The Election Volatility Skew

September 13, 2024

The Markets at a Glance

Wednesday's market action demonstrates just how sensitive the equity market is right now to the confluence of factors including inflation, interest rate cuts, the upcoming election, and the public's on-again-off-again love affair with tech stocks. To have that big of a swing within a single trading day not only demonstrates how jittery investors are right now but that they can't even make up their minds about direction.

The economy continues to create a quandary, even for the pundits, who can't decide whether to favor a stronger economy with less of a rate cut or a weaker economy with a larger rate cut. While the overwhelming consensus now assumes a quarter-point cut this month, further cuts this year remain quite murky and both inflation and job numbers are bouncing around too much for even the Fed to signal their intentions much into the future.

Then of course there is the election. Elections are assumed to increase the implied volatility of the market in the weeks prior and then drop within days following the event. This goes for the market as a whole as well as key stocks in industries that might be expected to benefit or suffer from the actions of one presidential candidate or the other. It was said, for example, that a Harris administration might be assumed to benefit climate companies, while a Trump administration might be better for crypto companies.

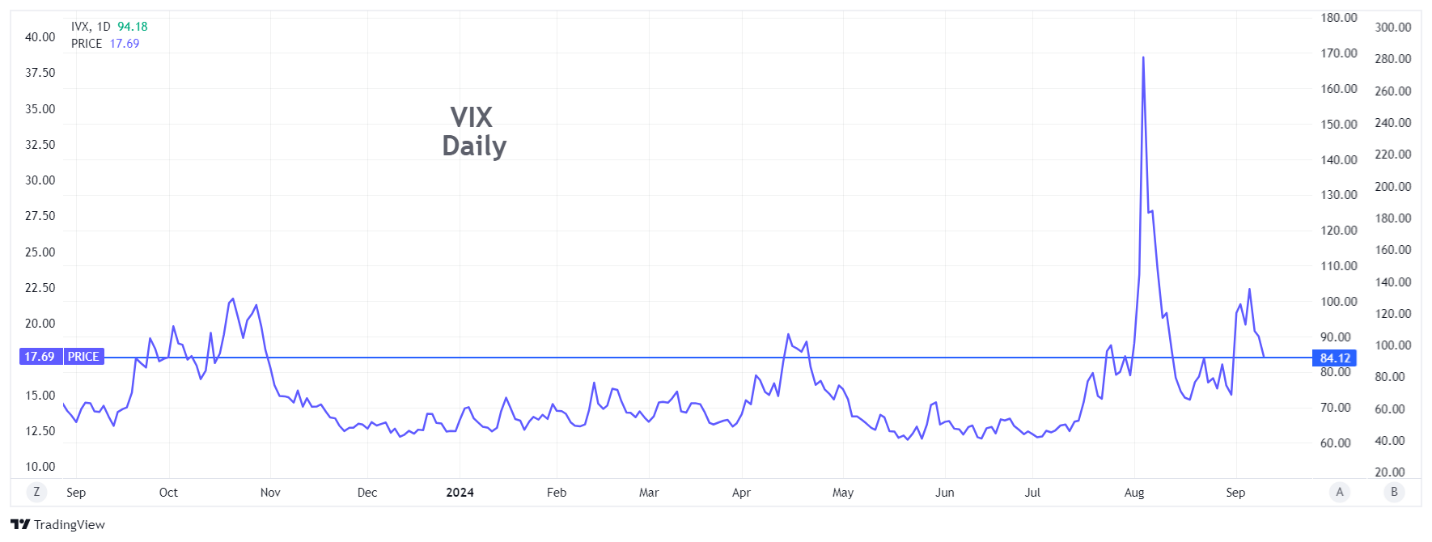

So, I looked at what the volatility skew might look like regarding this upcoming election. VIX did drop a bit from recent highs over 20 but remains at the high end of the range over the last year. However, to my surprise, I did not see a volatility skew yet in SPY relative to the election.

Strategy Talk: The Election Volatility Skew Doesn't Exist Yet

What is the importance of a volatility skew?

Volatility skews represent situations where the implied volatility of options on a particular underlying are not level across time. When the differences are significant, they can have a substantial effect on option strategies. They can also create an opportunity to use an option strategy to capitalize on the skew.

The possibility that VIX will rise (or already has) prior to the election and fall afterward could affect strategy in much the same way as major corporate announcements such as earnings affect individual stocks.

The type of skew described above (a time skew) will cause near term options (prior to an expected event) to exhibit heightened implied volatility (i.e. be relatively more expensive) relative to more distant options (after the expected event) at the same strike price. Usually, the more distant option prices reflect the level that a model such as Black Scholes would predict, given the historic level of volatility for the stock, while near-term options are overvalued.

To capitalize on a time skew, one would need to be long an option dated beyond the event and short an option dated prior to the event. That essentially allows the trader to be long volatility at a reasonable cost and short volatility at a heightened price. But as I discussed last week, a straight calendar spread doesn't work well as it is exposed to direction risk that could easily outweigh any gain from a reduction in implied volatility.

A better way to play a volatility skew is to purchase s straddle in the more distant expiration and short a straddle in the close expiration (all at the same strikes). This is the equivalent of having both a put calendar and a call calendar on the same stock, thereby removing much (but not all) of the direction risk.

The greater the difference in short vs. long-term implied volatility, the greater the profit potential in the strategy. So, the question today is whether there is a sufficient volatility skew in the market relative to the election.

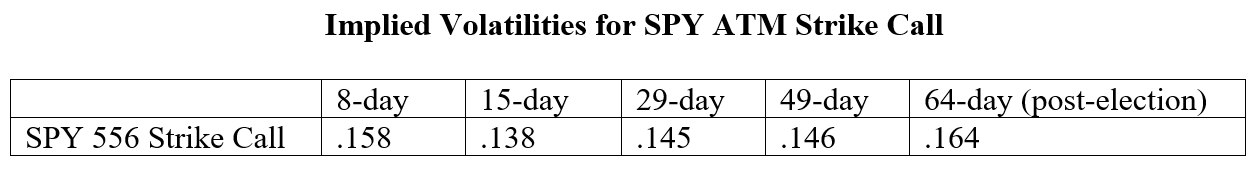

My current answer is NO! The numbers are shown below using mid-morning quotes on Thursday.

At these prices, there is virtually no volatility skew evident in SPY based on the election. One might yet develop, but it's not there yet. To be worthwhile as an option strategy, I would want to see a clear pattern of higher IVs prior to the election vs. post-election and for the near-term IVs to be at least 25-50% higher than the more distant calls.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.