When Writing Puts is a Better Strategy than Writing Covered Calls

May 10, 2024

The Markets at a Glance

Is the Correction Still Alive?

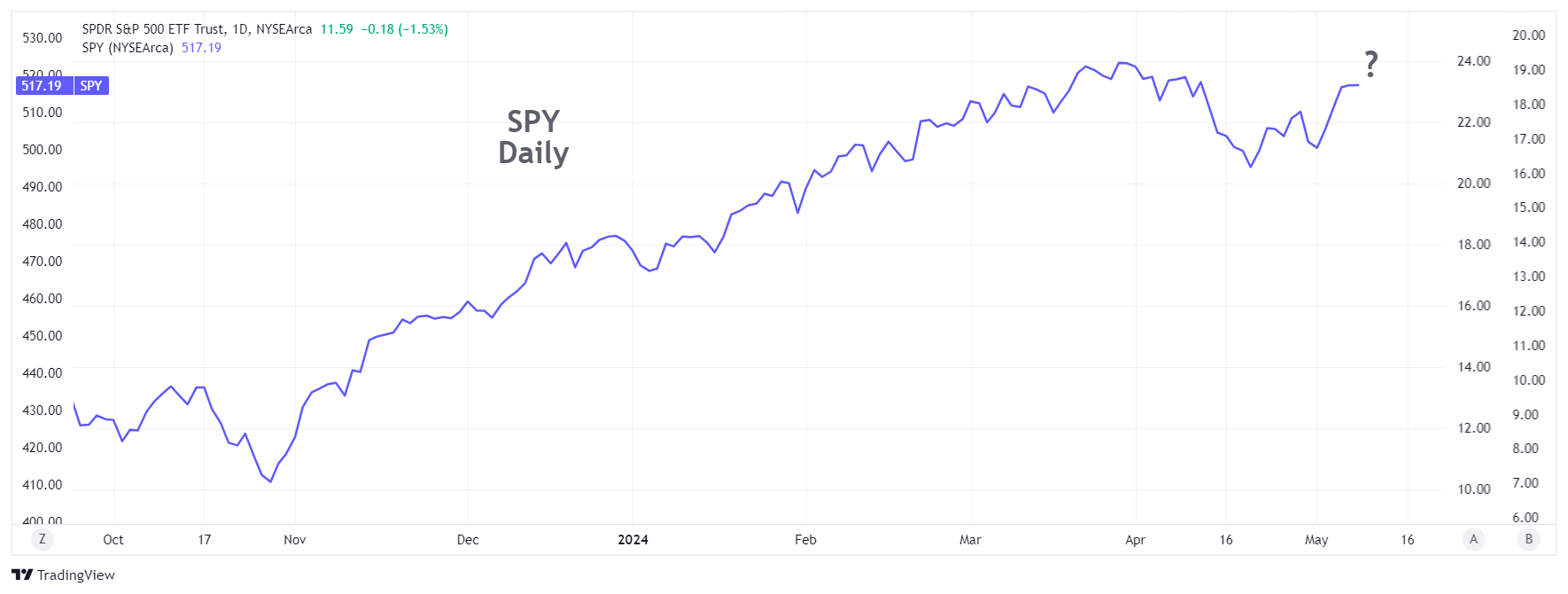

Stocks remain below the highs of April 1st, but not by much. Wednesday's close for SPY was 517.19, just 1.4% below the April high. That leaves us with a "V" formation on the S&P 500, dropping from the high by nearly 6% in three weeks, only to recover most of that in the next three weeks. In doing so, the market has reached a level that leaves us with questions as to whether the initial 6% drop was the first leg of a larger move or whether it was the full correction in its entirety. A minor additional move upward could set a new high, suggesting strongly that the upward momentum from last October is still intact.

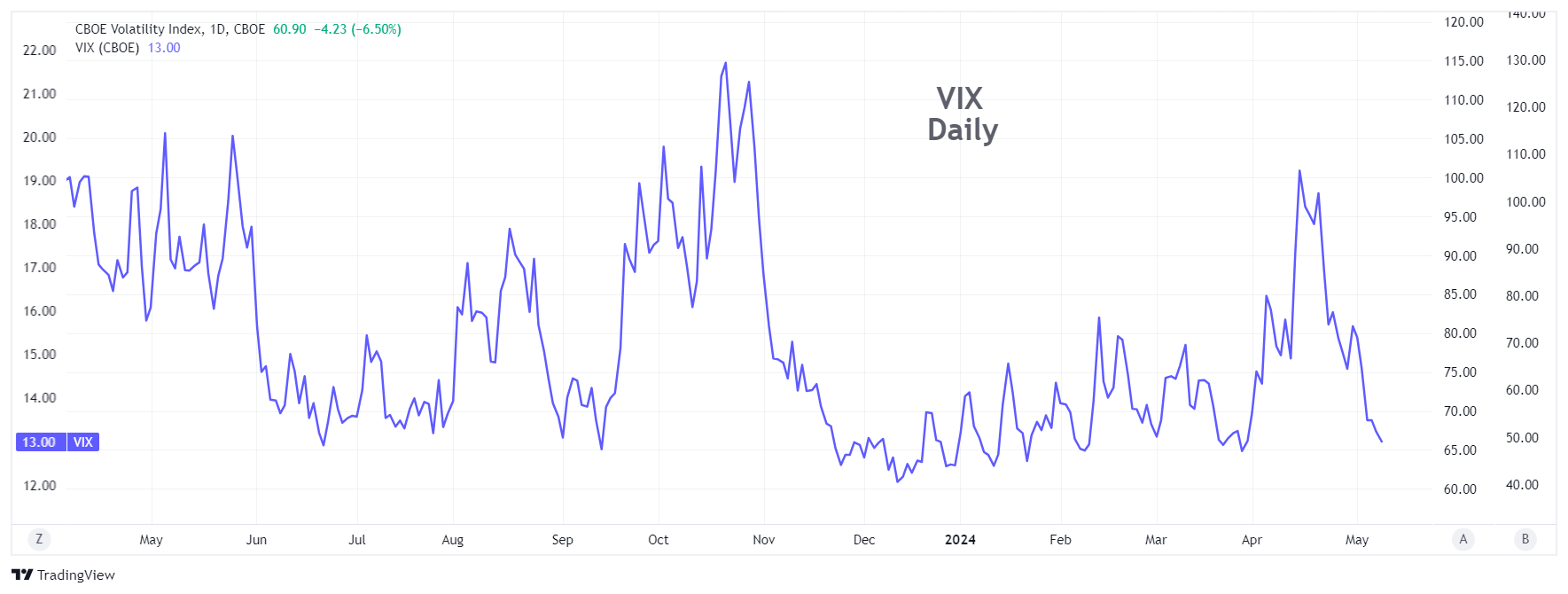

On the other hand, double-tops or near double-tops are not uncommon, so the answer to the question about the correction being over is as yet unanswered, though it will likely be answered in the next few days. Meanwhile, VIX has dropped back down to 13 from a recent spike up to 19, lending support to the argument that the market remains strong and that a larger correction does not appear imminent.

Nonetheless, I personally remain unconvinced that we are continuing the rally at this point, with the following as my rationale:

• On a 15-minute chart there is a downtrend line that passes right through all the recent peaks since the early April high. That tells me we have touched resistance but not yet exceeded it.

• The narrative that has fueled much of the bull market this year appears to be predicated on interest rate cuts by the Fed and no recession this year. I believe that is a most optimistic scenario and that any number of issues could spoil that narrative. One Fed official was quoted as saying that rates will remain at current levels as long as they need to for control over inflation and that even higher rates could be necessary if inflation picks up from here.

• Defensive securities such as utilities stocks, gold, and US Treasury Bonds have rallied recently.

So, at this time, I still lean toward selling rallies in the overall market, but I am also eyeing individual stocks and ETFs that could be traded in either direction over the short term.

Strategy talk: Writing Puts over Covered Calls

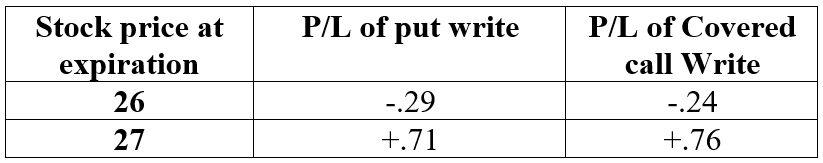

I was enlightened many years ago to the fact that short puts had the same risk-reward profile as covered calls at the same strike and expiration. It just didn't seem intuitive to me that it would be true. But it is (give or take any minor differences in prices due to the bid-ask spread). Draw the profit/loss graphs for the two and they will be identical.

Take Southwest Airlines (LUV) as an example. Here is a 30-day ATM put write and covered call comparison.

Stock close: 27.18

Price of Jun 7 Call at 27 strike: .94*

Price of Jun 7 Put at 27 strike: .71*

*Prices represent the midpoint between the closing quotes.

Given that the expected returns for all stock prices at expiration is essentially the same for both strategies, which is better?

There are slight differences in the strategies when the stock issues a dividend during the option's term (dividends slightly favor the call writer), and when a covered call write is held in a taxable account and the stock can be owned for longer than one year, in which case taxes would be lower on any gains.

But the material difference between the strategies is the capital required. A covered call write in a cash account requires 100% of the stock price, less the proceeds from the sale of the call. The same position in a margin account can reduce the capital requirement to 50% of the stock price. A put write, however, requires margin of only around 20% of the stock price. Thus, the put write has essentially the same absolute gain or loss potential as the covered call write but requires one-fifth as much capital. That means up to five times the same return percentage as a covered call write for cash or more than twice the return as one on margin.

The margin requirement on the short put could go up if the stock price declines, but all things considered, the put write usually doesn't get its full respect as a strategy.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.