New Feature Alert: Intraday price action and IV analytics for every options contract

What we’ve done:

We’ve heard your comments and in the latest release of IVolLive, we’ve added contract-level intraday price and IV data!

We’re excited to bring you this highly requested feature, enabling you to view intraday price action and IV calculations for every options contract on the market with minute-by-minute historical data. Day traders, looking to evaluate opportunities around intraday option trades will find this tool incredibly useful to perform quick visual backtests.

What this means for you:

Backtesting a strategy demands a full understanding of an option’s behavior, and the closing snapshot doesn’t tell the entire story.

Now, you can rapidly backtest ideas by visualizing an option contract’s price and IV action throughout the day with minute-by-minute data, comparing your hypotheses about options prices through the day against empirical data. For the first time, take a data-driven approach to intraday strategies that were once only available to the best resourced equity derivatives desks.

How to start:

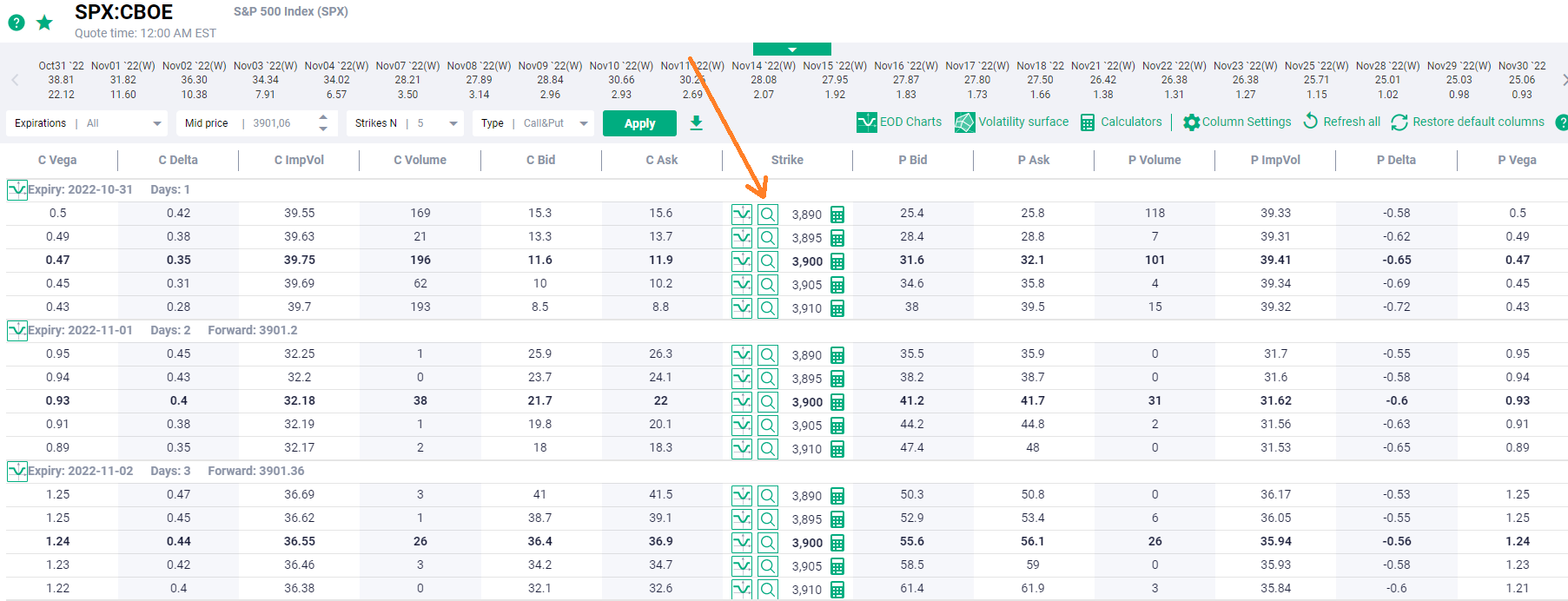

Starting to backtest intraday ideas is as easy as clicking an icon:

Then view how that contract’s price and IV changed intraday:

YouTube video about new feature is available here.

Where we’re heading:

Backtesting is tough. Big funds and traders have quantitative analysts (quants) to filter, process, visualize, and analyze data to power backtests. With IVolLive, we bring you the benefits of having your own quant, with none of the cost. Going forward, we’ll be focusing on expanding your backtest toolkit and leveling the playing field between you and big money Wall Street funds. Expect more backtesting tools coming your way and please let us know of any tool you’d like to help you better test ideas.

IVolLive provides professional grade tools for options traders including volatility charts, data download, calculators, advanced watchlists, scanners and more.

Learn more here.