Making HECMs Trading More Transparent

February 28, 2025

The Home Equity Conversion Mortgage (HECM) market remains one of the smallest and least transparent segments of the Agency MBS market. A significant amount of critical information on HECM performance and features is not readily available in standard systems. This lack of transparency is concerning, especially as an aging population and growing home equity – now totaling $35 trillion in the U.S. (including $14 trillion for homeowners aged 62 and older) – make this financing option increasingly important.

Our goal is to bring greater transparency to this market by providing loan-level insights on all originated HECM loans. With this data, market participants can price and hedge HECM bonds more accurately, reducing the risks associated with owning these securities. As a result, HECM rates could become more competitive and affordable for borrowers.

Key HECM performance drivers missing from standard systems:

- HECM Product Type

- Draw Performance

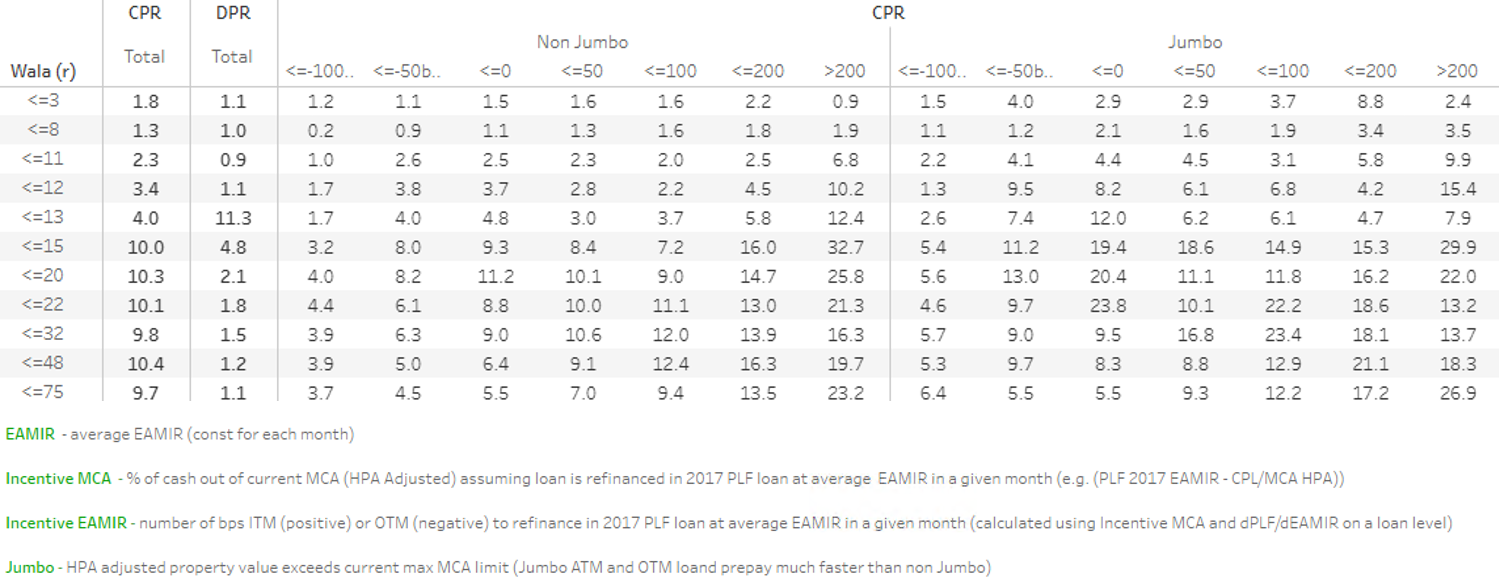

- Incentive EAMIR (adjusted for HPA, borrower age, and market EAMIR, presented in mortgage-rate terms)

- Jumbo (adjusted for HPA)

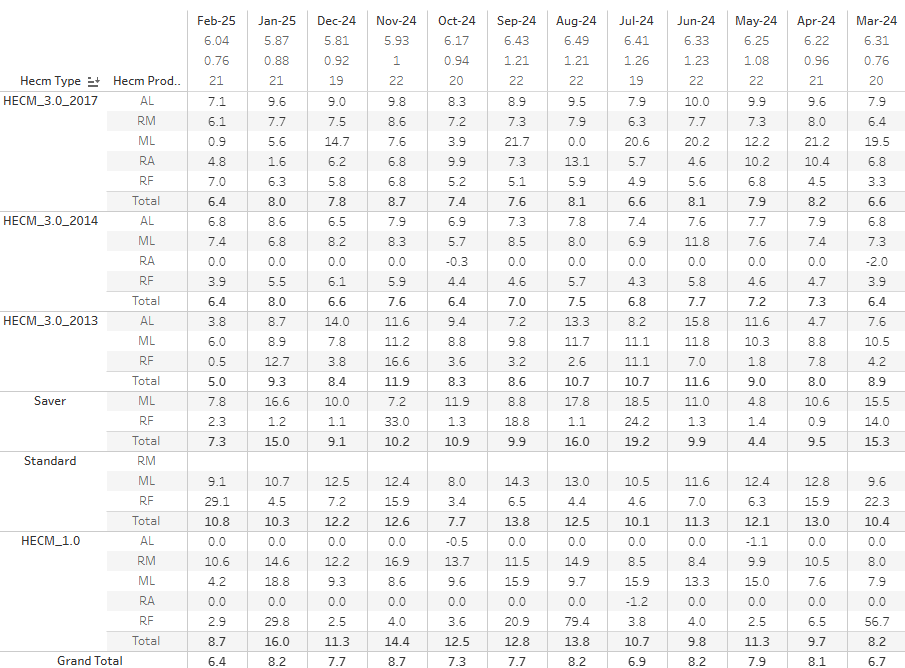

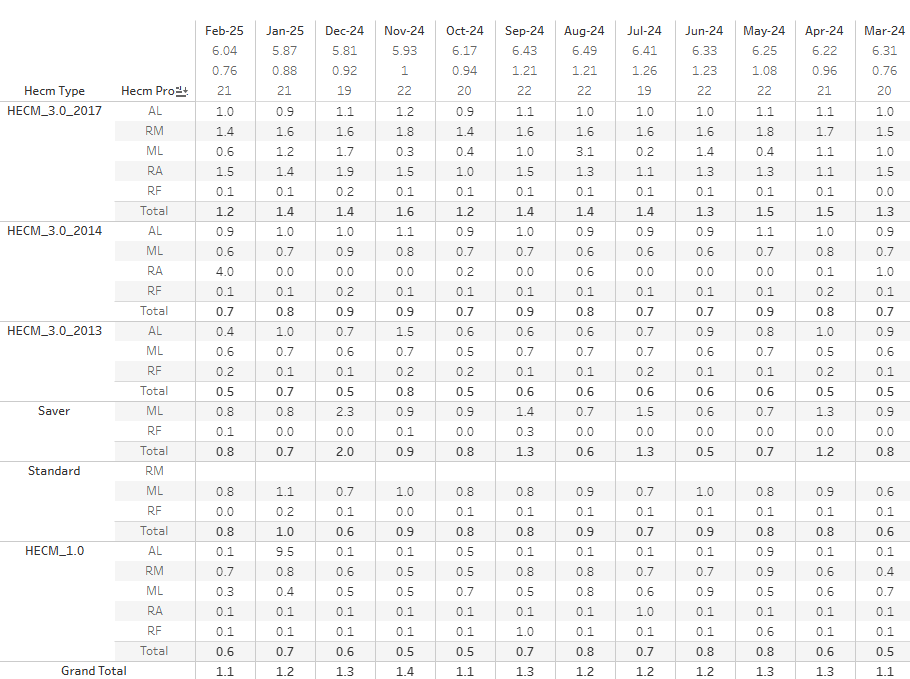

Why these fields matter for bond performance & pricing is clear from the figures below:

- Fig 1 CPR by HECM Product Type

- Fig 2 Draw by HECM Product Type

- Fig 3 CPRs by Incentive EAMIR and HPA-Adjusted Jumbo

By improving access to granular HECM data, we can help create a more efficient and liquid market—benefiting both investors and borrowers alike.

If you would like us to run custom HECM reports for you, please let us know!

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility has served more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Fig 1. CPR by HECM Product Type

Fig 2. Draw by HECM Product Type

Fig 3. CPRs by Incentive EAMIR and HPA Adjusted Jumbo

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.