Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Tuesday Webinar Webinar Topic: Harness The IVolLive Stock Monitor to Run and Create Custom Scans to Create a Hit List of Actionable Trades HERE

- Register HERE for our free, live webinars that we host every Tuesday and Saturday at Noon EST.

- Get a free IVolLive Trial HERE.

Marching in Place.

May 24, 2023

What's Happening Now in the Markets

Despite some jitters on Friday, markets rose on the week, with the S&P 500 rising at a strong 1.7% clip, the Nasdaq eclipsing this at 3%, and the Dow up 0.4%.

U.S. Treasury yields rose to their highest level in two months as the federal debt issue remained unresolved.

As we go to press, a deal on the federal debt levels remains elusive as President Biden and House Speaker McCarthy remain at odds. This means the potential of a government default still looms large on trader's minds.

Zooming in on company specific action, auto parts giant AutoZone (AZO) shares fell under pressure yesterday as the retailer reported weaker than expected results, causing rivals Advance Auto Parts (AAP) and O'Reilly Automotive (ORLY) to drop in sympathy.

These firms are typically resilient. After all, drivers are forces to maintain and repair their vehicles in good times and bad, recessions, or bull markets, so savvy traders could use any weakness as a potential opportunity to strike.

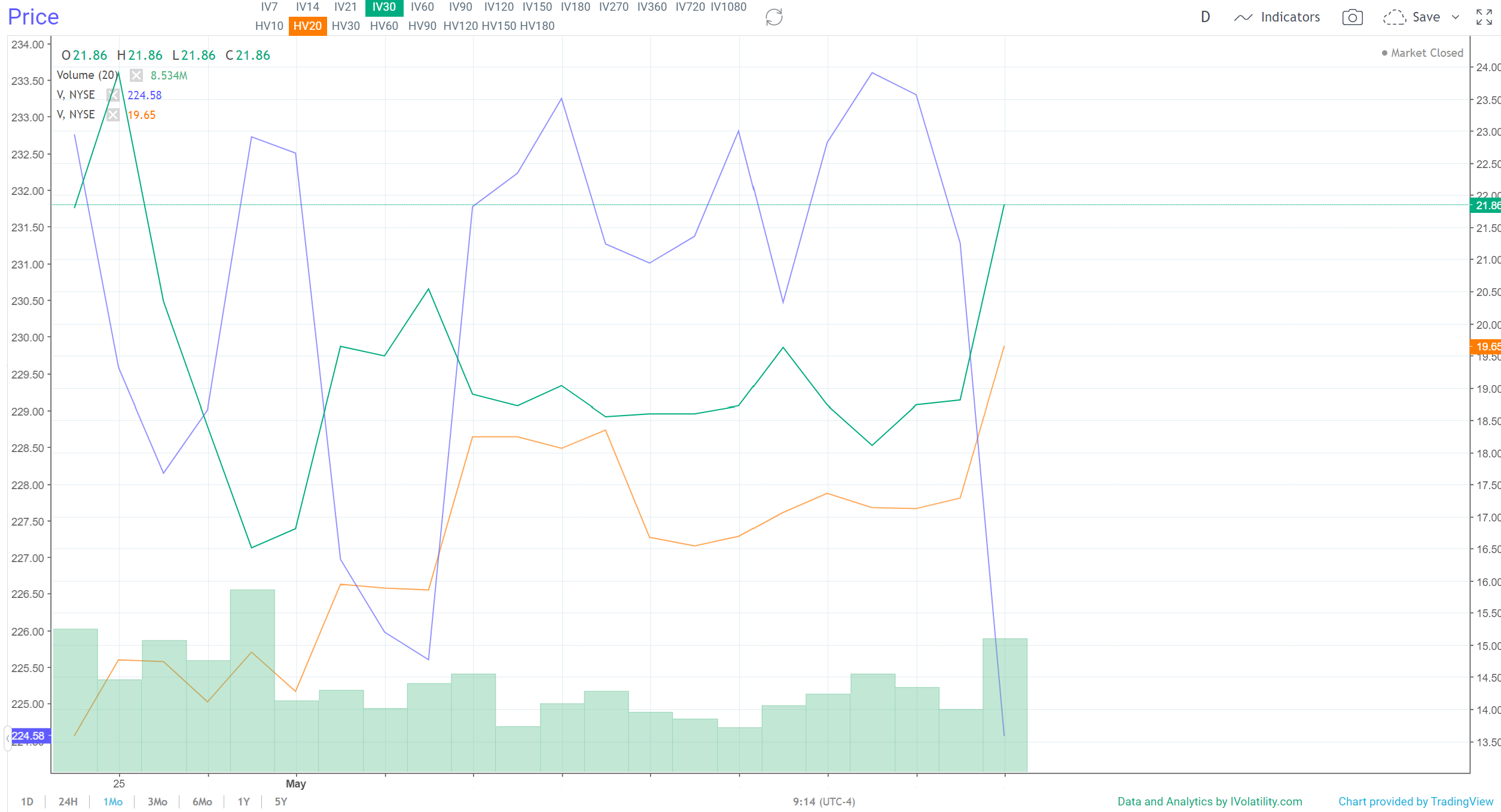

Speaking of potential openings, credit card processing giant Visa (V) was the worst performing stock in the Dow yesterday, sliding 3%.

Meanwhile oil giant Chevron was the top performer in the Dow index on the heels of an announced acquisition of smaller rival in the US and an upgrade to "buy" from banking giant HSBC.

On the earnings beat front, Lowe's (LOW) saw positive price action yesterday as the home improvement retailer beat on profit and sales forecasts.

Regional banks also showed signs of life for two straight days this week.

On the housing front, purchases of new homes increased more than expected in April as the average sale price plunged nearly 8% month over month.

The market's fear gauge - the VIX - has risen a bit over the past few sessions but remains subdued, trading below the dividing line of 20.0 we use for high- and low-VIX markets:

Bottom line: Despite continued negotiations around the debt ceiling, markets remain relatively calm and resilient. Dips and weaknesses in specific names that tend to bounce over time (like Visa and AutoZone) could present compelling entry points - especially as options premiums are relatively low thanks to subdued volatility levels.

How to Play It

With implied volatility remaining low across the market overall, this signals that options premiums will be falling. This means now could be a good time to go long options, or long volatility.

Interesting opportunities:

• Retail: In general, despite banking jitters and high inflation, the consumer has remained resilient. We're looking for overdone selloffs in select retail names like Home Depot, Visa, and AutoZone, for example, that cater to middle class American consumers.

• While volatility is low at the moment, hedging one's portfolio could be wise as periods of low volatility are always followed by spiked in the VIX. That's how markets work.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.