Last Week’s Highlights at IVolLive:

- Don't forget to register for our next live webinar on Tuesday, July 18th 2023 Webinar Topic: How to Use and Analyze Stock Market Sentiment to Create Actionable Options Trades HERE

- Get a free IVolLive Trial HERE.

Inflation Recedes, Markets Rise

July 06, 2023

What's Happening Now in the Markets

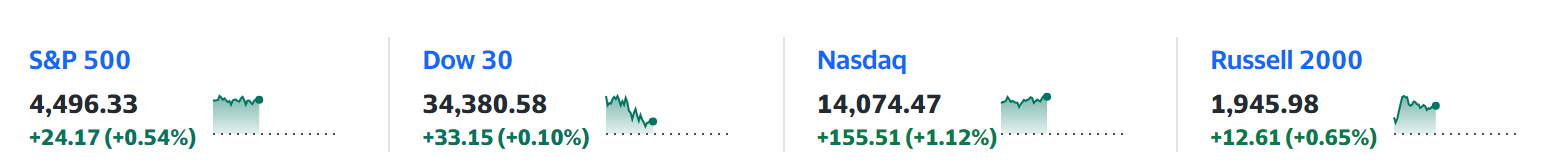

The buying algos kicked into high gear yesterday around midday on the heels of a report showing that consumer inflation rose less than expected in June.

Remember, lowering inflation figures make the markets optimistic that the Federal Reserve will at least pause in its rate hike cycle. And all else being equal, the market views lower rates as bullish.

One of the markets that is highly sensitive to interest rates is one we wrote about last week: the tech sector, with the Nasdaq rising 1% on the day yesterday.

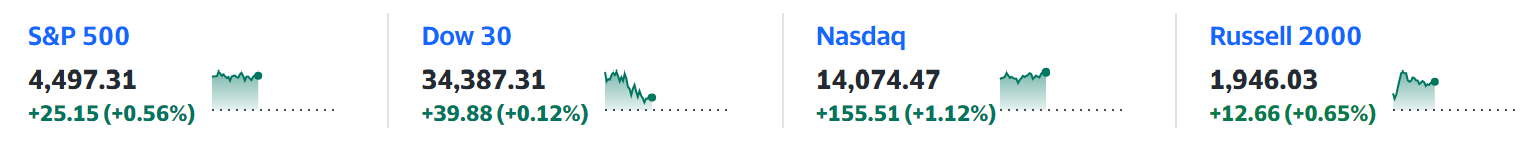

Speaking of tech, Amazon is fresh off the heels of its Prime Day, with projections that the tech giant will haul in over $8 billion in sales - a 10% increase over last year.

For perspective, Amazons sales this week are projected to account for nearly 60% of all ecommerce sales for this week:

Fellow tech giant Broadcom (AVGO) name just hit an all-time high after European regulators provided tentative approval for Broadcom's $61 billion purchase of VMWare.

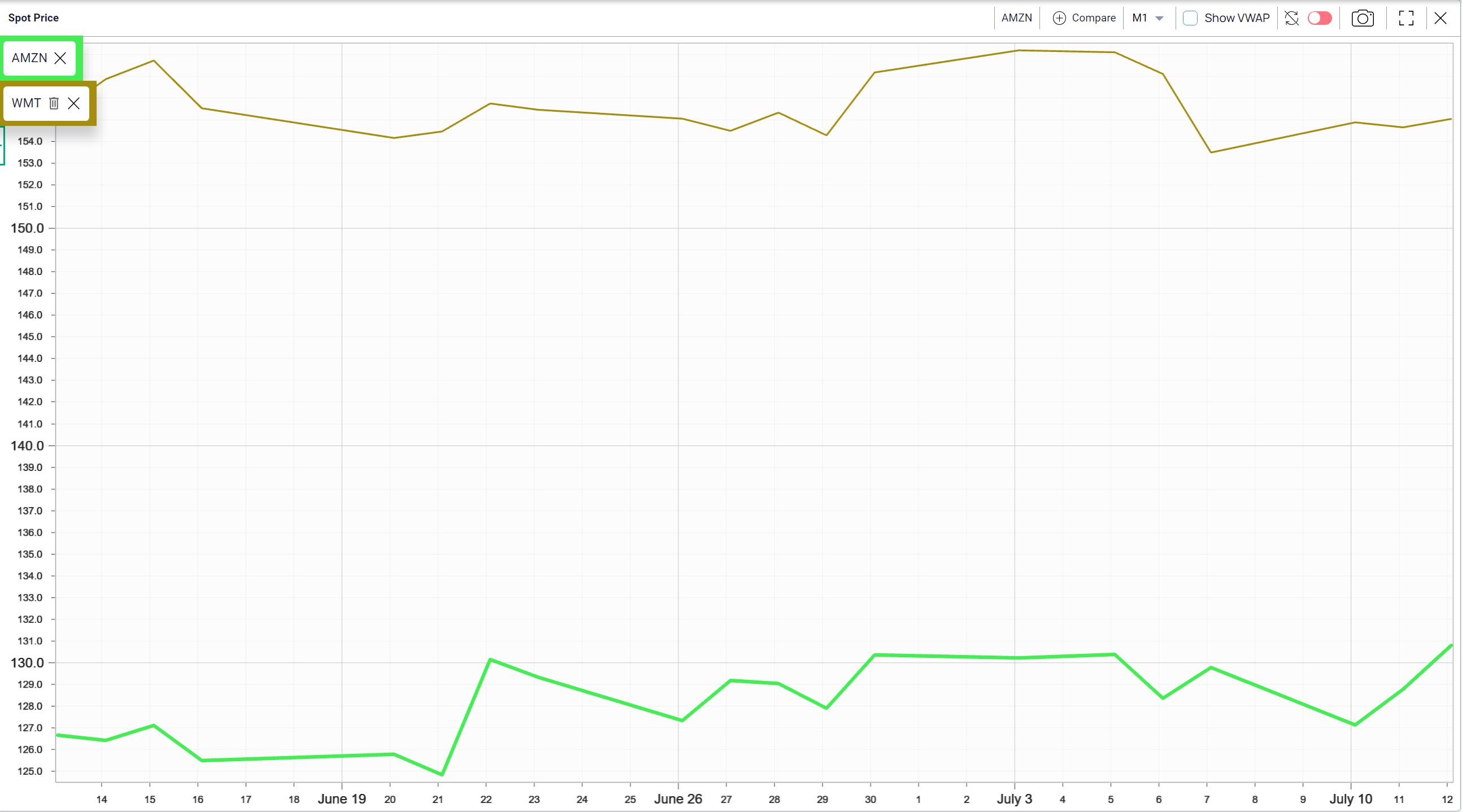

Ending this session on a light note - pizza - Domino's Pizza (DPZ) was the best performing stock in the S&P 500 on news its that the pizza giant struck a deal with Uber to list on its Uber Eats and Postmates app.

How to Play It

With inflation easing, tech remains in play (the strongest sector YTD). The VIX also remains low, so options prices are inexpensive. This means it's inexpensive to go long options on tech names you're interested in.

Previous issues are located under the News tab on our website.