Heading Lower

December 19, 2022

Encouraged by a slightly lower Consumer Price Index report last Tuesday morning the S&P 500 Index (SPX) opened gap higher, well above the 200- day Moving Average, but failed to hold much of the gain by the close.

The next day the Federal Reserve increased the fed funds rate by 50 basis points (bps) as expected and Chairman Jerome Powell insisted they intend to keep raising rates until inflation returns to their 2% objective. Once again SPX tested the menacing 200-day Moving Average and once again failed, closing slightly lower on the day.

Then on Thursday SPX opened gap lower in a delayed reaction to Powell's comments the day before then accelerated lower after a weaker than expected retail sales report for November.

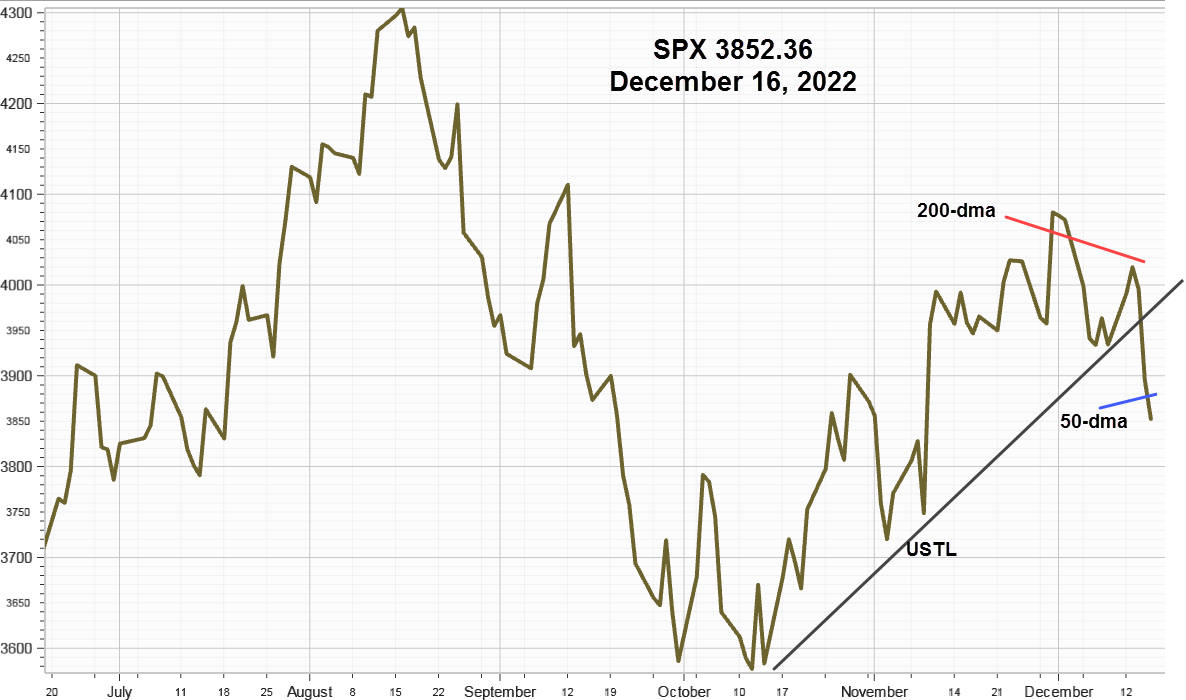

S&P 500 Index (SPX) 3852.36 slumped 82.02 points or -2.08 with most of the damage occurring on Thursday when it opened gap lower. The updated line on close chart below tells the story. It estimates the origin of the now well broken upward sloping trendline (USTL) along with Tuesday's intraday high and shows Thursday's damage to the uptrend of this recent bear market bounce along with the failure at the 200-day moving average(red line) and then Friday's close below the 50-day Moving Average (blue line).

Although circumstances may not be exactly comparable to December 2018, another time when rates were also rising when the SPX declined 12.9% from December 4, to December 24. Now like December 2018, the odds again favor the bears that come in more than one size, and color, e.g. black bears, brown bears and white bears so this year could end differently. However, based on failure to advance above the 200-day Moving Average the bears are now likely to press the downside and attempt to test the October 13 low down at 3491.58 before year-end.

Forecast and Predictions

With sentiment and many market indicators in the negative column and with more coming in the next few weeks, forecasts and predictions will be as overwhelming as trying to lasso a tornado.

Consider these thoughts:

We have two classes of forecasters: Those who don't know - and those who don't know they don't know. - John Kenneth Galbraith

"Economists are often asked to predict what the economy is going to do. But economic predictions require predicting what politicians are going to do - and nothing is more unpredictable." - Thomas Sowell

"Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window." - Peter Drucker

"When all the experts and forecasts agree - something else is going to happen." - Bob Farrell, long-time Merrill Lynch market strategist.

"It's tough to make predictions, especially about the future." - Yogi Berra

Summing Up

For the second time in two weeks, the S&P 500 Index closed below the trend defined by 200-day Moving Average and then closed below the operative upward sloping trendline from the October 13 origin at 3491.58 as well as the 50-day Moving Average.

The Fed confirmed another 50 bps rate hike and Powell emphasized once again their intention to keep raising rates until they see substantial progress to reaching their 2% inflation goal. Despite declaring they intend to keep rates higher for longer, the markets now expect rate cuts in the second half of next year.

With the bears in control and with substantial liquidity still waiting to pounce on the slightest bit of positive news, is it reasonable to expect a final equity market bottom until all the "buy the dippers" finally throw in the towel?

Previous issues are located under the "News" tab on the front page of our website.