Markets stabilize, Oil rallies

August 30, 2022

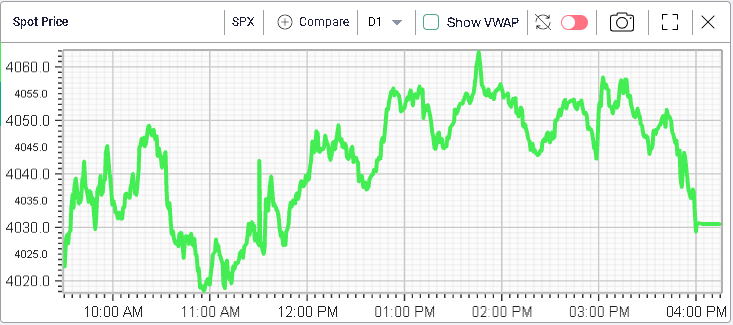

Markets remained under pressure throughout the session, the SPX dropped 0.67%, the NDX 0.96% and the DJIA 0.57%. Looking at implied volatility, short dated options dropped around 1 full point as the market downside momentum seemed to stall around the US open. Longer dated options remarked slightly higher.

Looking at yesterday’s session for the SPX, implied volatility tracked spot prices pretty closely with nervousness emerging as the market approached 4020 early in the session. The closing bell selloff to 4030 was not met with a similar upside reaction in volatility.

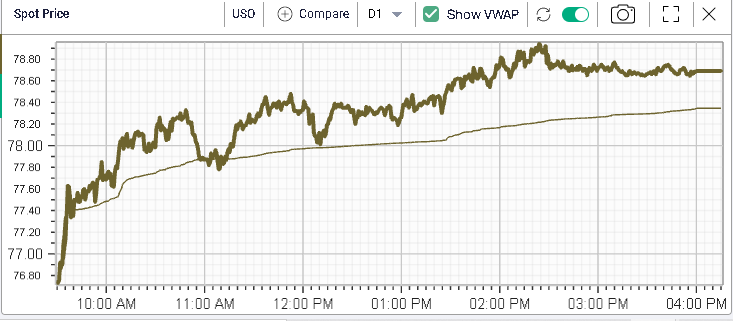

The main theme of the day was found in the Energy sector which gained another 1.5% over the day driven by Crude Oil prices that pushed higher.

Looking at USO prices against VWAP, the strength of the buying was clearly visible while on the XLE, it seemed to stall around the close as the broader market was showing signs of weakness.

Looking at a 12 months chart, we can see that Energy Equtiies (in brown below) have outperformed USO (in green) over the past few weeks.