Last Week’s Highlights at IVolLive:

- On Saturday, our experts gave a LIVE walkthrough and demo on the IVolLive platform, including how to trade puts, calls, and spreads as well as how to add features like stocks, charts, the Stock Monitor, and the Profit and Loss Calculator. Watch the video HERE.

- You can register for any of our upcoming LIVE webinars HERE.

- You can watch and view any of our past videos on our YouTube channel HERE.

- Register for a free IVolLive Trial HERE.

Bonds Got the Message

February 13, 2023

With the benefit of hindsight, it appears the S&P 500 Index reached a high on Thursday February 2, at 4195.44, the day before the Friday February 3 employment report, and marks the likely end to the current rally. Up to that point, More Bull or Bounce? leaned bullish, but that changed last week.

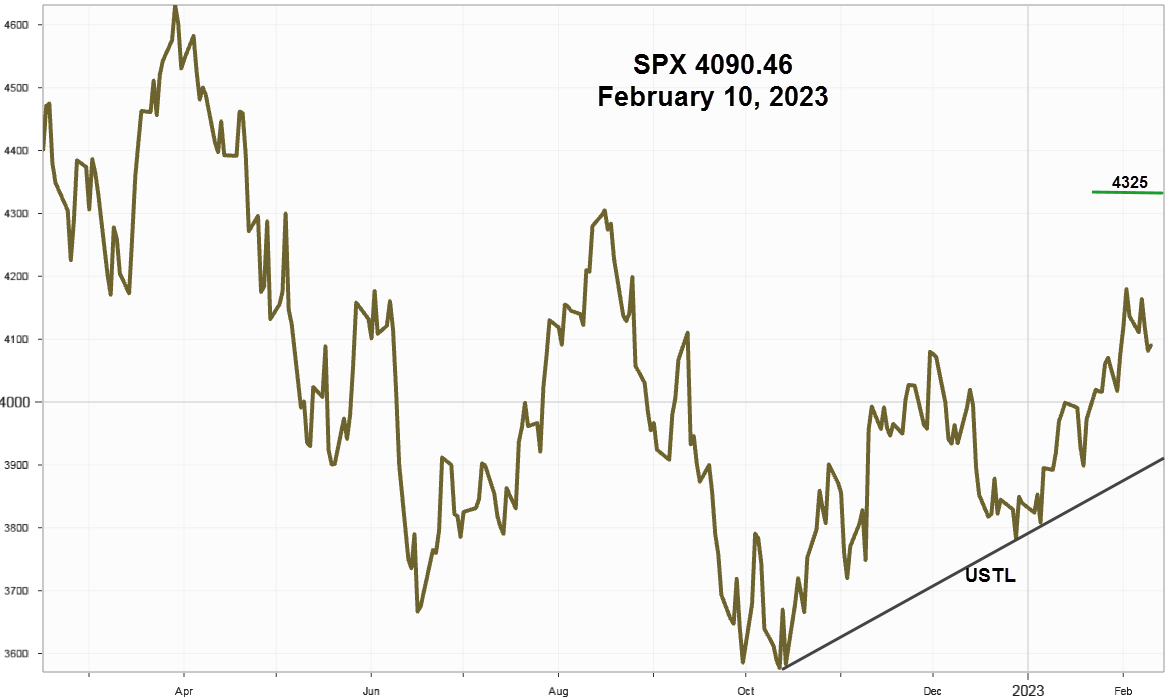

S&P 500 Index (SPX) 4090.46 slid 46.02 points, or -1.11%, last week making a well-defined downward sloping channel that began after the employment report. Although still well above 50 and 200-day Moving Averages, it closed below the first support zone around 4100 from mid December. The chart below shows the current upward sloping trendline (USTL) from the October low without the prior downward sloping trendline or the potential Head & Shoulder Bottom pattern included in last week's chart, but for reference still shows a small horizontal green mark at 4325 that would activate the pattern on higher closes.

As mentioned above, the decline began after on the February 3 employment report as bonds sold off with a noticeable 15 basis points (bps) jump in yield on the 1-Year Treasury Bill to 4.79%. Then on Friday it closed at 4.89%, some 39 bps above the 2-Year Note at 4.50%. For some reason the bond market really dislikes the 1-Year Bill.

As a collaborator the U.S Dollar Index, the index made a pivot low at 100.68 on February 2, then closed at 103.54 up .78 for the week , slightly above the downward sloping 50-day Moving Average.

With signs of speculation returning to the equity market the Federal Reserve brought out several officials last week to remind the markets once again about “higher for longerâ€