Monday bounce in stocks

October 4, 2022

Stocks climbed on Monday with the SPX gaining 2.6%, the NDX finishing 2.4% higher and the DJIA settled 2.66% higher.

Implied volatilities remarked lower from Friday’s close with 30d IVX closing around 27% or about 0.75% lower on the day.

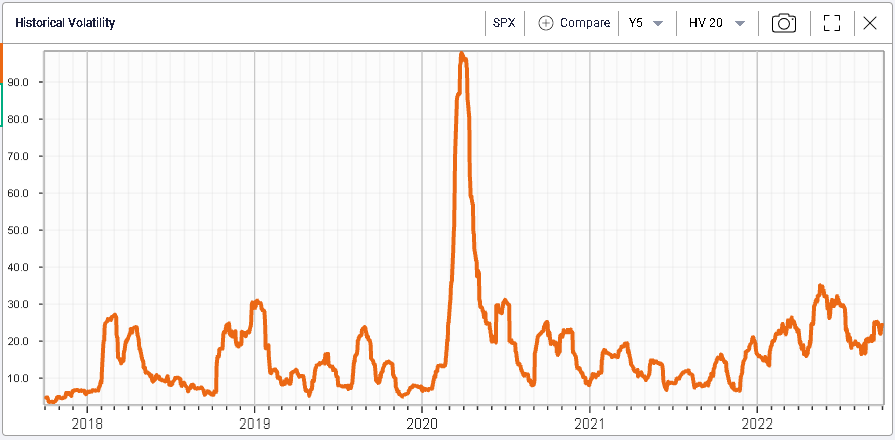

Looking at realized volatility, we can clearly see how it has so far remained subdued in the current environment with a realized volatility stuck around 25%.

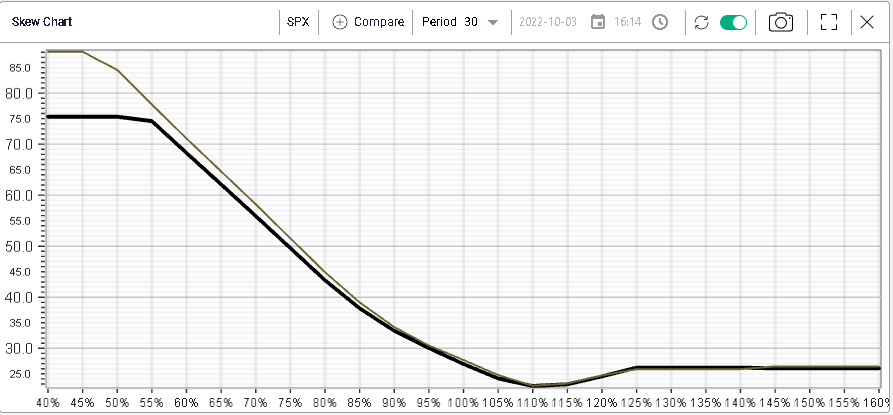

Looking at 30 days skew, we can see that downside puts implied volatility moved lower while at the money and upside calls were largely unchanged.

Looking at volumes, 1.2 million calls traded over the session and 1.44m puts exchanged hands. The market remains focused on short dated options with more than 500k of 3rd Oct’22 options trading on Monday.

We also note 15k of the 3700 calls with expiration 4th Oct’22 exchanging hands. Some Dec’22 3700 & 4350 calls also traded 7.4k times each with a further 6k of the 3800 calls trading.

On the put side, the most active options were the 3400 puts with expiration 7th Oct’22 which traded 15k times. Some 3050 puts with expiration 14th Oct’22 also traded 10.5k and a further 10k of the 2750 and 2800 puts with expiration 11th Nov’22.