Banks outperform

September 9, 2022

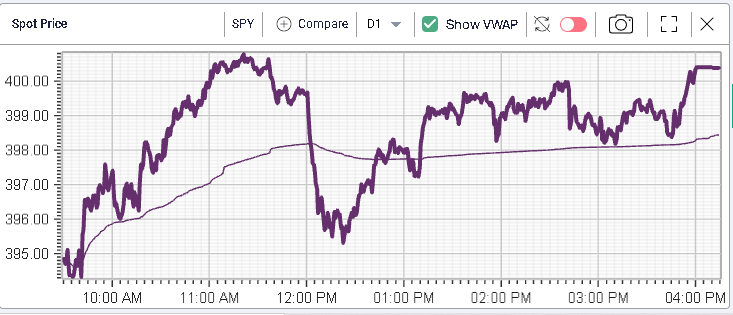

Central Bankers across the US and Europe sounded hawkish once again with the ECB raising interest rates by 0.75% and FED’s Powell reiteration of the FED’s determination in fighting inflation. The initial market reaction was bearish for Equity Indices with the SPX opening around 20 points lower but the sentiment quickly shifted around lunch time and stocks started to rally again.

Overall, the day was fairly positive with the SPX closing 0.65% higher, the NDX finishing 0.5% higher and the DJIA gaining 0.6%.

In Europe, the sentiment was also fairly bullish with Banks leading the charge and gaining more than 3% over the session. Headline Equity indices in Europe initially struggled on the announcement but rapidly turned around and rallied into the close.

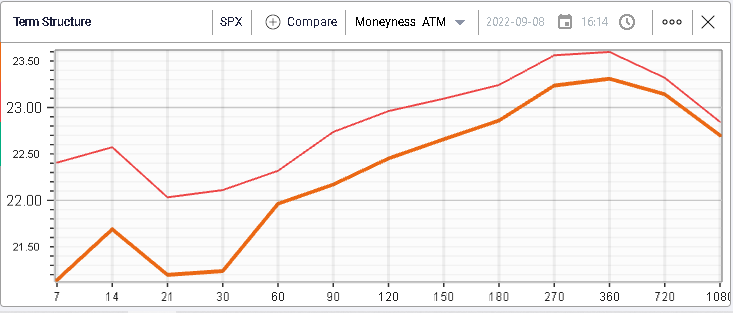

This resulted in implied volatilities moving lower over the session with 30 days IV losing around 1 point over the day for the SPX.

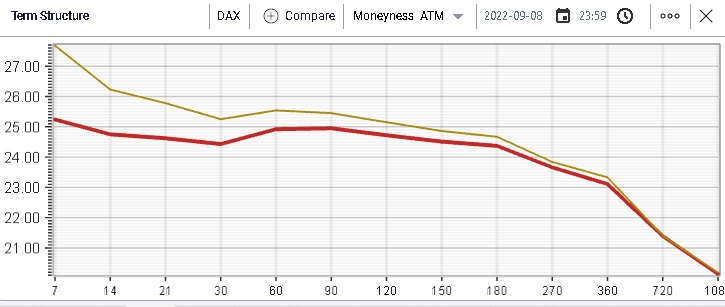

The same happened across European indices with the 30d IV for the German DAX shown below losing almost 1 point.

Financials were strong as well in the US with the sector gaining 1.76% over the day, the best performing sector.

Looking at Financials in more details, the sector is down around 14% on the year but still shows a 37.5% gain over the past 5 years.

Looking specifically at the banks, the 5 largest names are all lower in 2022:

- JPM lost 26.7%

- BAC lost 25%

- WFC lost 11%

- MS lost 12%

- GS lost 15%

The underperformance, particularly of commercial banks is partly explained by sentiment, partly by concerns about loan growth slowing as interest rates increase. There is also the risk that, with interest rates increasing, some customers may start to struggle repaying loans increasing delinquencies for banks.

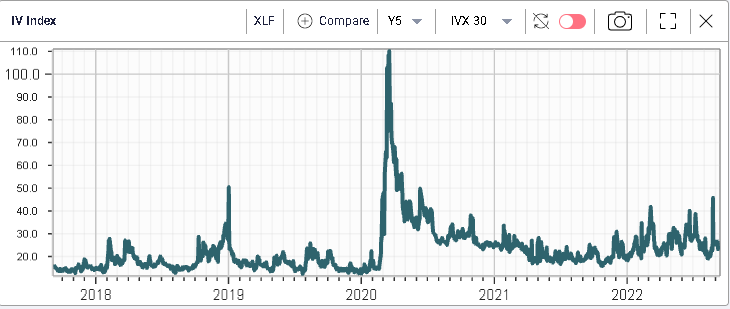

Looking at implied volatilities for the sector, they are trading in the middle of their 5-year history with the 30d IVX for the XLF around 23%.

It will be interesting to see whether this rally for Financials and Banks in particular has legs. BAC and WFC gained 3.2% yesterday, JPM gained 2.33%, MS pushed 1.8% higher and GS gained 1.46%.