A New Voice Behind Our Newsletter

January 12, 2024

IVolLive welcomes Richard Lehman as our new weekly writer for the newsletter. Rick is an options maven from the earliest days of exchange-traded options, starting his career on Wall Street the year the CBOE first opened its doors. He was a Regional Options Coordinator at E.F. Hutton and then the National Options Coordinator at Thomson McKinnon Securities, where he worked with options legend Lawrence MacMillan.

Rick went on to write two options books and then developed and taught the Options course at UC Berkeley Extension for financial professionals. Among other things, he currently teaches an Options course at Cal Poly and trains the new hires at Parallax Volatility Fund, a hedge fund specializing in options trading.

The IVolLive team welcomes Rick and looks forward to his insights and expertise.

Greetings IVol traders!

It's my great pleasure to be affiliated with IVolLive. I see options as a unique and fantastic instrument, providing more leverage and flexibility by far than any other financial vehicle. They are the only way to play equities with creative, risk-managed positions and they offer us dozens of different strategies on thousands of stocks and ETFs. But their sheer number can be overwhelming and they can be complex. Many people without a formal options education fall prey to misperceptions about options and behavioral biases in trading them that lead to disappointing results.

Today's lower trading costs and powerful tools like IVolLive provide options players with the means to take advantage of the full range of strategies that are available. I hope to help all of you become better traders in the months ahead.

I welcome your input. What would you like to see here? What do you want to learn more about? What are you looking to do that you're having difficulty with? What don't you understand about options?

Let me know!

You can reach me at Support@IVolatility.com

The S&P 500 (SPY) at a Glance

I use a 3-month chart of SPY to get my bearings as it generally captures the current trend of the equity market. And I annotate with a trend channel to see where we are inside the trend. This becomes very helpful in seeing when trends are changing.

• You can see that the uptrend from late October to present is still in place, though the market took a breather at year-end, perhaps from some profit-taking on the fourth quarter runup. So, January is showing us that the market is in an uptrend, but that the latest action indicates some degree of consolidation. Given the strength of the fourth quarter rally, it should not be at all surprising that the market has stalled somewhat. The drivers of the rally - good earnings, lower inflation, and the prospects for interest rate declines later this year - are now likely built into current prices.

• The markets may very well be searching for additional good news to keep the rally going and any earnings disappointments, escalation of global conflict, election concerns, or hints of a recession could lead to more profit-taking.

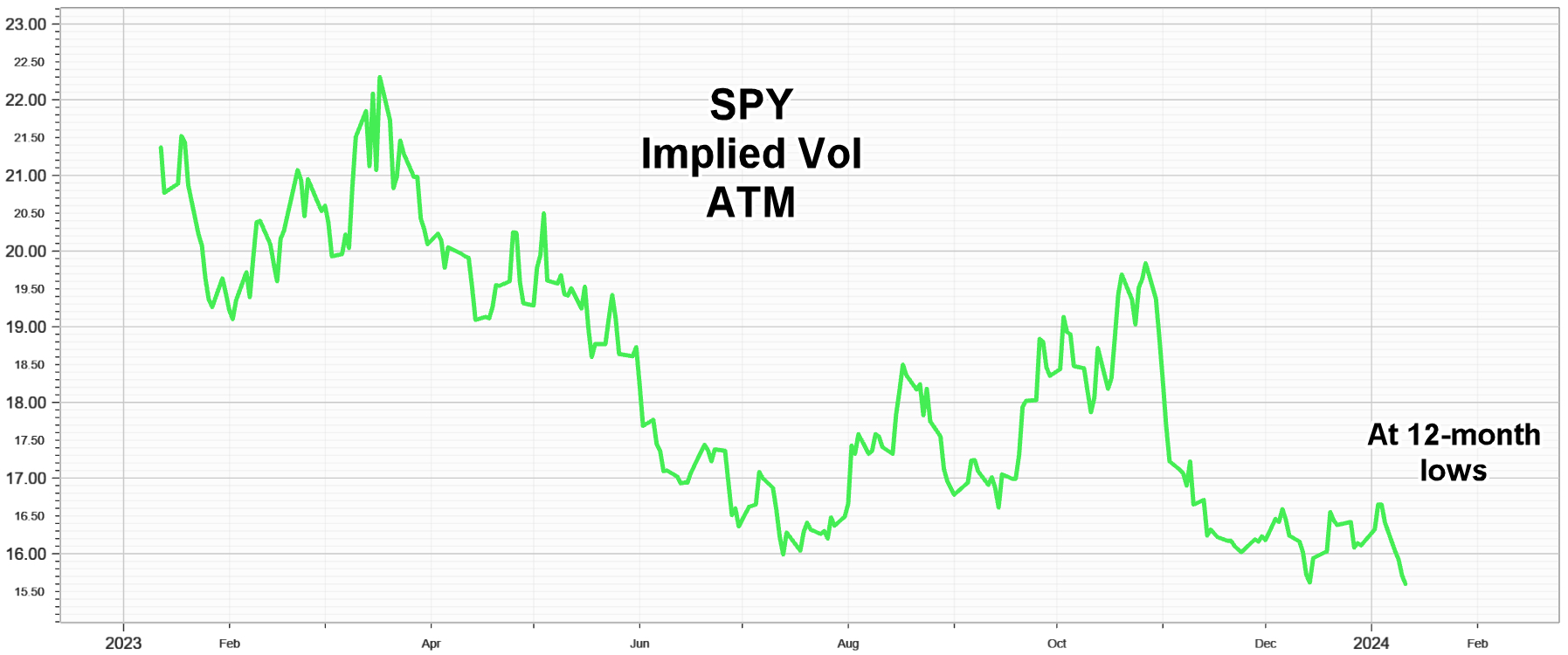

Option Volatility ($VIX) at a Glance

• From an options perspective, market volatility (as measured by ATM options on SPY) remains historically low, which means that (in general) options prices (or more specifically, options time values) remain quite subdued.

That means long options are relatively attractive (relative, at least, to when market volatility is a lot higher) and can be used for spreads and straddles. As a general rule, I do not recommend long options by themselves as a primary ongoing strategy. If you do find an attractive long stock play (in either direction), buying in-the-money options is much preferred. But if you are doing spreads or straddles (regardless of direction), long options are relatively cheap right now.

• Naturally, there are individual stocks and ETFs that remain highly volatile and carry lots of option premium. The bitcoin miners (MARA, RIOT, HUT, HIVE) are a prime example. Near term premiums are outrageous, due to the volatility in bitcoin surrounding the SEC approval of bitcoin ETFs. Longer-dated option premiums are more realistic on these stocks, setting up "volatility skews" where near-term expirations are way more overvalued than longer-dated options.

You can take advantage of volatility skews like this by purchasing longer-dated options (at say two months or longer) and selling the weeklies to make either calendar spreads or diagonals. Or, if you are going long, you can just do covered call writes or put writes using the weeklies or near-term monthlies. Keep in mind, though, that these stocks are a leveraged play on an already volatile instrument and options increase that leverage even more. You have to be willing to accept the possibility of 10%+ daily swings in these stocks until things settle down and there are a lot of people who bought these stocks specifically to play bitcoin on the long side and many are now selling (at steep losses).

Previous issues are located under the News tab on our website.