Goldman Sachs, Apple and Netflix

July 19, 2022

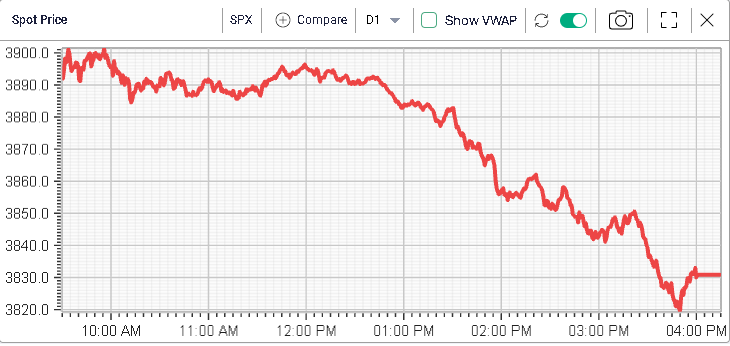

The strong buying pressure that emerged late on Friday evening seemed to continue yesterday during the European session. ES Futures pushed above 3900 but by the time US traders got in the office, the market had started correcting lower again.

The SPX managed to hold just below 3900 for most of the morning session but when traders got back from the lunch break, some more selling pressure emerged and we settled around 3830 on the SPX around 0.84% lower.

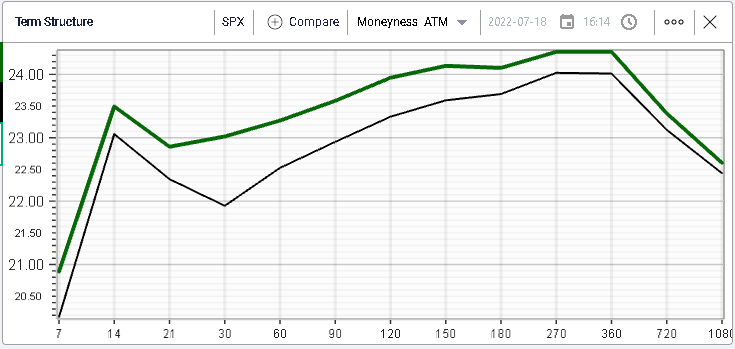

The NDX closed 0.89% lower and the DJIA settled 0.69% lower. Implied volatilities shifted higher by around a full point in the 30 days bucket.

At the sector level, the energy space moved higher again, helped by Oil prices moving up. The sector finished up around 2.29%. On the downside, the Healthcare segment lagged over the day losing around 2.1%.

Looking at single stocks and focusing on the components of the DJIA, MRK, one of the strong performers in 2022 (+20%) trailed the other DJIA components on Monday finishing 2.76% in the red.

On the upside, we note that GS was the best performing name over the session closing 2.64% higher. The company reported a better-than-expected set of numbers compared to analysts’ expectations.

In terms of narrative, one of the key questions over in the United States remains to know whether a recession is on the cards or not. We are seeing a meaningful slowdown in GDP as well as in expectations and consumer confidence partly because of inflation. At the same time, the unemployment rate remains extremely low and job creation remains healthy, especially at a time when job openings are at extremely elevated levels.

That, combined with healthy balance sheets from corporates, has been one of the strong arguments used by bulls to justify that a recession may not be happening this time around. They argue that if companies are in such great shape and are struggling to find new workers, they are unlikely to layoff employees and as a result, the slowdown may not last in time.

Bears on the other hand, seem convinced that the slowdown and all the talk about inflation will continue to weigh on corporate sentiment and will eventually signal a slowdown in hiring or even a reduction in forces.

On Monday, both Goldman Sachs and Apple fueled the debate.

For the former, the media reported that CFO Denis Coleman indicated that the firm would slow hiring and would probably reinstate annual performance reviews which could lead to job cuts. For the latter the company also reported that it would look to slow hiring as well as spending over next year to cope with a potential economic downturn.

These are only two companies but those indications might have weighted on sentiment during Monday’s session.

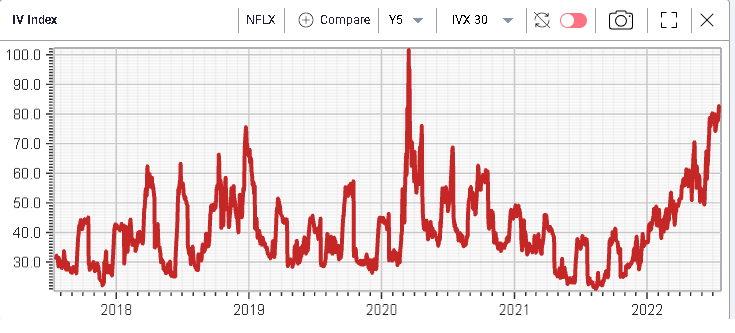

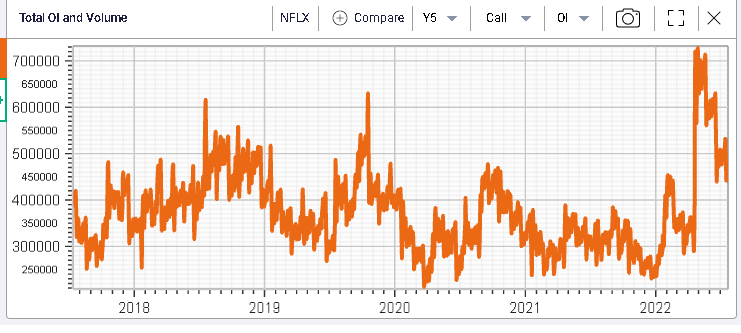

Today, the market will be looking at Netflix’s earning report. The implied volatility in the name has increased steadily in 2022 and is now above 80%.

NFLX is a name that can easily move 10% + on earnings, for instance in April, the company dropped 26% on its earnings release.

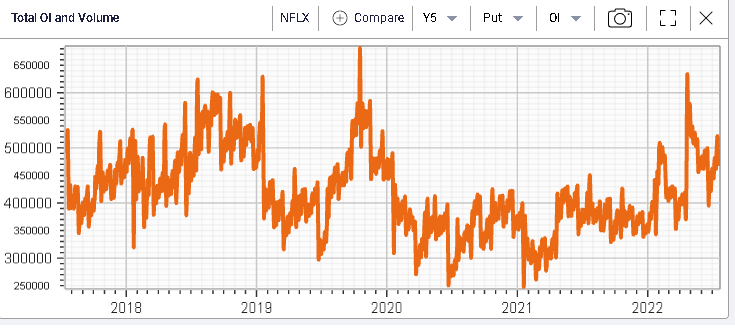

With the stock trading at a 5-year low sub $200, the interest for calls increased meaningfully and has remained slightly higher than usual as shown below.

The open interest for puts has also increased going into this set of numbers and it will be interesting to see what the company reports.