Last Week’s Highlights at IVolLive:

- Register HERE for our next live webinar on Tuesday, November 7th where we will cover how to identify the best option spread trades using the Real Time Spread Scanner within IVolLive.

- Get a free IVolLive Trial HERE.

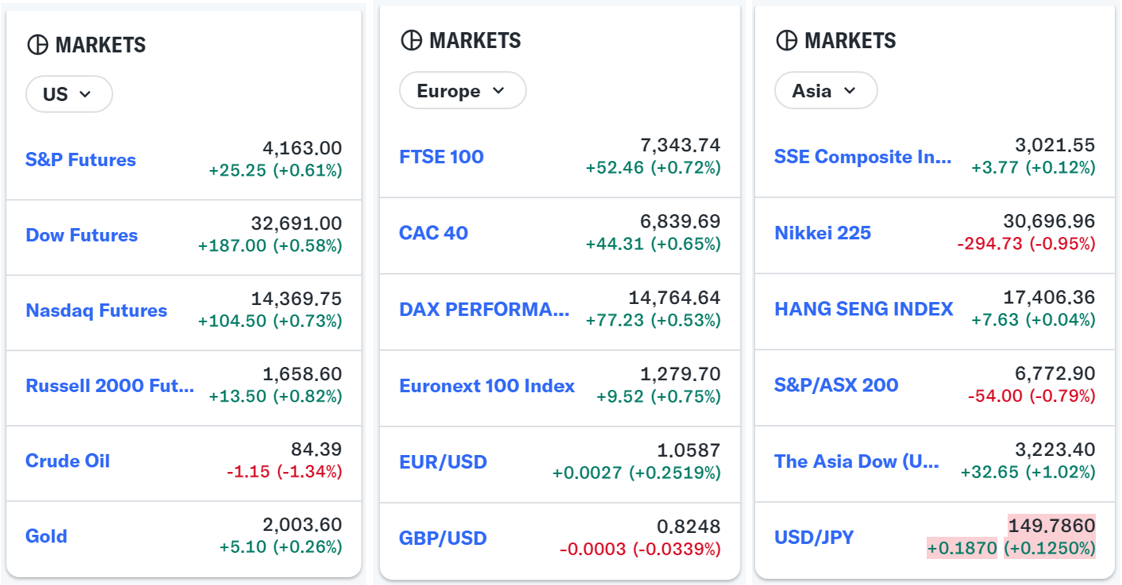

Market's Stage a Comeback

November 6, 2023

As the calendar turns to November and clocks roll back in the U.S., the stock market just notched is best weekly performance of the year. All told, the S&P 500 rose 5.9%, while the Nasdaq rallied an even better 6.6%.

Why the strong performance? A few things:

• The Federal Reserve chose not to raise interest rates at its meeting on Wednesday. This means the relentless pace of interest rate rising (making capital more expensive) is paused, at least for now

• Inflation concerns eased

• Strong earnings results from some of the largest companies in the market buoyed stocks

One name that didn't participate in the surge was Apple (AAPL). The tech giant released an earnings report that didn't thrill Wall Street... overall, revenue dipped 3% year-over-year (YOY). That said, a bright spot was services sector revenue (high margin), which grew 16% YOY.

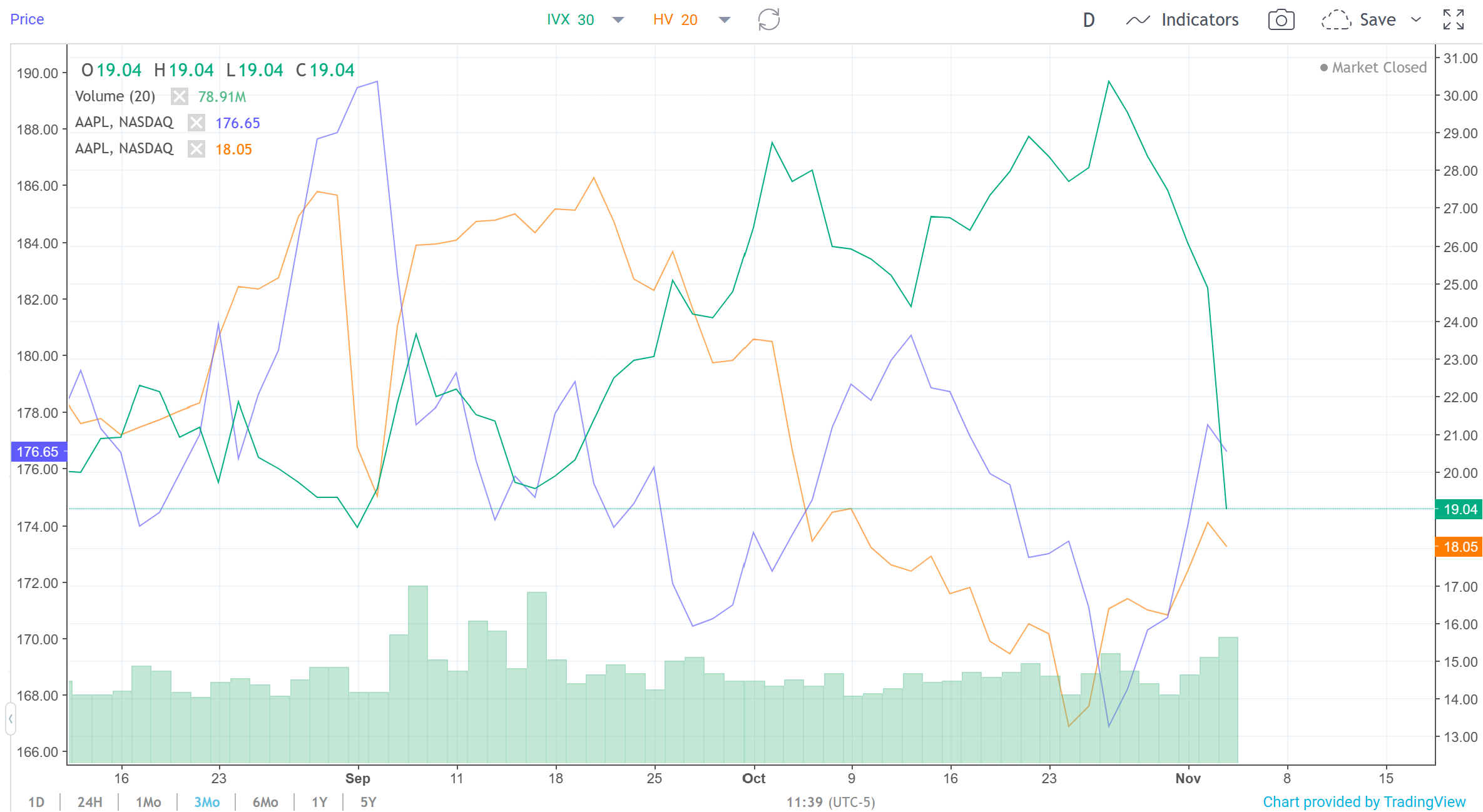

When we see a mixed earnings report like this, we immediately go to the charts at IVolLive:

A few observations jump out from the three-month chart:

First, price is in blue. We can see we're in the midst of a reverse head and shoulders pattern. After announcing earnings, Apples share price has dipped - but so too has Implied Volatility (green line).

This means option premiums, on balance, are getting cheaper. This means it's cheaper to take a position either way (bullish or bearish).

Let's take the analysis one step further...

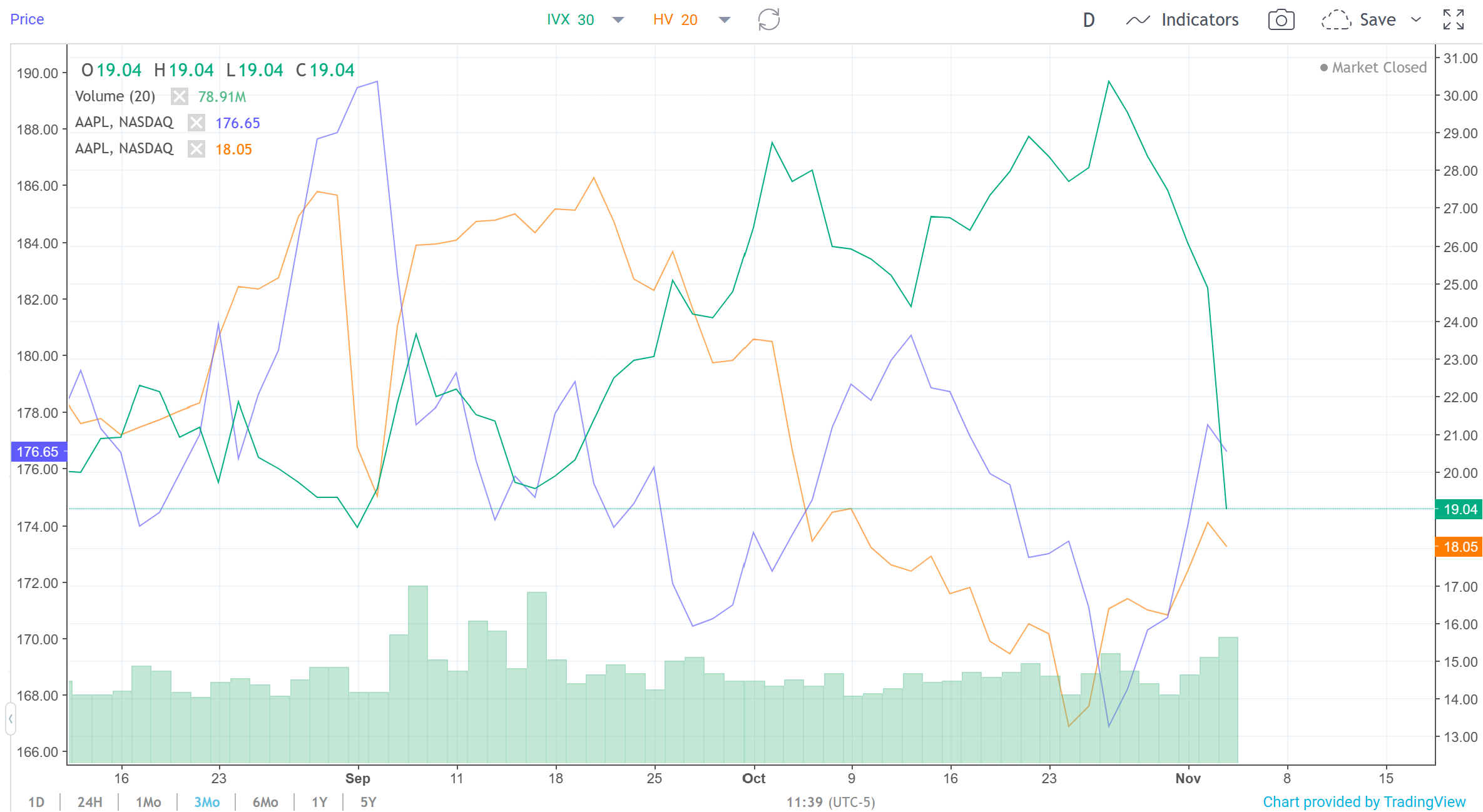

We'll isolate Implied Volatility only and apply some technical analysis indicators:

Here, we can see that Implied Volatility has crashed below its lower Bollinger Band as well as its lower RSI level around 30.

This means that, with IV stretched so far to the downside on the heels of the earnings release, we will likely see a shar rebound in IV. And a rise in IV normally leads to a decline in share prices.

How to Play It

With Implied Volatility likely to rebound, here's our thinking:

• If bullish on Apple, wait for IV to bounce, and any corresponding dip in share price, to play out. Then take advantage of lower IV levels to take a bullish position.

• If bearish on Apple, now is a good time to strike. Option Premiums are relatively cheap compared to this time last week, and Wall Street isn't thrilled about the short term for the tech giant - this means shares could be pressured lower as we go into the final stretch of 2023.

(Enjoy this Charting and Technical Analysis? Check out an in-depth demo video HERE that covers charting and technical analysis within IVolLive.)

Previous issues are located under the News tab on our website.