Last Week’s Highlights at IVolLive:

- Register HERE for our free, live webinars that we host every Tuesday and Saturday at Noon EST.

- You can watch and view any of our past videos on our YouTube channel HERE.

- Register for a free IVolLive Trial HERE.

Spending Bills, Earnings, and Volatility

April 24, 2023

What's Happening Now in the Markets

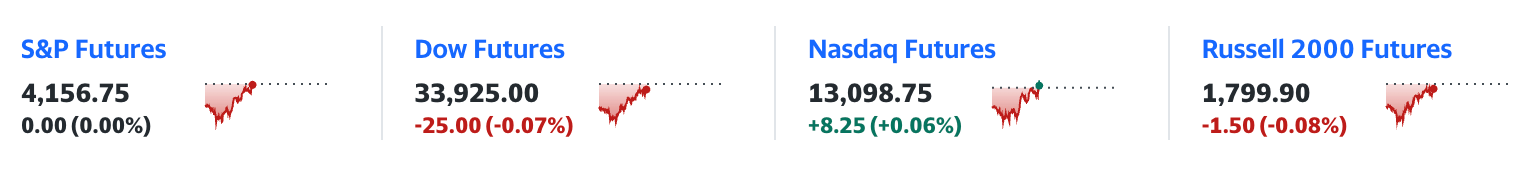

Last week, all three indices were slightly lower, with the S&P 500 dipping 0.1%, the Dow contracting 0.2%, and the Nasdaq falling 0.4%. While small declines, this was the market's worst weekly performance since March.

Oil prices fell for the week and the yield on the 10-year Treasury rose slightly to 3.6%.

Looking ahead...

The U.S. House of Representatives will be voting on a spending and debt bill this week. We expect a deal to get done - one always is reached... even at the last minute. This year there is the added wrinkle that the cost to insure US debt for one year is at its highest on record (measured by credit default swaps). In other words, the market is taking a closer look at Uncle Sam's balance sheet.

In fact, as a group, hedge funds have never been more bearish on US Treasuries with leveraged net investor shorts hitting an all-time record.

That said, there is sure to be plenty of brinkmanship at play per usual as both sides of the political aisle try to gain points with their constituents.

If the negotiating gets particularly tense, volatility will likely appear in the markets. Speaking of volatility, the market's fear gauge "the VIX" is hovering around Year-to-date (YTD) lows at 17.4. This means that investors are calm and complacent. This also means that options premiums are declining.

There is one very interesting thing to note, however, on this YTD chart of the VIX:

Notice that recently, as the (blue line) (price) is going down, implied volatility (green line) is rising - that's an interesting divergence which tells us that a spike in the VIX could be just around the corner.

After all, periods of low volatility are always followed by periods of high volatility. That's the way markets work. And looking ahead, here are some catalysts that could spark an increase in volatility.

- Unusually heated negotiations around the spending bill in the House.

- Earnings... to date, nearly 20% of the S&P 500 has reported earnings with 76% beating EPS estimates and 63% beating revenue estimates. In other words, solid performance so far. This week we're watching earnings from Coca-Cola (KO), Canadian National Railway (CNI), and the much-anticipated release from First Republic Bank (FRC).

One company we may not hear from in a while is Bed Bath & Beyond. The retailer announced a Chapter 11 bankruptcy and plans to liquidate unless it finds a last- minute suitor.

Summing Up

In other news, the tech sector (which we've written about frequently in past issues) is off to its strongest start since 2009 despite a gloomy earnings outlook, with analysts predicting a 15% decline in profits for Q1.

An earnings decline could lead to downward pressure in stock prices - leading to a surge in implied volatility, and interesting trading opportunities.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.