Playing the 'Magnificent Ones'

February 8, 2024

The Markets at a Glance

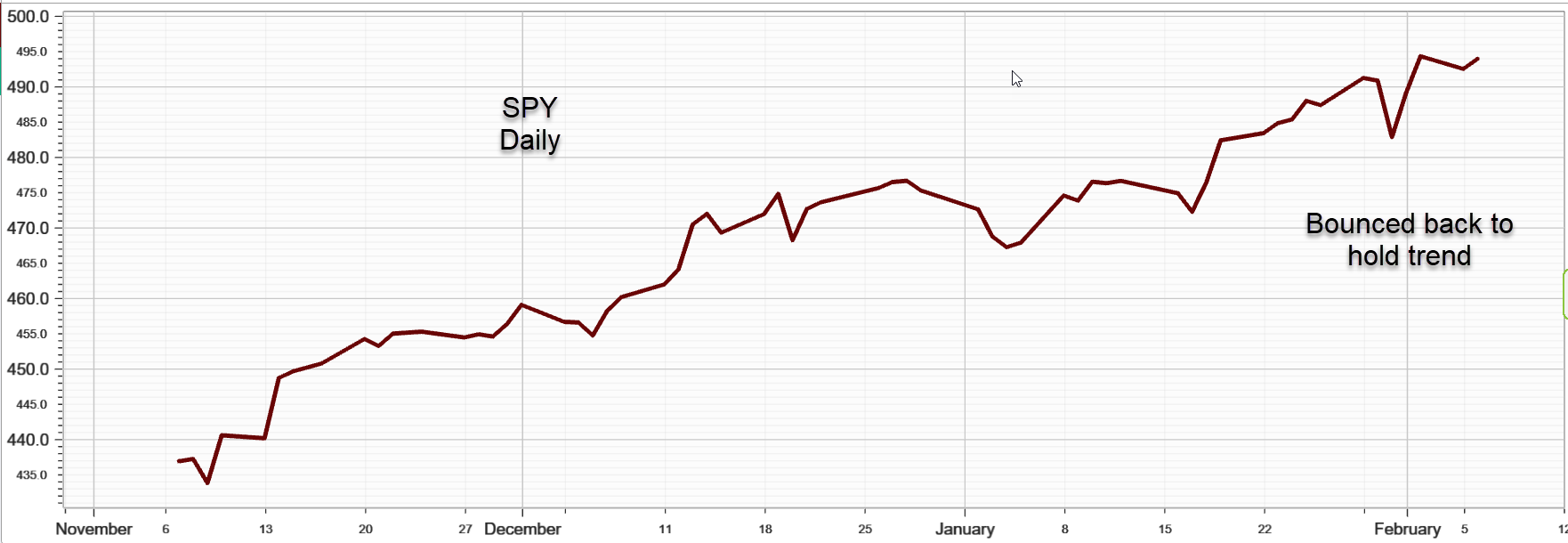

The S&P 500 (SPY)

SPY closed on Wednesday at 498.10 after recovering from last week's dip to clearly remain in its uptrend from the fall of 2023. The ETF is now up 3.93% for the year on price, which puts it ahead in 2024 of its 10-year annual average advance of 12.21%, according to Morningstar.

Thus, the big one-day decline highlighted in last week's letter did not, as yet, result in a trend change or arguably even a loss in upward momentum.

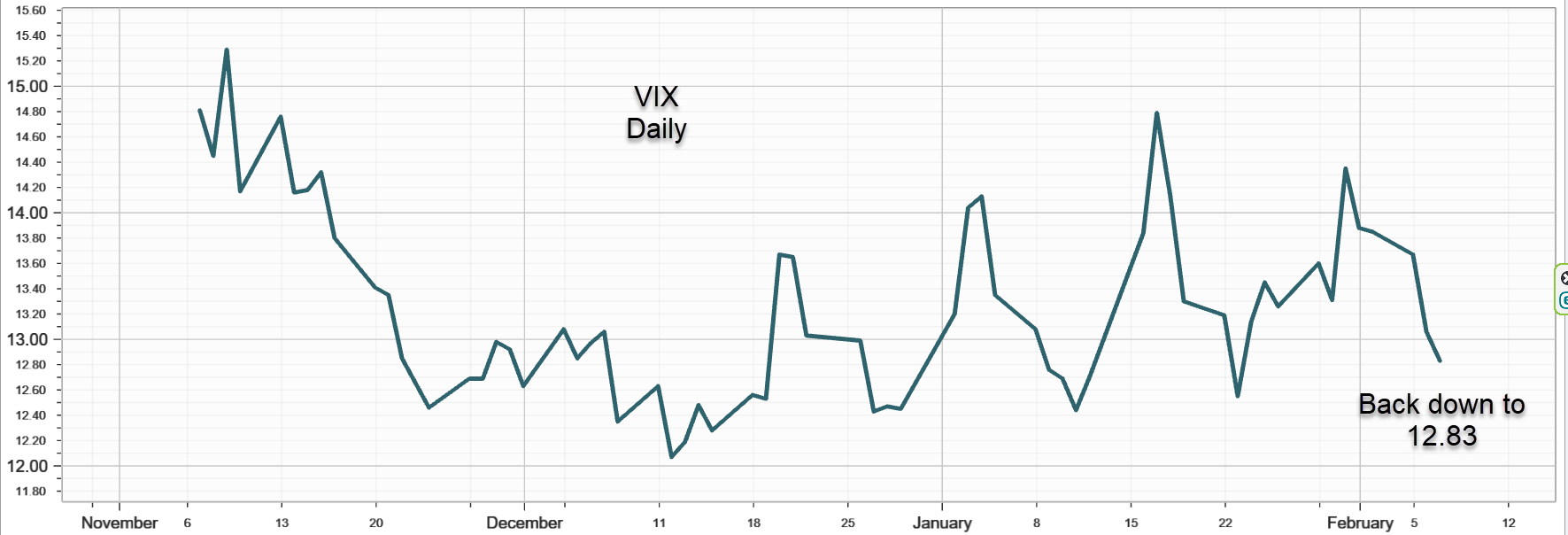

Option Volatility ($VIX)

Implied volatility mirrored the recovery by dropping back once again below 13, leaving a pattern of four 'false starts' for higher implied volatility in the last month, all of which lost steam within the week.

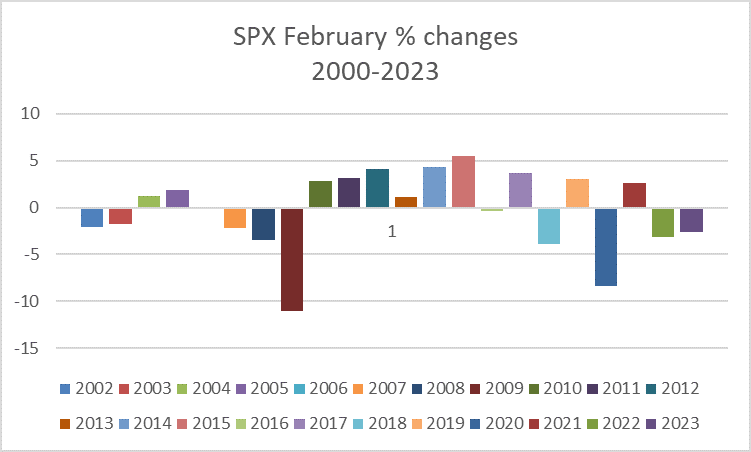

The message I take from this is that the broader rally from last fall is not yet over and, while some choppiness is occurring around earnings, there is insufficient evidence to suggest that it is time to invoke a bearish strategy on the broader market. That said, however, Februaries have been mixed months and from the chart below, you can see that since 2000, there have been nine sell-offs in February, two of which were quite significant.

As such, the odds are likely increasing that the market will see some corrective action, and while it might be premature for outright bearish strategies, positions such as credit call spreads above the market could be considered.

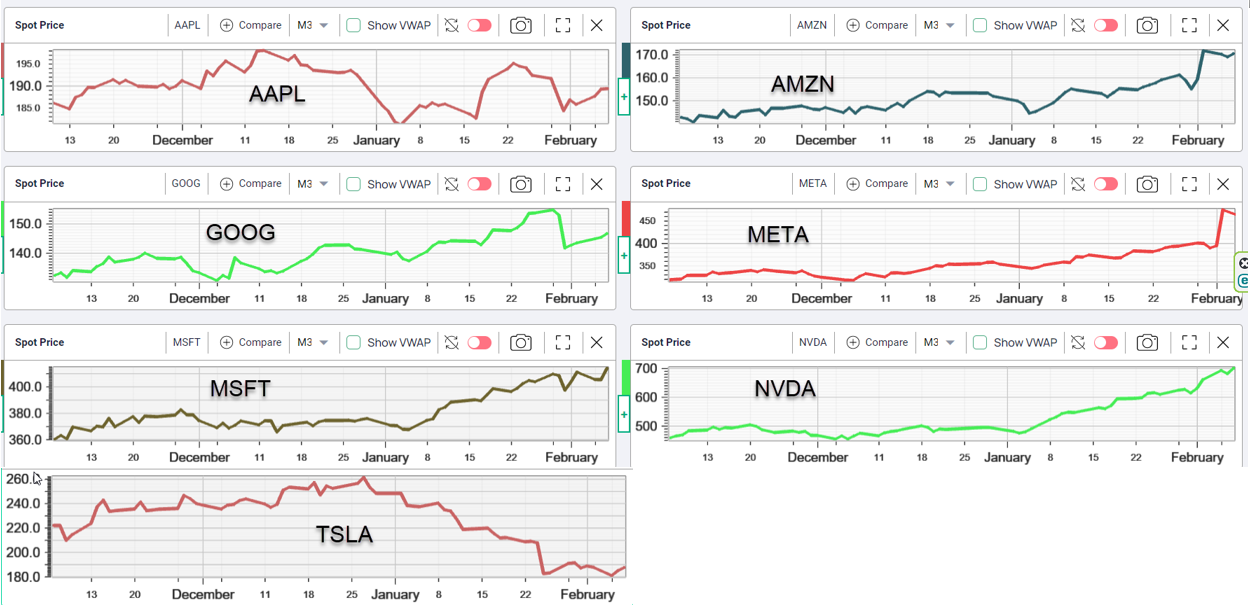

When you look under the hood, however, a very different picture emerges among stocks that were big drivers of the rally so far. By that, I refer to the so-called "magnificent seven".

This Week's Stock Highlight - The "Magnificent Seven"

The charts are small, but the point they make is that stocks that powered the rally in 2023 have met vastly different fates in 2024 and that option strategies on the individual stocks are diverging here. TSLA, for example, peaked in late December and has been declining since then. GOOG and AAPL took significant recent hits after their earnings announcements and are making slow recoveries. AMZN and META both had very positive responses to earnings announcements but are looking overbought. Numerous potential option strategies can likely be found among these giants.

Strategy tip: OTM credit spreads for peaking or basing stocks

For stocks like TSLA and AAPL, one might consider a strategy that can profit as the stocks recover but doesn't require the stocks to make a sharp move back up. A short-term credit spread with puts below where the stocks are currently trading can accomplish this. If the stocks merely form a base here, an OTM put spread can still make its profit and if the stocks come back stronger than expected, then the profit could come sooner. Meanwhile, time premium is also working in your favor.

An example would be:

Long TSLA Feb 16 175 put

Short TSLA Feb 16 180 put

Credit: $ .97

The strategy returns a max of nearly 25% in 9 days and has room for the stock to fall back a bit and still make money.

The same strategy can be applied in the reverse direction to stocks like AMZN and META using OTM credit call spreads as well.

Previous issues are located under the News tab on our website.