The Strategy of Patience

June 28, 2024

The Markets at a Glance

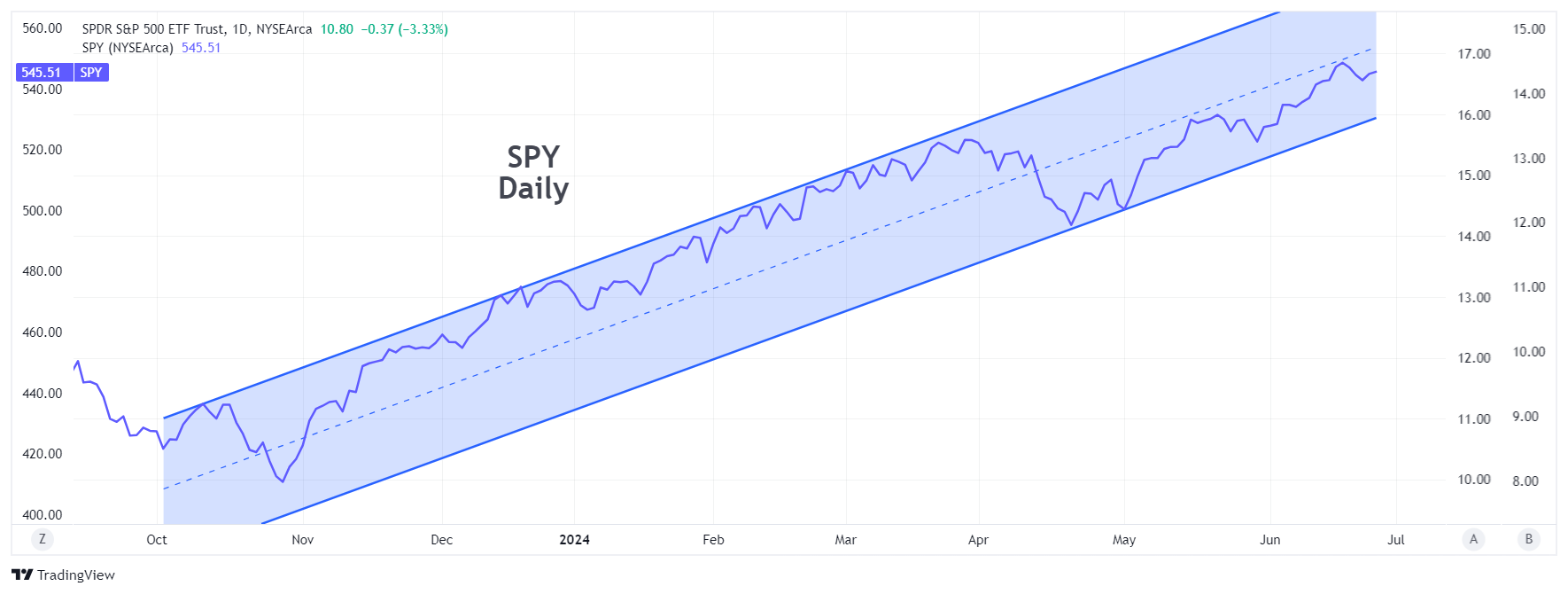

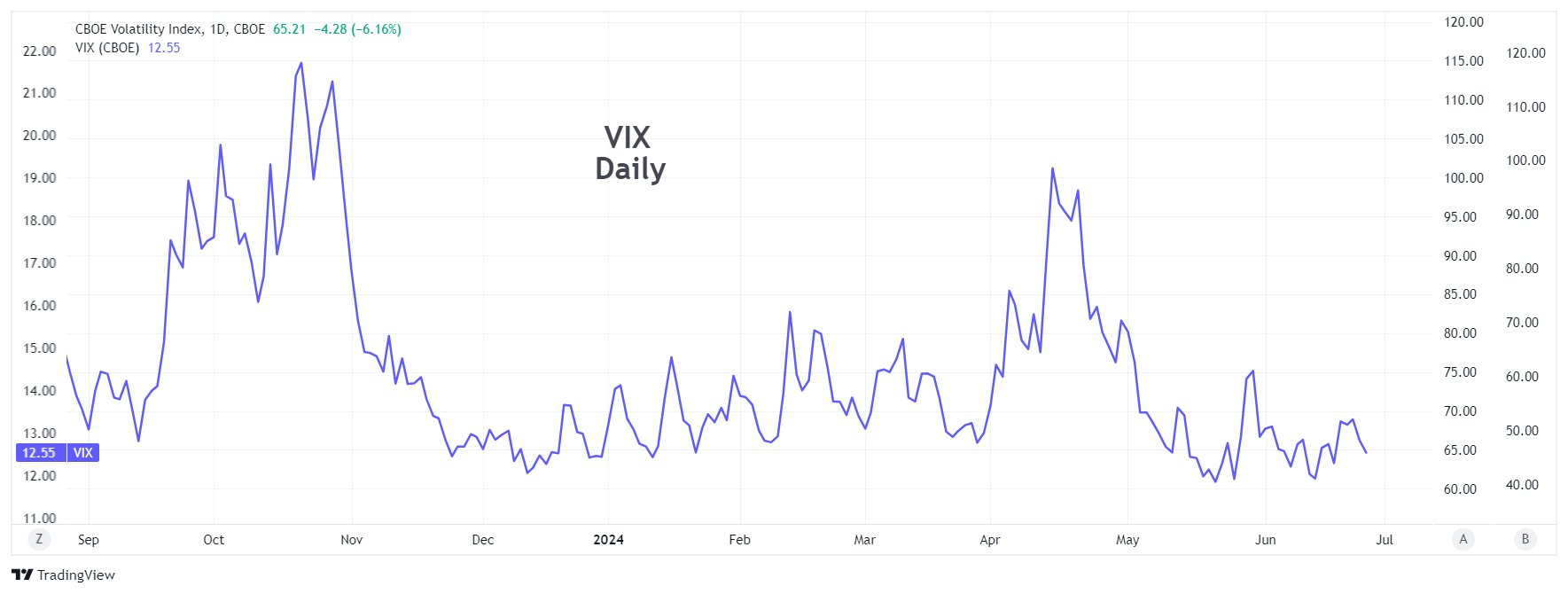

Despite a reversal in Nvidia (NVDA) and a sharp sell-off and partial recovery in bitcoin (BTC:USD), the overall posture of the market didn't change much from the prior week. The major indexes held up in their uptrends, while the equal weight S&P ETF (RSP) continued its divergence by heading lower. As a result, VIX backed off as well into the low 12s again.

For options players, a lack of volatility is a mixed bag. Writers like that volatility is low for existing short positions, but then writing new positions isn't as attractive. For buyers, low volatility produces some attractive entry points, but leads to frustration when movements stay low. Above all, both buyers and sellers of options tend to fall into a lull when the market is somewhat ambiguous about direction.

The economic and political backdrop is somewhat unique here and numerous articles and market commentaries are pointing out the oddities of the current situation. In general, these oddities revolve around the continuing, though waning uptrend in US equities overall, the mixed signals coming from the broader market under the surface, the future of AI to corporate America, the political stalemate surrounding the coming US election, the elongated wait to see whether inflation is under control and interest rates will be lowered, and the ever increasing number of geopolitical uncertainties surrounding wars, elections, and global economies. Plus, it is summer, when thoughts wander toward travel and vacations and away from the markets.

Unfortunately, the virtue of patience has never been a particularly strong one among options traders. But we must also realize that reaching for a trade just to have something going rather than having money sitting idle is strategy that generally yields poor results. It is true that option traders thrive on uncertainty, but also true that holding to a discipline or to predetermined parameters are the best practices for capitalizing on that uncertainty.

Strategy talk: The Strategy of Patience

I bring up the notion of patience with particular regard for the current overall situation in US equities. A recent post in Yahoo Finance by Jared Blikre made some good points about the current environment, noting the following:

- "While the generals were sleeping, the soldiers were on the march...moderate losses in large-cap energy and financials were offset by outsized gains in the consumer discretionary sector - thanks principally to Amazon and Tesla."

- "This seesaw theme has become a subtle but important market narrative. On days when AI isn't leading the charge, select pockets of strength keep the S&P 500 from more pronounced sell-offs - which itself is holding index volatility near multiyear lows."

- "During that harrowing three-day slump [in NVDA], a funny thing happened: the Dow Jones Industrial Average - up only 3% this year versus 14% for the S&P 500 - staged a comeback. Energy perked up, and biotech jumped, as forgotten pockets of the market showed signs of life. This seesaw-offsetting behavior is everywhere right now in lieu of correlations between even stocks in similar sectors. Stocks simply do not want to move in the same direction."

- We've never had the S&P 500 up this much with the advance-decline line this negative since at least 1996.

- "None of this detracts from the argument - supported by ample research and history - that it's perfectly normal in a bull market to have gains concentrated in a few stocks."

- "At some point, the music stops and all sectors start selling off in unison, kicking off a new bear market." However, "Research by the data analytics team at BofA suggests that the current regime of low inter- and intra-sector correlation can persist for years."

Weeks can be an eternity for option traders. Years would be something unfathomable. So, the strategy for options players right now may be one focused more on patience than anything else. Chances are that better trends and signals will surface soon enough. Meanwhile, pick up some long-term VIX calls while they are cheap, or write some calls on extended stocks. Having something in your portfolio will help quell the urge to find the rare pocket of opportunity amid a listless market.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.