up to 15 CPR. Popular prepayment models lagged these shifts due to lengthy recalibration cycles (often 3-6 months). As a result, market participants realized that prepayment models were too slow compared to actual speeds. This led to a significant widening of OAS spreads in these models - hundreds of basis points for premium MBS pools and thousands of basis points for MBS derivatives. In reality, many bonds were trading at negative OAS once adjusted for the actual S-Curve. This was confirmed by the same prepayment models once they were eventually recalibrated. - Market or Regulatory Changes

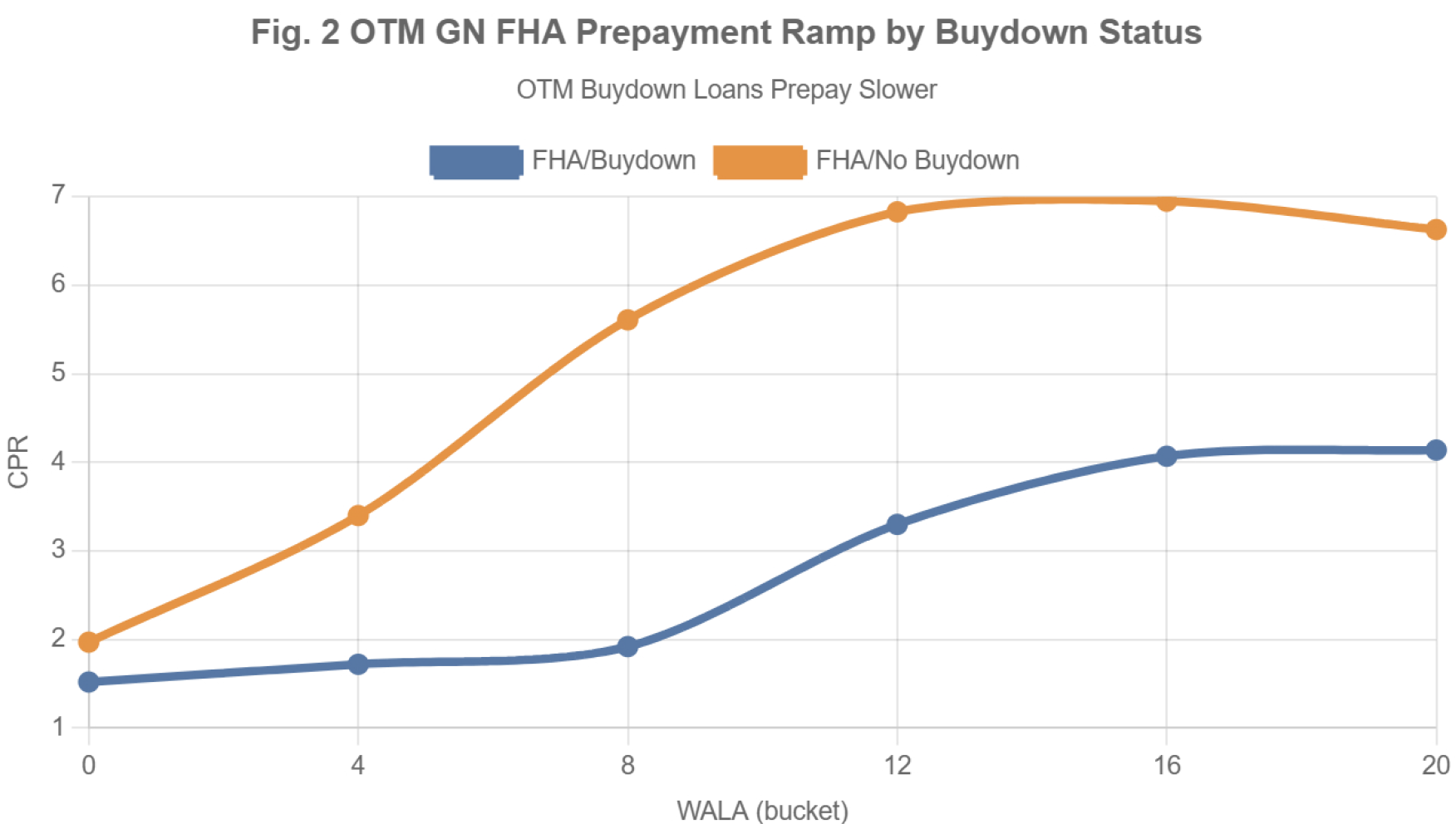

Prepayment models become even less useful when there are market or regulatory changes (e.g., MIP, LLPA, and other GSE, FHA, VA program changes). Some of these changes have a significant effect on pricing and, in most cases, are already reflected in market prices well before prepayment models are adjusted. See Examples 3 - increase of builder buydowns or Example 4 - the recent acquisition of Mr. Cooper (Nationstar) by Rocket. Both had a large impact on the market. - Off-The-Run Collateral

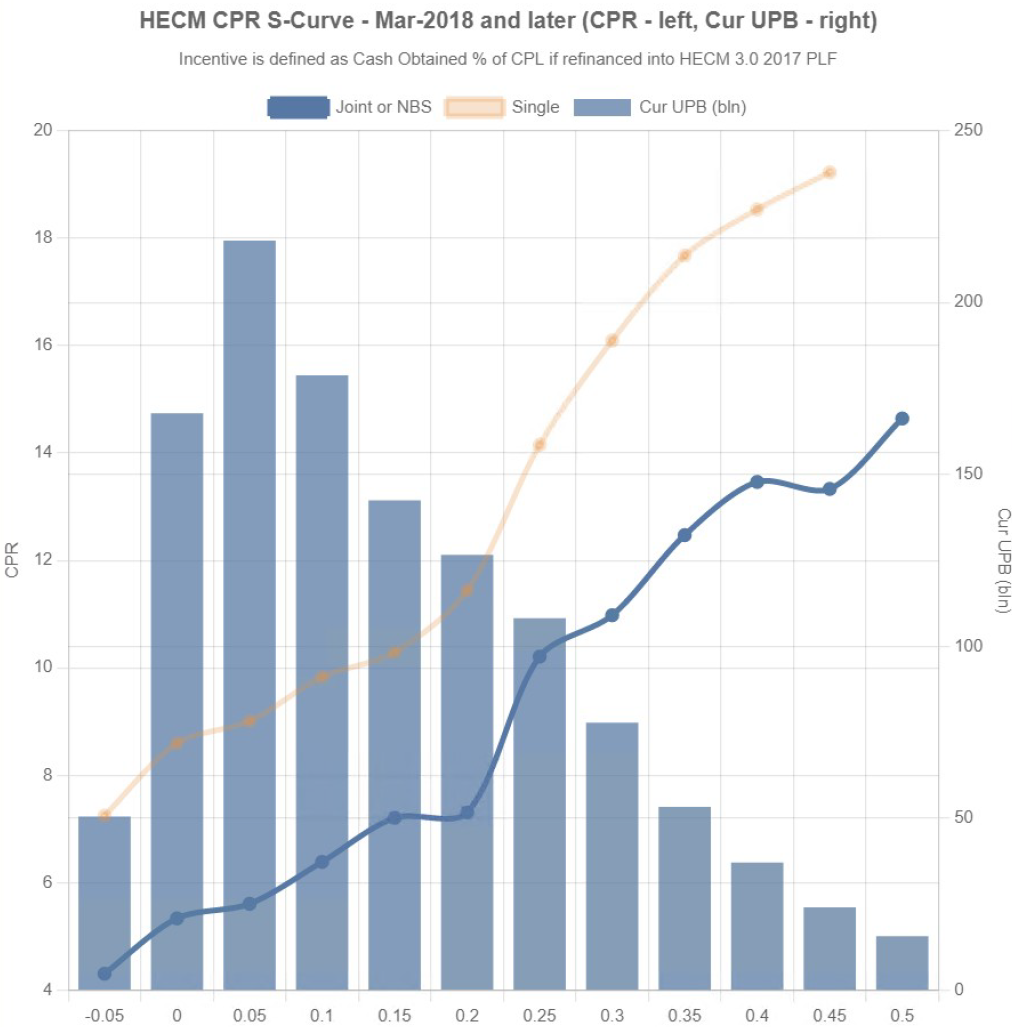

The largest issues when using prepayment models arise when a bond is backed by off-the-run collateral. Although the size of these collateral types is small compared to the $13 trillion MBS market, it is still very material, often amounting to hundreds of billions. Examples include HECMs, HFAs, modified collateral, and pretty much all non-Agency sectors. Each of these sub-markets have their unique features which change over time so it is next to impossible to model them all accurately. Good example of this would be HECM market (see Example 5).

What is the best solution to the problems above?

We believe it is running and analyzing the bonds using historical data directly – without model complexity and subjective modeler assumptions. But the biggest challenge is that in most cases, this process is manual, very time-consuming, subjective (based on an analyst's opinion), and inconsistent – even though all trading desks perform similar manual processes.

We automated this process and made it easy to use. It is different from a prepayment model in the following ways:

- Comprehensive – covers all types of collateral as long as there is historical performance data available

- Transparent – all results can be validated against historical data

- Objective – not based on modelers' subjective assumptions

- Timely – updates as soon as a new monthly prepayment report is released

This No-Model Data-Driven Valuation Technology automates this process across all structured products, delivering the most accurate and consistent pricing and risk metrics.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility serves more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics.

Discover the benefits of using IVolatility solutions for Mortgages:

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Please let us know!

Previous issues are located under the News tab on our website.