A very busy week ahead

November 1, 2022

A slight correction in US equity indices yesterday as traders fine tune their books going into one of the busiest weeks of the year. The SPX lost 0.75%, the NDX -1.22% and the DJIA dropped 0.39%.

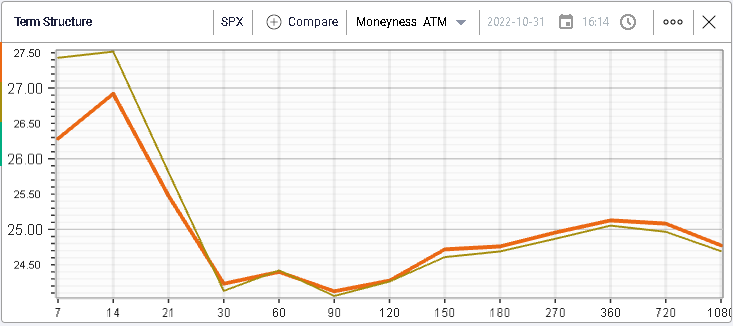

Implied volatilities were largely unchanged as seen below on the SPX term structure.

Turning to the week’s important events, we recap below some of the most anticipated releases over the next few days.

ISM Manufacturing

A key indicator based on the survey of purchasing and supply executives across a diverse range of companies in the US. The 50 mark is thought to play a crucial role for the ISM as the level separating contraction and expansion.

On Tuesday at 10am EST, the ISM Manufacturing will be released and is currently anticipated at 50.

ADP Employment

Provides an estimate of employment trends in the US. It is generally used as a first indicator before the crucial Non-Farm Payrolls report.

The report will be released on Wednesday at 8.15am EST and is currently expected at 193,000 job creations over the past month.

FOMC

This week’s meeting is highly anticipated with the FED expected to raise rates by 0.75% to 4%. Many market commentators have debated whether a pivot at this week’s meeting or at the December meeting was likely given the significant pace of hiking seen in 2022.

The FED decision on interest rates will be released at 2pm EST and followed by the press conference at 2.30pm.

ECB Lagarde’s speeches

Following last week’s ECB conference, many commentators have raised the prospects that the ECB was indicating that it was getting close to a pause where it would wait and reassess whether further hikes were required.

This week’s speeches are expected on Thursday at 4.05am EST and Friday at 5.30am EST and might bring some clarification from the president of the ECB.

Bank of England

The Bank of England is expected to release its decision on interest rates on Thursday at 8am EST where the market expects a 0.75% hike to 3%.

At 8.30am EST, Governor Bailey will lead the BoE’s press conference to discuss their decisions.

ISM Services

Like the ISM Manufacturing, the ISM Services will be highly anticipated. The Services sector has resisted more than its manufacturing counterpart with an anticipated ISM Services seen at 55.5. The release is due on Thursday at 10am EST.

Nonfarm Payrolls

The BLS’s official estimate of employment changes over the prior month is one of the most important economic figures expected on Friday at 8.30am EST.

Market consensus is looking for a gain of 200k jobs over the previous month and the unemployment rate is seen ticking to 3.6%.

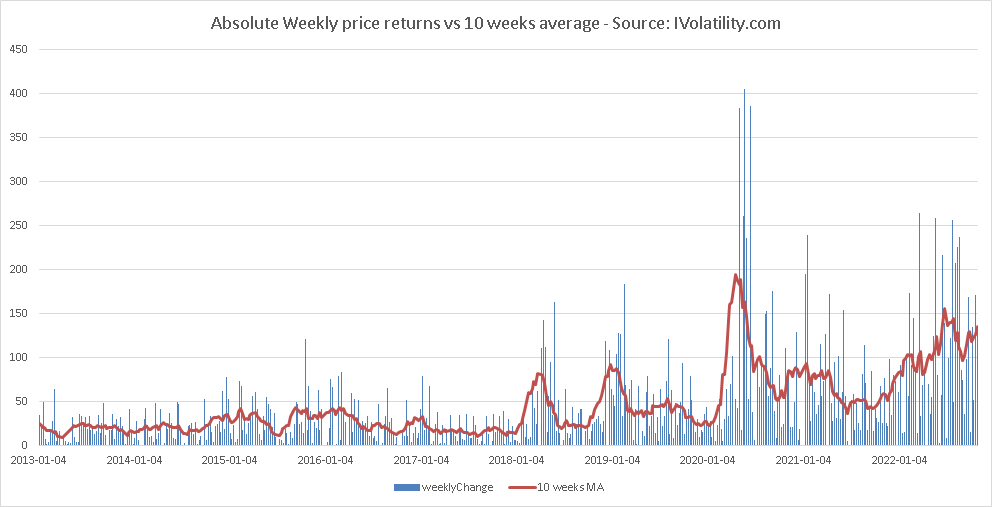

Looking at the options market, weekly 3900 straddles are priced around 100 points. On the below chart, we display the historical weekly absolute price change for the SPX alongside the 10 weeks average shown in red.

Over the past week, the SPX moved 148 points and the 10 weeks average was standing at 136 points.

All in all, this week will be expected to be very busy helping traders transition from the recent focus on stocks back onto more macro discussions.