The battle of 3900 and worries around ZOOM |

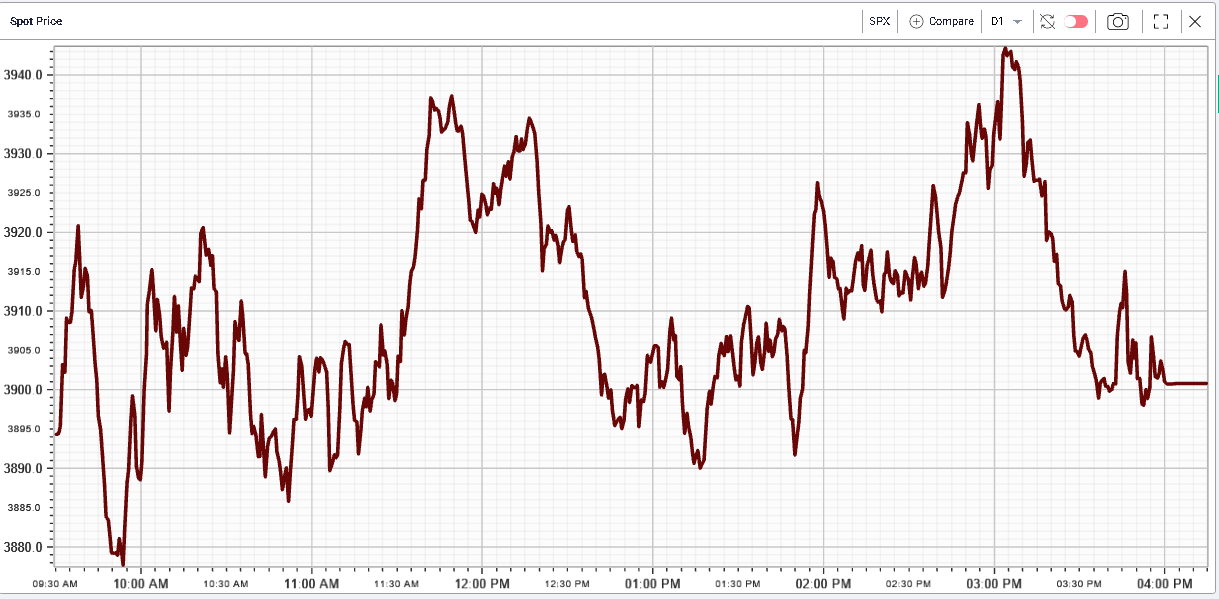

Overall US indices managed to hold their ground on Thursday with the NDX closing 0.4% lower, the SPX 0.6% lower and the DJIA 0.8% lower. There was an important battle throughout the day between buyers and sellers as the market opened below 3900 and each side tried to hold SPX over or under that mark throughout the day. |

|

In the end, the market settled very close to 3900 so that no side could claim victory and both would have to meet again on Friday. |

Importantly, Friday is option expiration day so next week will be interesting as traders will arrive on Monday without a decent portion of their options position. Considering that the SPX lost almost 10% in Apr’22 alone, it is likely that May’22 was used as an expiration to plug the holes and hedge the most immediate downside risks. Although previous analysis has shown that the open interest and volumes on SPX options have remained low, books will nonetheless require some finetuning over the next week. |

Little sign of option buying was visible yesterday in any case as implied volatility remained under pressure with 30d IVX finishing 2 points from its opening print in the SPX. |

|

The relationship between the IVX30 and underlying SPX prices will be an important one to watch next week to assess whether investors are rebuilding hedges or not. |

Looking at sectors, staples continue to underperform and traders seem to have completely fallen out of love with them following WMT and TGT reports this week. The sector finishes 1.8% lower and is down 7.4% over the past 5 trading sessions. |

Technology stocks also underperformed on the day with the space finishing 1.1% lower on the day. Industrials remained under pressure as well and lost 0.9% on Thursday. On the upside, the defensives rotation continues out of Staples and into Materials and Healthcare which finished respectively 0.7% and 0.2% higher on the day. |

At a single stock level, it is difficult to avoid talking about CSCO which closed 13.7% lower on the day. The company issued a warning about its Q2 numbers saying its sales number would be lower than anticipated. |

NKE remained under pressure over the day and the company finished 2.7% lower. The shares have lost 36% in 2022 so far. |

|

WMT also shed 2.74% on the day sending it to its lowest close of 2022 down 17.7% on the year. |

|

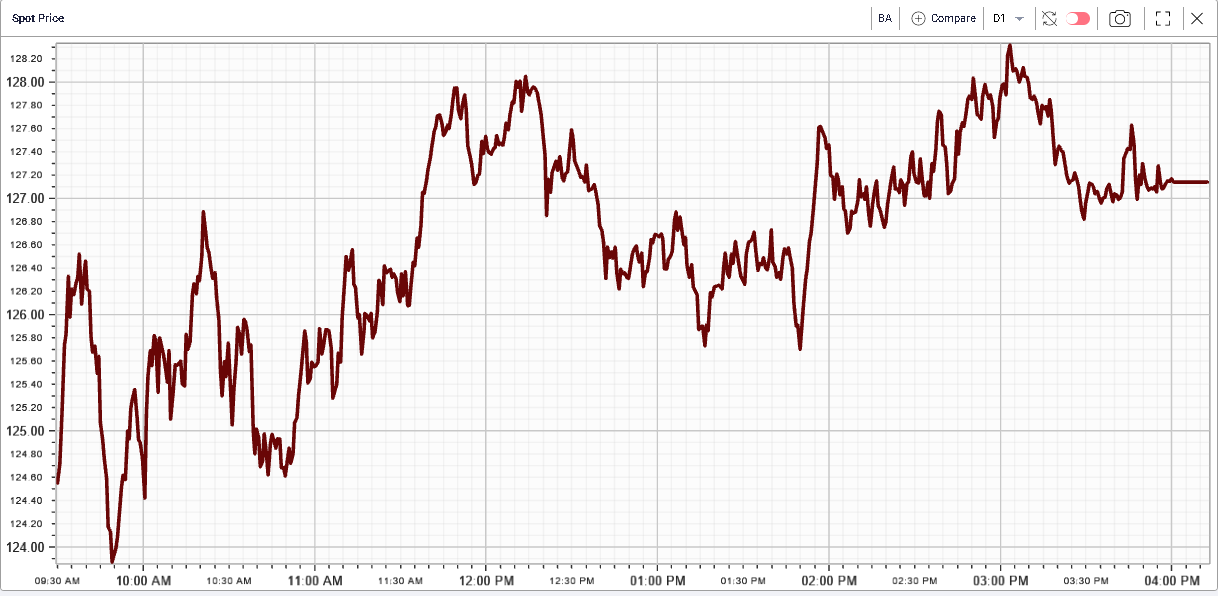

BA rose steadily throughout the day to gain 1.3% and seems to be trying to form a bottom around the recent lows around $120. |

|

|

On the upside UNH was the best performer of the DJIA components closing 1.52% higher. The name has managed to hold its ground in 2022 losing a mere 4.72%. |

|

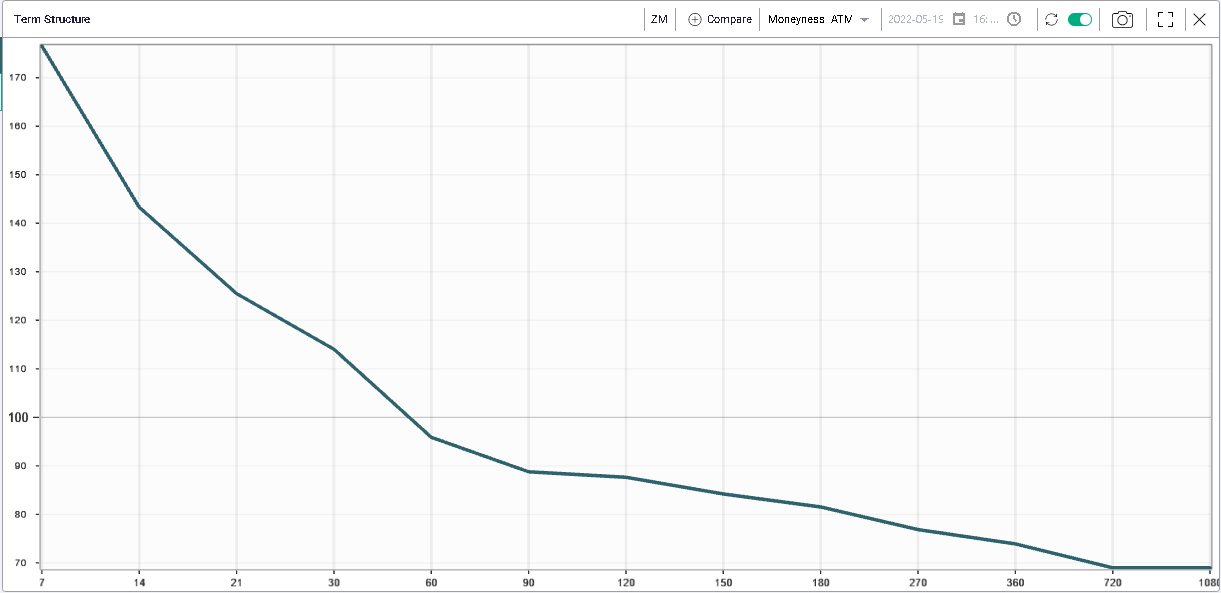

One stock where the market seems to be worried about a possibly large move next week is ZM. The term structure is heavily inverted as shown below with 30 days options trading above 110%. |

|

At the close yesterday with the stock at $90.94, the $70 puts expiring in 30 days ie on the 17th Jun’22 were worth $3.65. In the same manner the $120 calls for the same expiration were priced at $3.2. |

As a reminder, ZM has lost more than 50% already this year and almost 78% from its 52 weeks highs. The company is due to report earnings on Tuesday next week. |

|

Looking at the IV Premium it is pretty much at its highest level in 12 months and current 30d implied volatility is around 30 points higher than the 20 days realized volatility. |

|

This shows that market makers are bracing for a significant move in the stock most likely around its earnings next week. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |