What Europe did on Memorial day |

With US markets closed for Memorial Day, Monday saw relatively little action across the globe. Asian markets caught up with Friday’s rally in Europe and the US. The NKY finished more than 2% in the green while the HSCEI was 2.5% higher on the day. |

European traders were met with a fairly slow trading session with headline indices opening higher and fighting throughout the day to remain in positive territory. The French CAC finished 0.72% higher and the German DAX gained 0.79%. |

Implied volatilities dropped slightly on the day, the CAC 30d IVX lost 0.4% and the DAX 30d IVX lost 0.15%. |

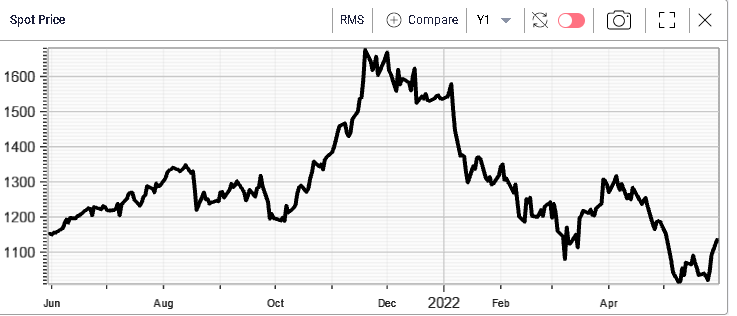

The more pro-risk segments of the market did better yesterday while defensives were slightly under pressure. For instance, RMS in France gained almost 4%but is still 26.5% lower on the year. |

|

RMS is an interesting company because despite being French, most of its revenues actually come from the Asia/Pacific region. As such, it is a bell weather for international commerce and global growth and in particular Chinese economic health. |

The stock has been battered this year as the market has been concerned about the capacity of the Chinese economy to cope with the Covid restrictions put in place by the government. |

Implied volatility in the name remains fairly high historically when compared with its own 12 months history as shown below. |

|

Over the day, the luxury sector was fairly strong with Louis Vuitton in France gaining around 2.5% and Kering gaining more than 3%. |

The European technology sector was supported over the day, with Prosus gaining more than 3% as well and ASML which is also listed on the Nasdaq gaining shy of 3% over the day. |

Utilities were amongst the worst performing names on the day with stocks such as ENEL losing 0.5% on the day. Iberdrola in Spain also dropped almost 2% on the day. |

It will be interesting to see if this sector rotation can have legs and also be witnessed across the Atlantic when US markets reopen on Tuesday. |

In Germany, Delivery Hero jumped almost 10% on the day, a much-needed gain after a catastrophic year for the stock so far. The name is still trading 64% lower on the year and has bounced from its IPO level of 25.5 euros. |

|

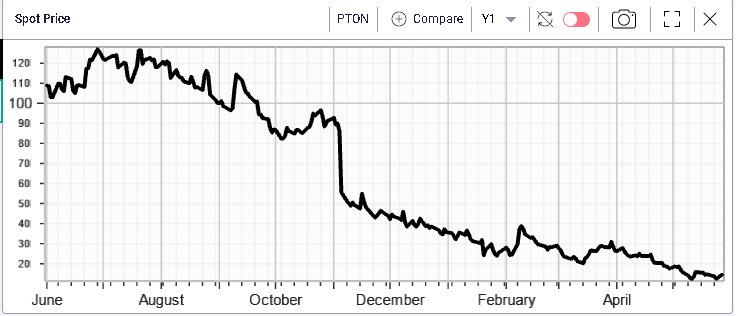

DHER is an interesting stock to watch as it benefited hugely from the pandemic but has since struggled to hold its ground. To some extent, it trades a bit like a lot of US companies that were introduced to the market recently and have struggled off late. |

Peloton and Robinhood are two examples of such companies that were sold to the market but have dropped significantly in 2022. |

|

|

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |