Taking stock of the FOMC’s impact

September 22, 2022

The FED yesterday took central stage and raised interest rates by 0.75% to a target range of 3% - 3.25%. FED’s Powell reiterated the resolve of the committee to get inflation lower even at the cost of slowing the economy and increasing unemployment (FT).

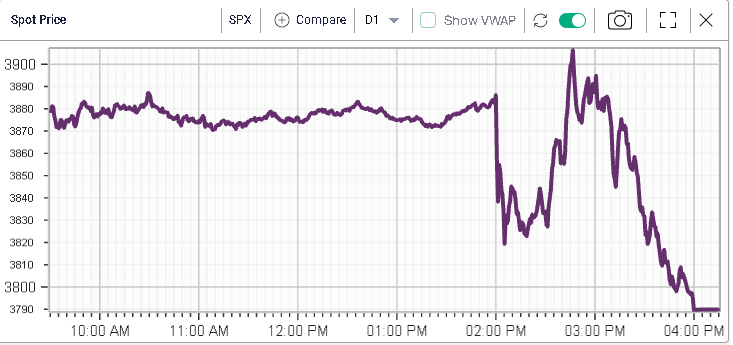

The intraday volatility was very large with the SPX dropping 60 points in a straight line before rallying back above 3900 early in the afternoon. It eventually settled below 3800.

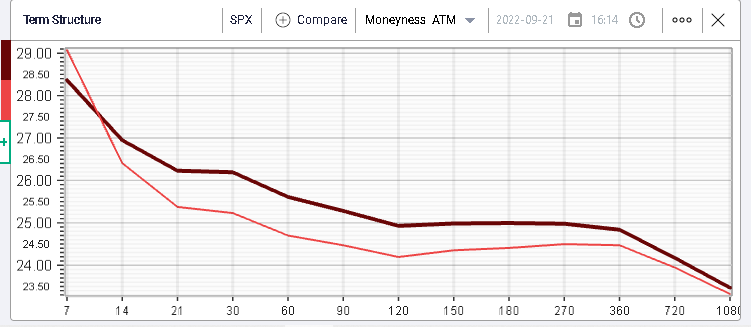

This resulted in a fairly stable volatility that drifted as the market tried to break above 3900 but quickly reverted to finish around 26.5 for 30d IVX on the SPX.

Without much surprise all sectors finished in the red yesterday with Communications and Consumer Discretionary leading on the downside finishing around 2.5% lower. Sectors and stocks were fairly concentrated in terms of performance, with pretty much all components of the DJIA finishing between -1% and -3% except for WMT which closed almost 1% higher on the day.

It is very plausible that on a day like yesterday, traders hedged their macro exposures without paying much attention to the specifics of their single stock positions. As a result, once the initial phase of portfolio adjustments on the back of the news will be completed, it is quite likely that traders will start focusing once again on companies’ stories.

Looking at the term structure, implied volatility remains elevated in the short term with weekly options around 28%. Longer dated options also moved higher yesterday with all points for the next 12 months closing above 25%.

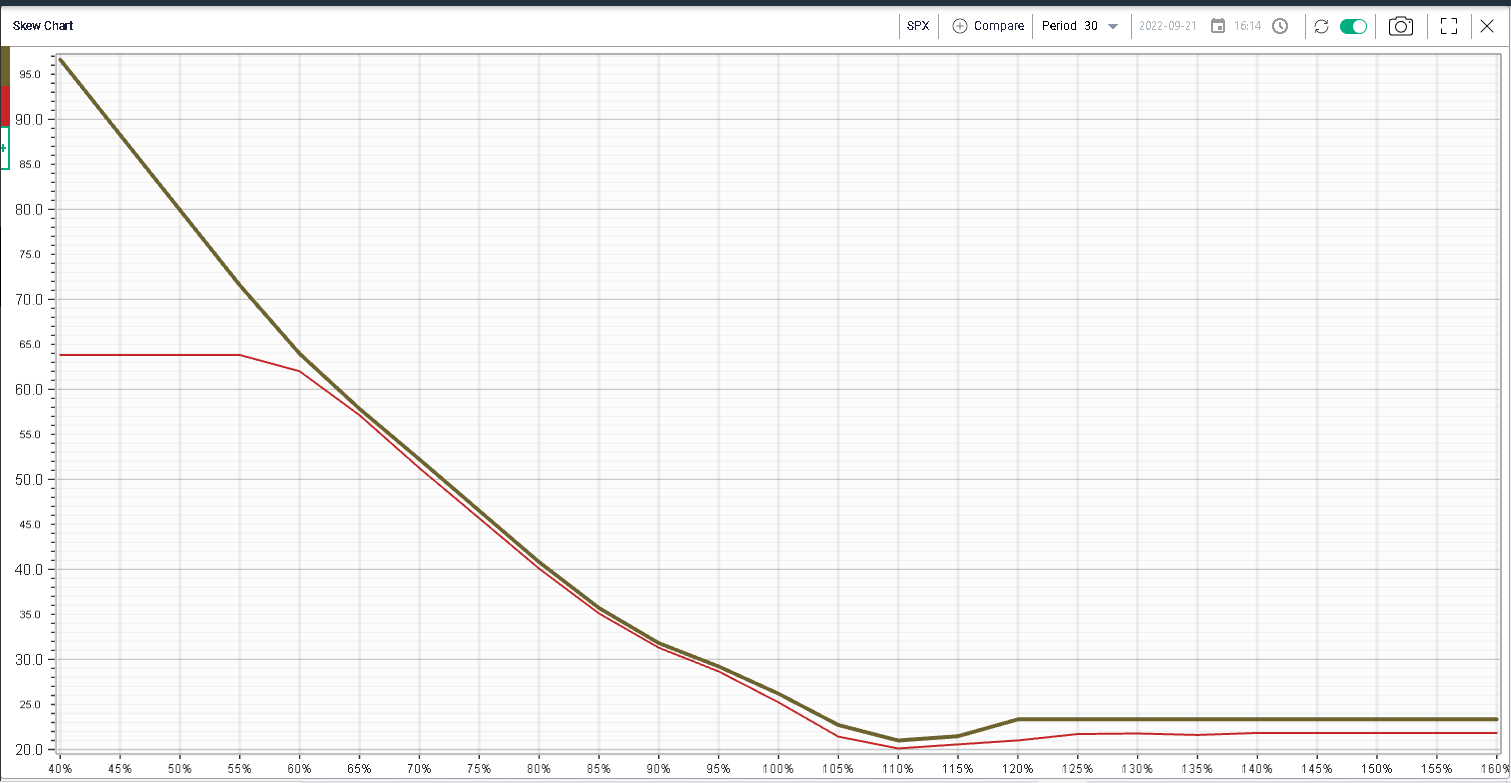

Looking at the skew, all implied volatilities remarked higher yesterday for the 30 days expiration with upside calls (generally the cheapest part of the curve) moving by most.

Overall, it seems that over the past few months, the notion that a soft landing of the US (and global?) economy has vanished slowly. It now seems that most market participants are wondering how bad things will be in the upcoming slowdown.

After a late start, the FED has reiterated its resolve to fixing the inflation dynamics and the market is now stuck between two highly conflicting narratives. On the one hand, the notion that if the FED manages to calm inflation it will be best for the economy over the medium to long term but at the same time the notion that, in order to achieve that goal, it might need to shock the economy in the short-term.

This creates a highly volatile backdrop, supported by an uncertain path for the economy.