Agency MBS Spec Pools: "Permanent" vs. "Temporary" Value

March 06, 2025

The MBS agency pools market is one of the largest (about $9 trillion) and most liquid (130K trades a month in the most recent FINRA Trace data) fixed-income markets in the world. Many MBS pools trade at a pay-up over generic pools due to their collateral having favorable prepayment characteristics. One of the challenges in valuing different pay-up stories is that the prepayment characteristics of a pool may change as the pool seasons.

For "permanent" value pools, pay-up stories are based on factors that do not materially change over time, such as loan size or geography. In contrast, "temporary" value stories are influenced by factors that may evolve over time.

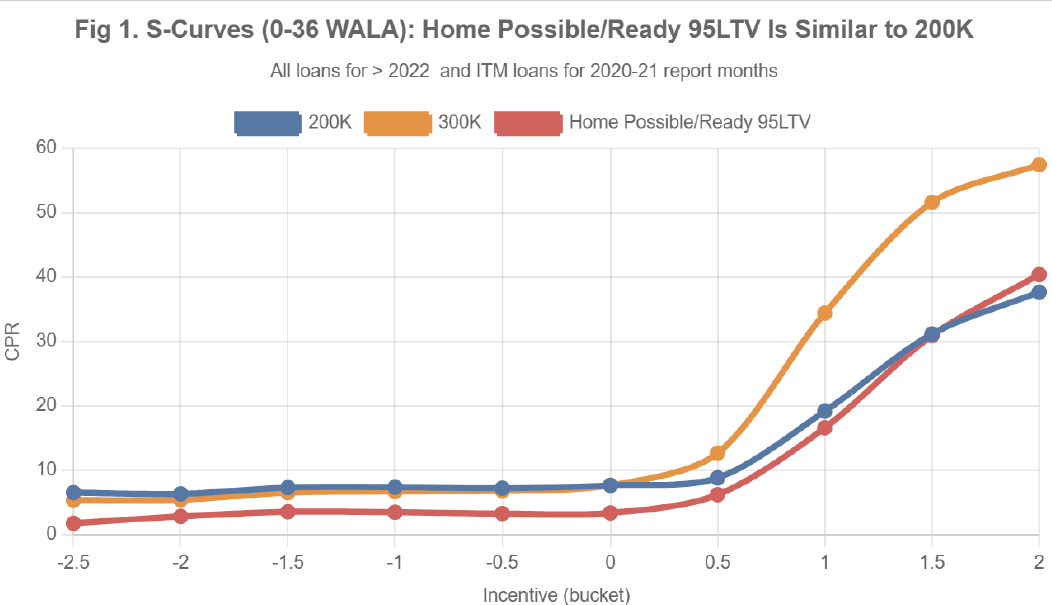

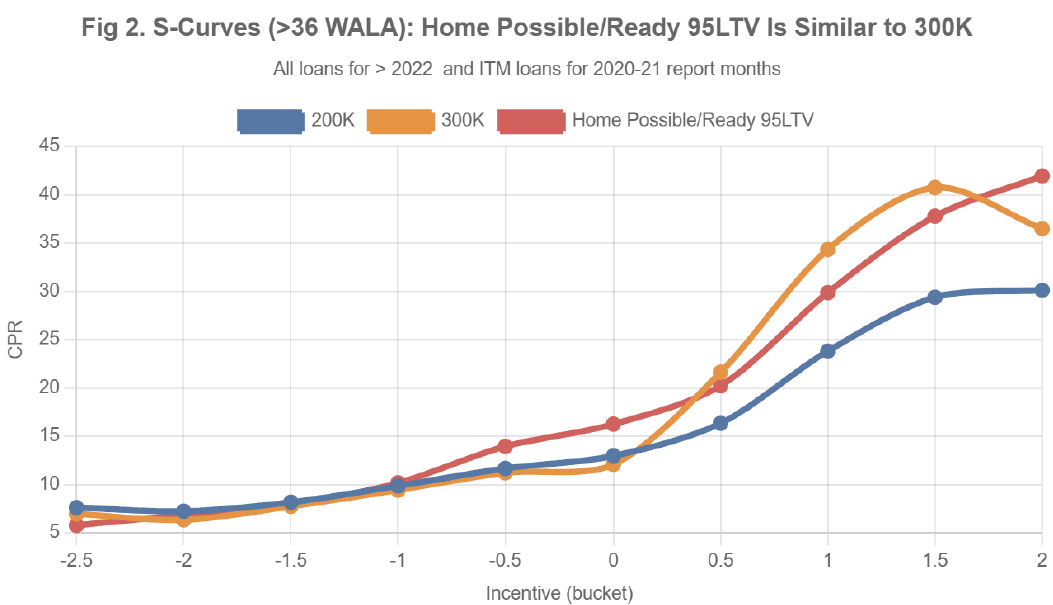

One example of a "temporary" value pay-up story is high original LTV (loan-to-value) pools. Initially, these pools prepay more slowly because borrowers lack sufficient home equity to refinance. However, as the loans season – particularly in a positive HPA environment – LTV decreases. Once it reaches approximately 80%, the speeds of these loans can even surpass those of generic collateral due to pent-up demand. As a result, the favorable prepayment characteristics of these pools diminish over time, reducing the value of the pay-up. Figures 1 and 2 below illustrate this:

- Fig 1: S-Curves (<36 WALA): Home Possible/Ready 95LTV Is Similar to 200K

- Fig 2: S-Curves (>36 WALA): Home Possible/Ready 95LTV Is Similar to 300K

If you would like us to run custom Spec Pool stories reports for you, please let us know!

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility serves more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Please let us know!

Previous issues are located under the News tab on our website.