Why the Spread Beats the Long Call

March 21, 2024

The Markets at a Glance

The Trend Gets Another Boost From the Fed

The market held ground on Wednesday while it awaited the latest announcement from the Fed on interest rates. But as soon as the Fed reiterated its stance on issuing several rate cuts this summer, the "all clear" was essentially sounded and the market lurched higher with lower implied volatility indicated by S&P options.

Thus, the market continues in its 6-month trend and long positions in many stocks may be starting to give traders the jitters. As uptrends lengthen in time, they are commonly characterized by a broadening effect among individual stocks and sectors, causing traders to seek out stocks that may not have necessarily been leaders during the early stages of the rally, but may come to life as profits from the early winners are redeployed.

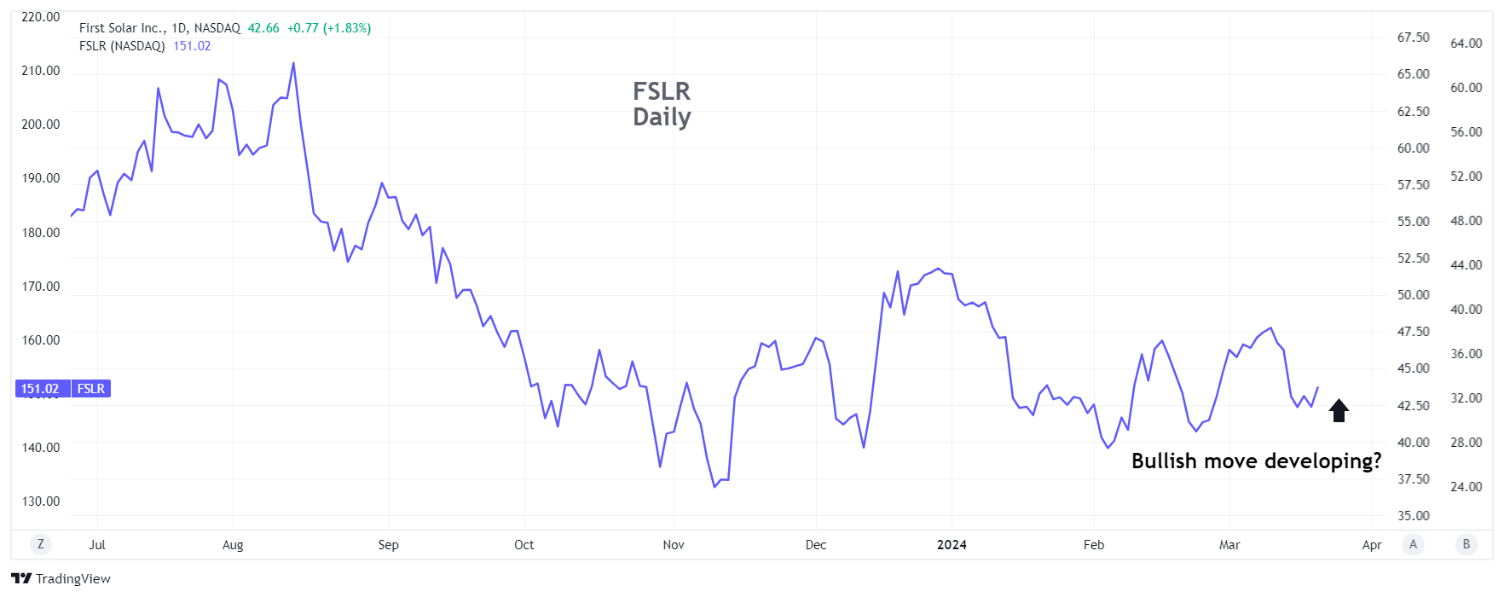

One such stock might be First Solar (FSLR). A recent earnings report was positive, its valuation is reasonable, and it had been a lot higher before people rotated out of it. Perhaps it can see more interest in the coming weeks. Here's what the chart looks like:

Strategy talk: Why the Spread Beats the Long Call

As someone who prefers to take home modest profits on a more frequent basis than swing for the fences and strike out most of the time, I prefer vertical or diagonal spreads over long puts or calls by themselves in almost all situations. Besides having risk-reward characteristics that are more aligned with my risk posture, spreads reduce the dreaded time value decay of long calls and the pressure to take a profit or loss too early as a result.

In addition, there may be a perception by some that a spread is less desirable because it caps your profits. There is of course a cap with spreads, but the cap can easily exceed 100-200%, and it reaches that profit level at a lower price on the underlying stock. So is that necessarily a bad thing? What traders don't always recognize is the additional leverage, the lower breakeven point in the stock, and the wider range of prices where a profit will exist from the spread.

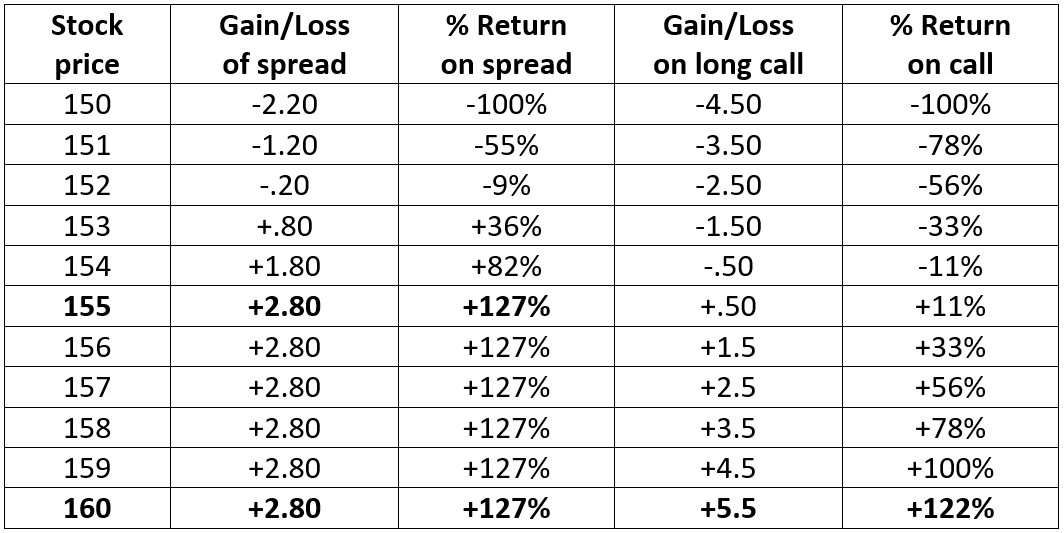

Let's compare the two strategies on FSLR. If I decide to use a 150/155 call spread in the March 28 expiration (long 150 call and short 155 call), it will cost about $2.20 (based on Wednesday's closing prices). Purchasing the 150 call by itself would cost about $4.50. Below is a table of the results for prices on FSLR between 150 and 160 at expiration.

The spread will max out at +127% profit but returns that amount for all prices above 155. The long call has a theoretically unlimited potential gain but will not return as much as the spread until the stock goes up beyond 160 at expiration. And the spread breaks even at 152.20, whereas the long call doesn't break even until 154.50 on the stock.

The bottom line is that the call may be open-ended but will return less than the spread for a more likely range of near-term prices. And IVolatility Spread Scanner can help you compare the characteristics of many possible spreads in a flash, to help you zero in on the best one for you.

Got a question or a comment?

We're here to serve iVol users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.