Earnings-Related Implied Volatility

July 25, 2024

The Markets at a Glance

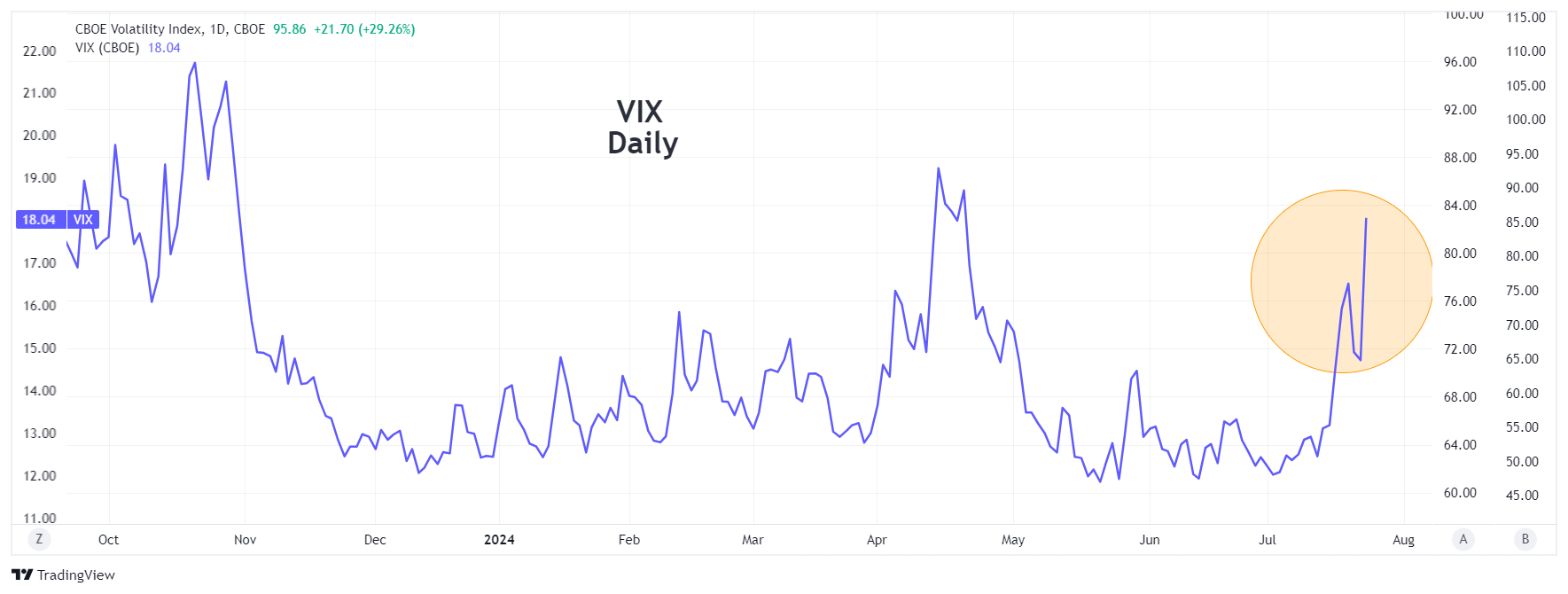

Market action turned down this week with Wednesday's decline showing a potential trend break for the SPY and with QQQ getting close to the trend support line. VIX moved up over 18 to its highest level since April, confirming that institutions are taking the correction somewhat seriously now. What may have looked like a rotation last week is now morphing into broader corrective action, suggesting that defensive strategies may now be in order.

There are earnings-related declines in stocks such as Tesla (TSLA) that may be adding momentum to this downside action. Therefore, caution is advised on the long side until the correction appears to have found support. Calls are generally more expensive now and writing them could be attractive.

Earnings-related moves can sometimes be viewed as overreactions, tempting traders to enter new long positions following an earnings-related decline. The more effective way to implement such a strategy would be to either write puts or covered calls rather than buy calls for a bounce. I will show implied volatilities for TSLA below over the past week to illustrate what typically happens in a quick decline after earnings.

Strategy talk: Earnings-Related Implied Volatility in TSLA

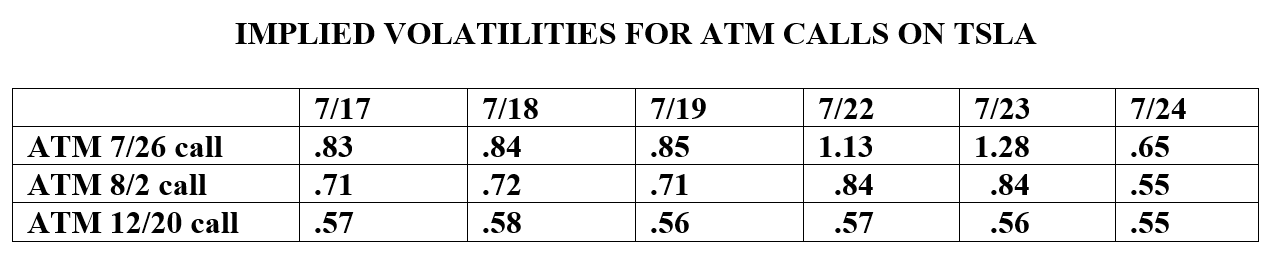

Earnings announcements almost always raise the implied volatility of near-term options, which can increase somewhat dramatically in the days prior to an earnings announcement, only to drop immediately after the announcement - regardless of the stock's price move. Traders may, however, be distracted by the directional move in the stock and lose sight of what happens to implied volatility. Below is a recap of the implied vols for TSLA over the past week, using the ATM strike to remove the stock's price fluctuations from the analysis.

We can see that TSLA December ATM calls remained rather steady at IVs of .55-.58 for the period. This can thus be considered the "baseline" IV for TSLA at the present time. Meanwhile, the IV for the ATM call in the nearest expiration was trading at .83-.85 with about a week to go, and then up to 1.13 the day before and 1.28 the day of the earnings announcement.

After the announcement (the next trading day), the nearest expiration ATM dropped to .65 and the next nearest dropped all the way back to the baseline level of .55. This shows how implied volatility wastes no time in correcting itself back to baseline level, despite a 12.3% drop in the stock price following the earnings announcement.

A couple of lessons should be readily apparent from these figures:

- Buying options in either direction within days of an earnings announcement will subject you to a significant drop in implied volatility. This is a big headwind for any long option trade.

- Implied vols will drop immediately after an announcement is made.

- The drop will usually be all the way back to baseline level, which can be estimated by the implied volatility on ATM calls with at least several months of time remaining.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.