Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Webinar (June 6th, 2023) Webinar Topic: How to Use Implied Volatility and Pricing Charts to Time and Make Actionable Options Trades HERE

- Get a free IVolLive Trial HERE.

Debt Deal and Jobs Euphoria.

June 5, 2023

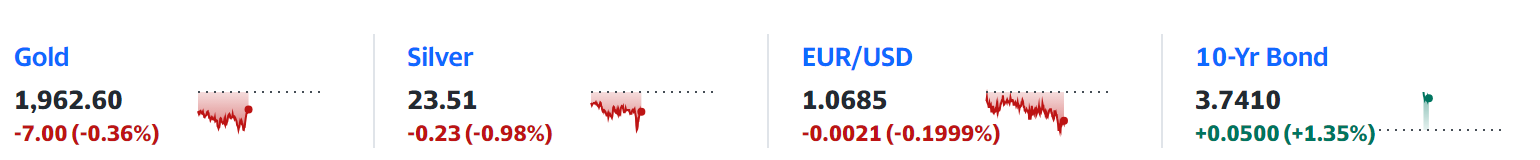

What's Happening Now in the Markets

U.S. equities soared on Friday on the heels of a better-than-expected jobs report as well as the Senate passing a bill to raise the federal debt ceiling limit - preventing a federal government default.

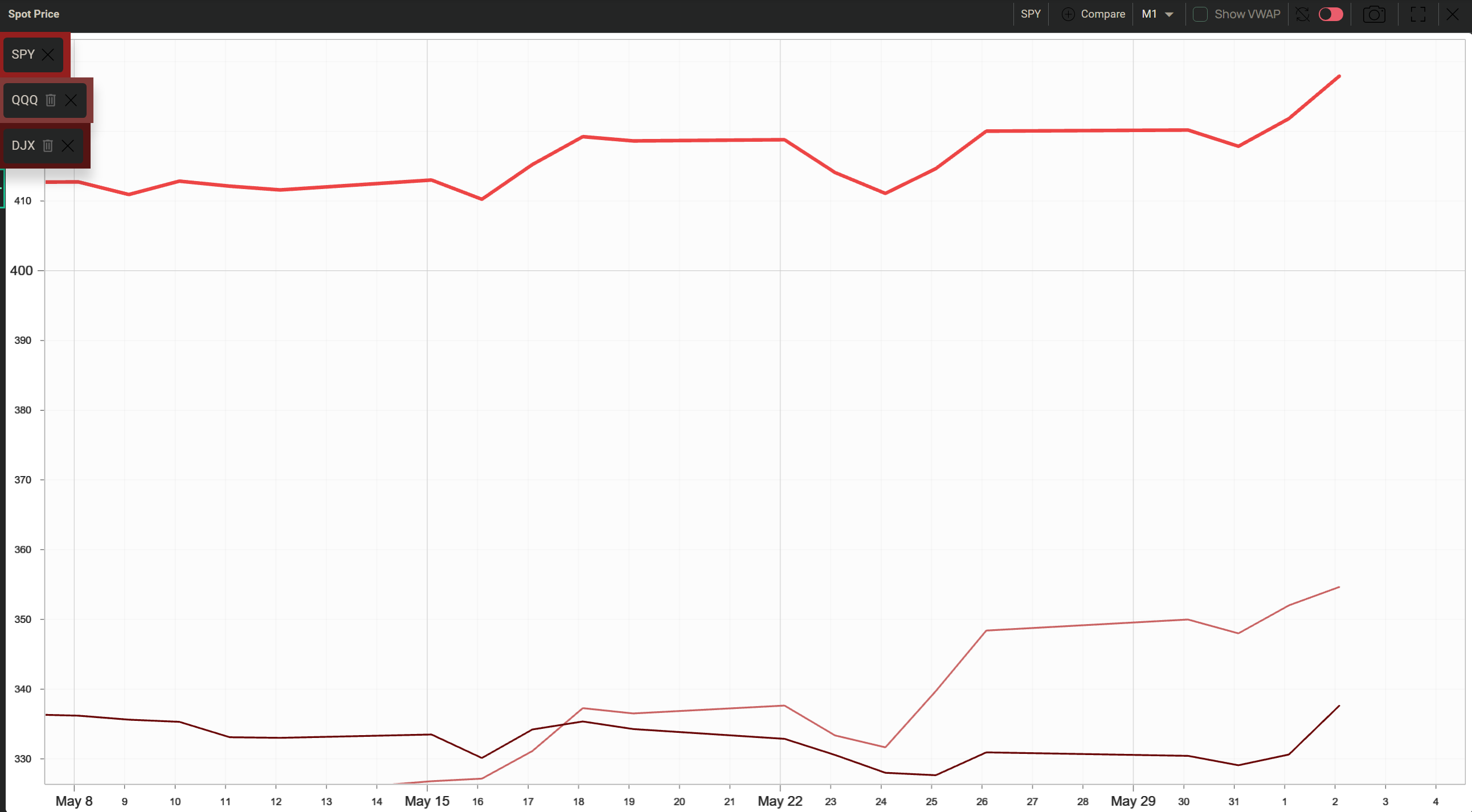

The S&P 500, Dow, and Nasdaq were all up more than 1% in midday trading on Friday, as you can see in this one-month chart from IVolLive below which tracks the three major US indices:

The rise was led by giants 3M (MMM), Caterpillar (CAT), and Amazon (AMZN).

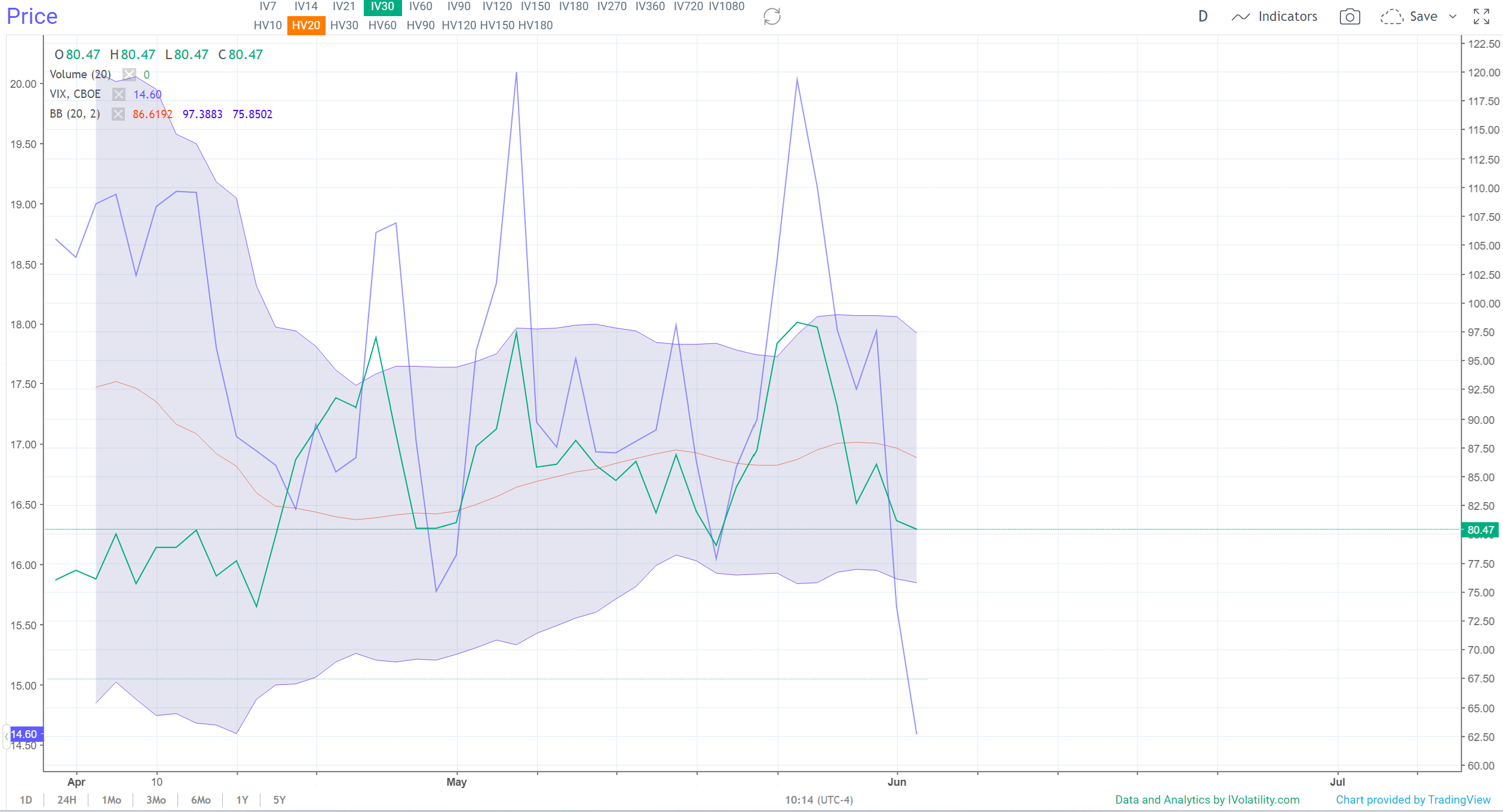

And remember the inverse relationship between the market and the market's "fear gauge", the VIX. As the indices surged on Friday, the VIX closed below its lower Bollinger Band. At the same time, the S&P 500 closed above its upper Bollinger band.

Bottom line: It's time to prepare for at least a short-term pullback. If you're ready to enter bullish positions, consider waiting until the market dips a bit. This will allow for a better entry point for a long buy, or bullish (long) options trade.

How to Play It

With the market's recent bullish strength, implied volatility remains low across the market overall. This also signals that options premiums are low. At the same time, the market's technical indictors are overextended.

From where we sit, the best move for now is to hold on to profitable long positions and wait for a market pullback on strong names that take temporary, one-off hits, leading to a decline in price.

Interesting opportunities:

• Communications: Connectivity giants AT&T (T), Verizon (VZ), and T Mobile (TMUS) lagged the strength of the market last week, yet all three remain profitable atop customer bases that number in the tens of millions of customers.

• Travel: The consumer remains resilient. We're looking for compelling trade setups in major hotel and airline names such as Hilton (HLT) and Delta (DAL) as the summer travel season kicks off in earnest.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.