Let’s talk about those record option volumes

September 27, 2022

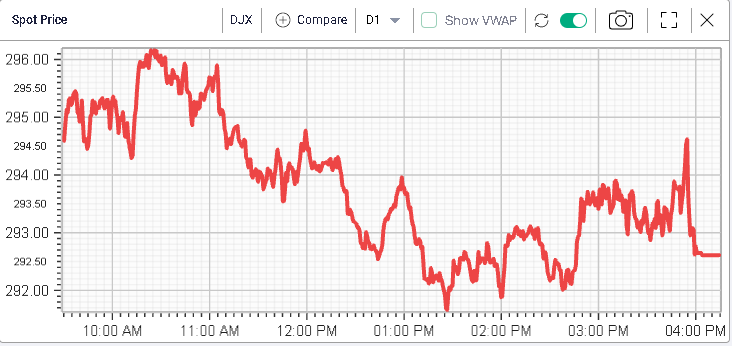

Stocks tried to push higher off the open but failed to hold their ground and revisited Friday’s lows again. Headline indices managed to finish off their worst intraday levels but still closed in the red with the DJIA closing 1.1% lower, the NDX 0.51% down and the SPX 1.03% lower.

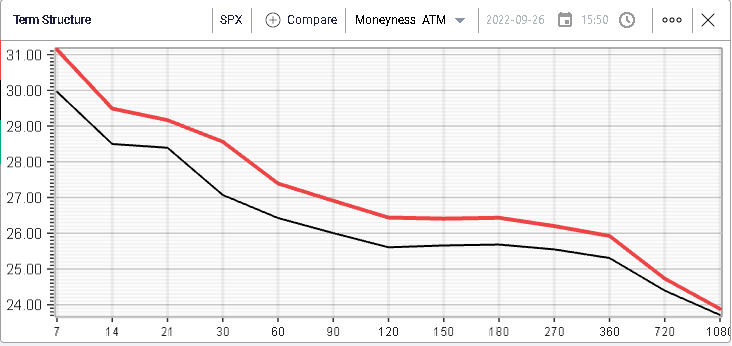

Implied volatilities parallel shifted higher over the session with weekly options at 31% IV and 30 days options marked at 28.5% up 1.5 points from Friday’s closing values.

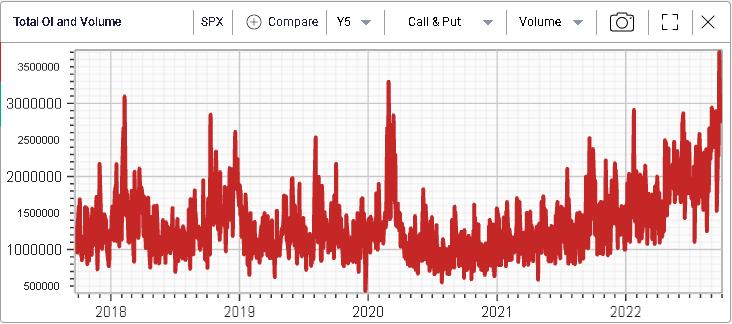

Friday’s options volumes were extremely elevated with both calls and puts volumes at their highest level for more than 5 years.

Volumes dropped on Monday but remained historically elevated with more than 2.75m contracts exchanging hands across calls and puts.

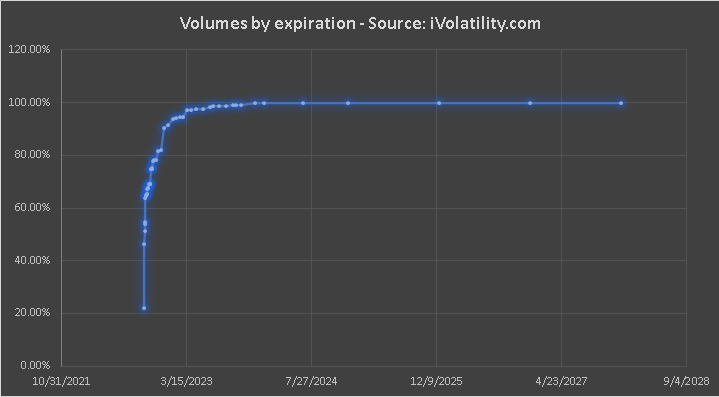

Looking at the distribution of those volumes on the SPX, more than 50% of all the volume traded on Friday and Monday expired prior to the 27th Sep’22. Options expiring in December made up around 8.3% of the total volume and October was at 5.74%.

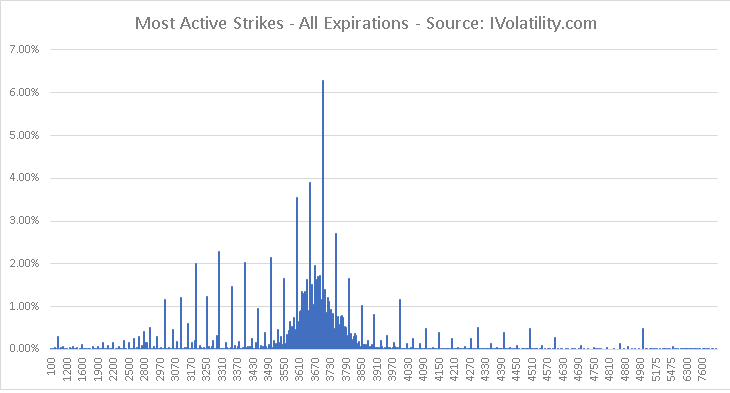

Puts made up 62% of the total volume while calls made up 38%. In the below chart, we look at the most active strikes across all maturities. Between strikes 3600 and 3800 we find around 55% of all the trades executed across calls and puts for Friday and Monday.

The most active strikes were 3700 with 6.3% of all trades, 3650 with around 4% of all trades, 3600 with 3.5% of all trades and 3750 with 2.7% of the volumes recorded. Then comes the first out of the money strike with 3300 trading in 2.3% of the total volume recorded across the two sessions.

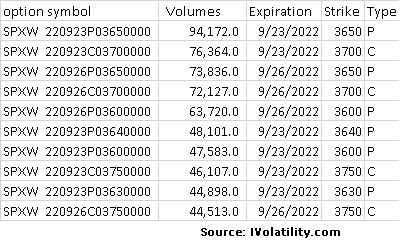

Across the two sessions, the most active options are listed below, very much concentrated around current spot price level and split almost evenly between puts and calls.

It is also interesting to note that all of those options ended up expiring worthless or very close to.

Overall, it seems that traders remain highly split over the future path of stocks and equity indices. Perceived risks have definitely increased which has attracted more volumes than ever before with a very large focus on short dated options. As discussed in yesterday’s market update, opportunities may also lie in intermediate maturities.