Rolling When Calls Are ITM

July 15, 2024

The Markets at a Glance

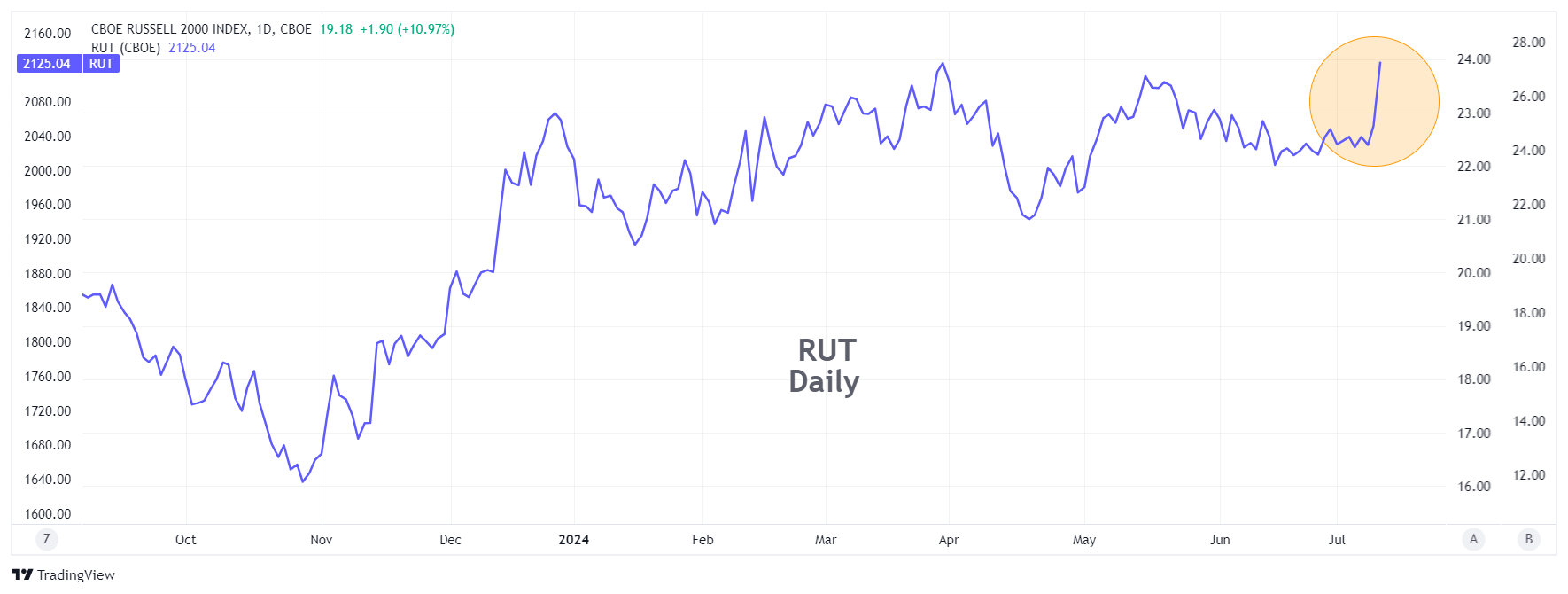

Amidst the usual upward activity in the SPY and QQQ this week, something new has emerged on a different chart. The Russell 2000 (RUT) index (IWM for the ETF) turned sharply upward, suggesting that investors may have all come up with the same thought at once - that it's time to turn attention to the small caps.

MarketWatch had this to say about it: "Long-suffering small-cap shares surged, with the Russell 2000 RUT up 3.6%, while the previously highflying Nasdaq Composite COMP slumped 2%. That marked the biggest one-day outperformance for the Russell over the Nasdaq based on records going back to 1986, according to Dow Jones Market Data."

Does that now signal a change in heart from megacaps to minicaps? And will megacaps actually decline or simply slow their ascent in favor of the little guys? It's too early to say for sure, but the abrupt turn of market attention to small caps certainly bears watching.

Strategy talk: Rolling When Calls Are ITM

There was a response to last week's post on rolling covered calls that suggests I hit upon something of broad interest, so I am going to continue exploring the practice further.

Covered call writers (and diagonal spread buyers) are faced with a decision whenever they approach an expiration date on their short position - should they allow the stock to be called away or roll the short side forward, and if so, to which new option.

The typical objective on a roll is to take in as much or more from the new short as you spend to cover the old position - in other words to roll for the maximum credit available. However, that is an oversimplified goal, since the situation is complicated by the fact that the stock will now be either higher or lower than when you wrote the current call.

A trade-off must now be made between the credit received on the roll and the upside potential on the stock during the period of the new call write. If you write the new call at a lower strike than the previous call, you pick up more option premium in the roll but cap the stock potential at a lower price. If you write at a higher strike price than the current call, you take in less premium (possibly even rolling for a debit), while allowing more room for the stock to appreciate.

There is no way to calculate the best action to take without making an assumption about where the stock will be at the next expiration. It has to be a judgment based on your expectation for the future stock price. A more conservative approach will be to write a lower strike and a more aggressive approach will be the higher strike. If you write the higher strike, you will take in less premium from the new call and may thus not be able to roll for a credit. That means you might need to pay to roll and must have the available cash in your account to do so.

If your stock is only slightly above or below where it was when you wrote the current call, it should not be difficult to decide on your roll. If the stock has moved a lot, the decision becomes more complicated. Let's look at an example.

Let's take NVDA as an example: A month ago, NVDA was trading at around 125. If you wrote a call at that time for the July expiration using, let's say, the 140 strike, you would have likely received around 4 points in option premium. On Thursday July 11th, with one week until the July expiration, the stock closed at 127.40 and the July 140 call option closed at .60.

The stock is up slightly and the option has lost 85% of its value. There is no urgency to do anything yet, but there is now only .60 more you can earn on the option so you might be starting to think about rolling. The stock did travel up to 140 and then later to 135 during the last few weeks, but it is back now to almost where it was in mid-June.

Rolling to the August 140 now could bring in about 3.85, less the .60 you would pay to close the July 140, yielding about 3.25. This is a somewhat straightforward decision and taking in 3.25 for 36 days generates a 25% annualized return from option premium.

Rolling for a credit will be easily possible whenever the current option is at or out-of-the-money and you roll to a similar strike price, since the option has only time value and you would be rolling to a longer duration with more time value. If, however, the expiring option is in-the-money, it becomes more complicated, as you will likely want to roll to a higher strike price.

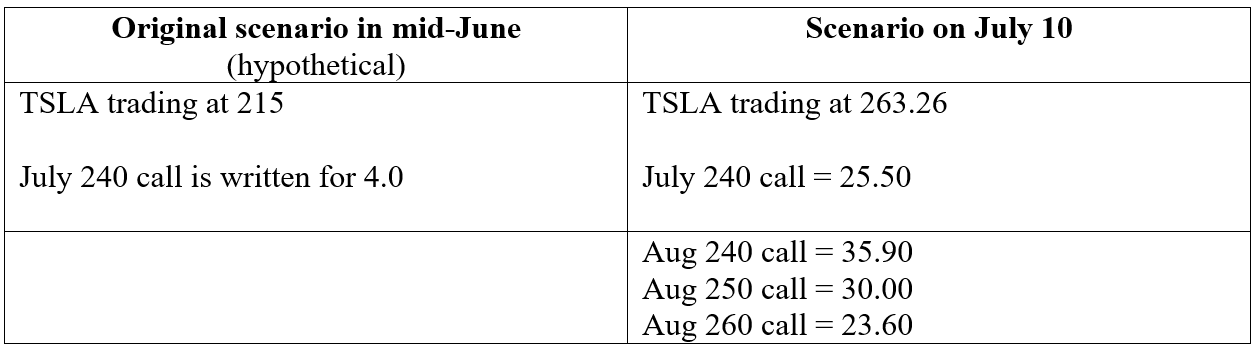

Covered call writers of Tesla stock (TSLA) may currently be experiencing this dilemma. Let's look at the possibilities for TSLA, assuming the stock was originally 215 in June and a July 240 call was written.

The stock exploded in the last month and the 240 call for July is 20+ points in-the-money. Being called away in July would yield a gain of 25 + 4 = 29.00 for the month. While that is an attractive return (about 135% annualized), a call writer might be upset that the stock was up 48.26 during the same period all by itself (225% annualized). It should be remembered, however, that covered call writing will spread returns out more evenly during the year than holding the stock by itself and that without any calls, a monthly drop of 20% is not out of the question for a stock like TSLA.

The question now is whether to roll the option and if so, to what strike price. If the sale of TSLA due to assignment would trigger a large tax liability, a roll may be necessary. But let's assume the stock is in a non-taxable account and examine the roll strictly on its own merits.

Rolling to the Aug 240 call (a flat roll) will result in realizing a 21.50 loss in the July 240 call, offset by an additional unrealized gain of 20.00 on the stock and 35.90 for writing the Aug call. The roll therefore generates a credit of 35.90 - 25.50 = 10.40, so the writer will receive $10.40 in cash for the roll. Note that this is the most the writer can make over the next month by rolling the position to the 240 call. That's about 40% annualized, so actually still attractive.

Rolling up to the Aug 250 will result in a 21.50 loss in the July 240 call, an unrealized gain of 30.00 on the stock + 30.00 for the Aug call. The roll generates a credit of 30 - 25.50 = 4.5 and there is $10 more value in the stock. That means the maximum gain for the next month can now be 14.50 as long as the stock holds above 250.

Rolling to the Aug 260 will result in a 21.50 loss in the July 240 call, but an unrealized gain of 40.00 on the stock + 23.60 for the Aug call. That means a net debit on the roll of 25.50 - 23.60 = 1.90 with 20 points of potential gain on the stock if it remains above 260 in August.

The highest potential return (20 - 1.90 = 18.10) for the month would thus occur by rolling up to the August 260 call (or even higher strikes), but one could achieve 80% of that return by rolling to the 250 instead and 57% of that return by writing the 240 - with greater downside protection.

So, it all depends on the tradeoff between option premium and potential stock price in any given writing period. Writers need to understand these trade-offs as well as realize that being called away on a covered call write can be a desirable outcome as well, particularly if there is near-term downside potential on the stock.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.