Concerns about Chinese growth remain |

Concerns about Chinese growth are coming back to the forefront and markets started the week poorly. Europe closed down about 2% and after Europeans stopped trading, US indices started to move higher finishing in positive territory. The NDX closed 1.3% higher, the SPX was 0.6% and the DJIA finished 0.7% higher. We flagged in Monday′s market update how the price action last Friday looked like a wave of capitulation/hedging hit the market and the tape yesterday seemed to confirm that with investors mostly sitting on their hands and watching how things played out. |

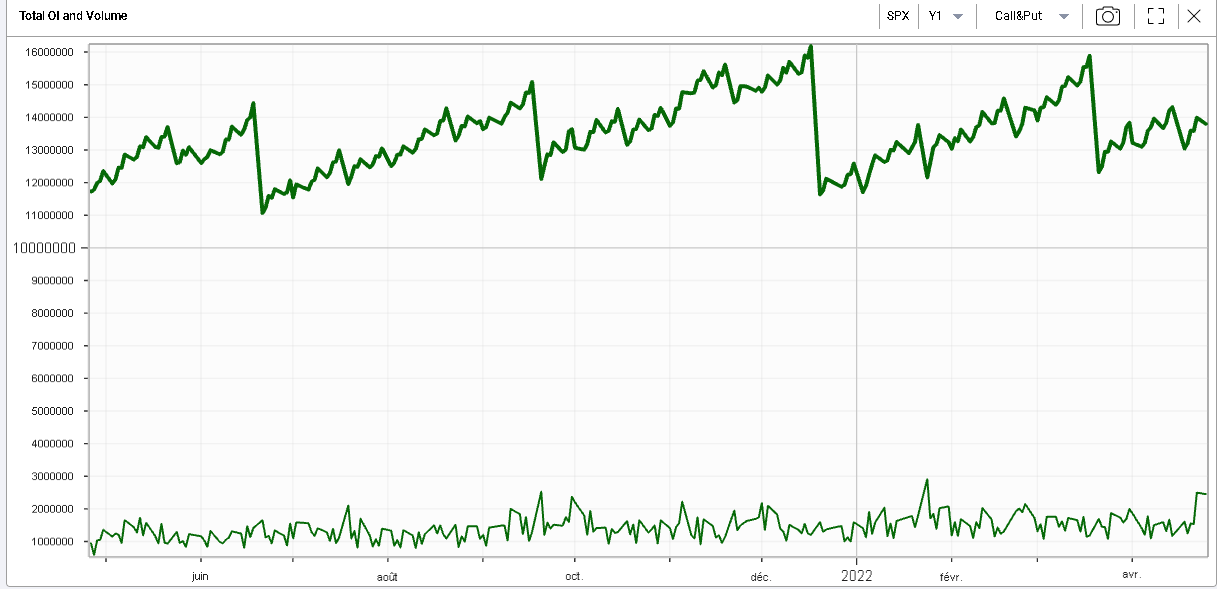

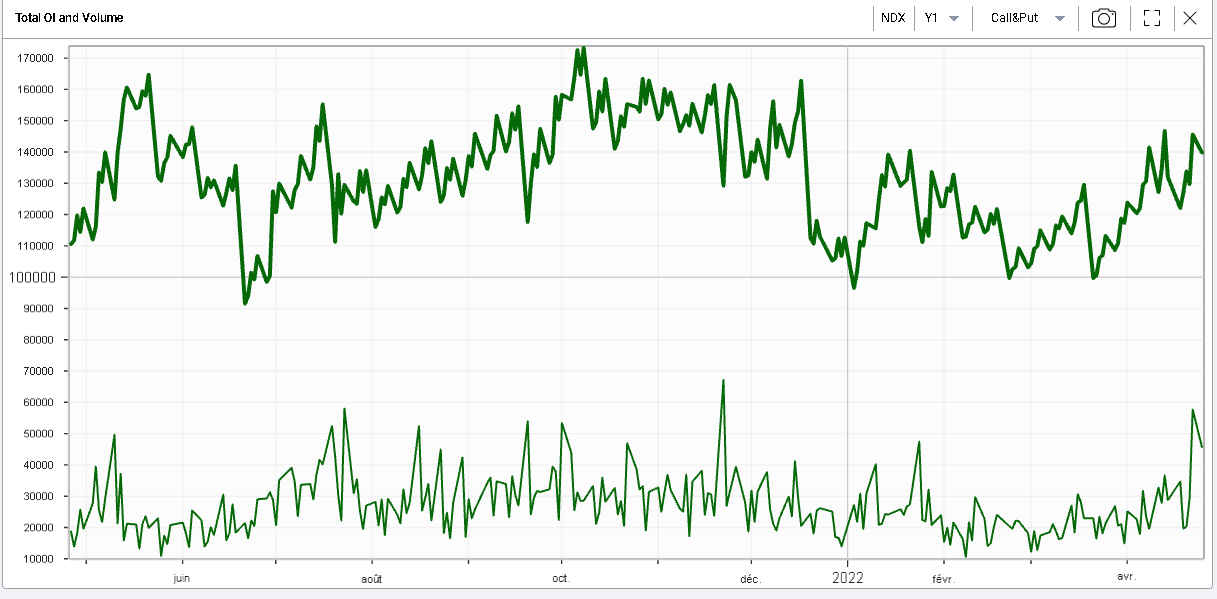

Volumes in options remained elevated both for the SPX and the NDX as shown on the below charts (bold line = open interest, thin line = volumes). |

SPX Calls + Puts open interest and volumes - last 12 months |

NDX Calls + Puts open interest and volumes - last 12 months |

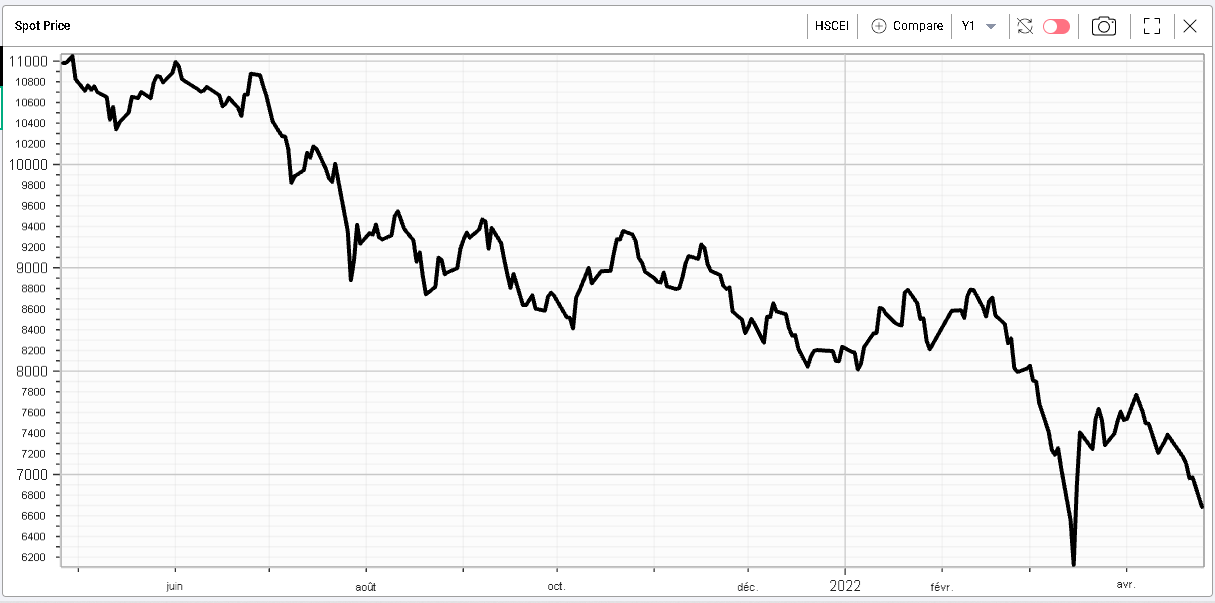

As the situation in China remains very fluid, traders should keep an eye both on headlines and on indices and domestic shares to understand if the market perceives that overall situation as improving or not. |

Looking at the HSCEI, we can see that after the initial bounce triggered by a more supportive message from authorities, stocks have turned around and are now moving back towards the lows seen mid-March. |

|

The country is now implementing mass testing across some of its largest business centers which is creating worries about possible lockdowns as well as the economic impact of aggressively controlling the spread of Covid. |

This being said, it is not entirely sure what the overall impact of such a slowdown would be as two conflicting forces would be at play. On the one hand, a meaningful slowdown of one of the largest economies in the world would heavily impact the global growth potential for 2022. This would come at a time where elevated disruptions are already creating lower revisions of global GDP for this year. On the other hand, a slowdown of the Chinese economy would most likely reduce the pressure on global commodities and probably provide some relief for central banks and reduce the urgency to act rapidly to curb domestic demand. |

Watching commodities will thus continue to be key. On that note, Crude Oil retreated below $100 yesterday and USO finished about 2.2% lower. |

|

Using diversified commodities ETFs like DBC can be fairly useful in order to quickly appreciate the overall changes in commodity prices. |

|

DBC finished lower by around 0.75% yesterday but as seen on the chart above remains fairly high historically. |

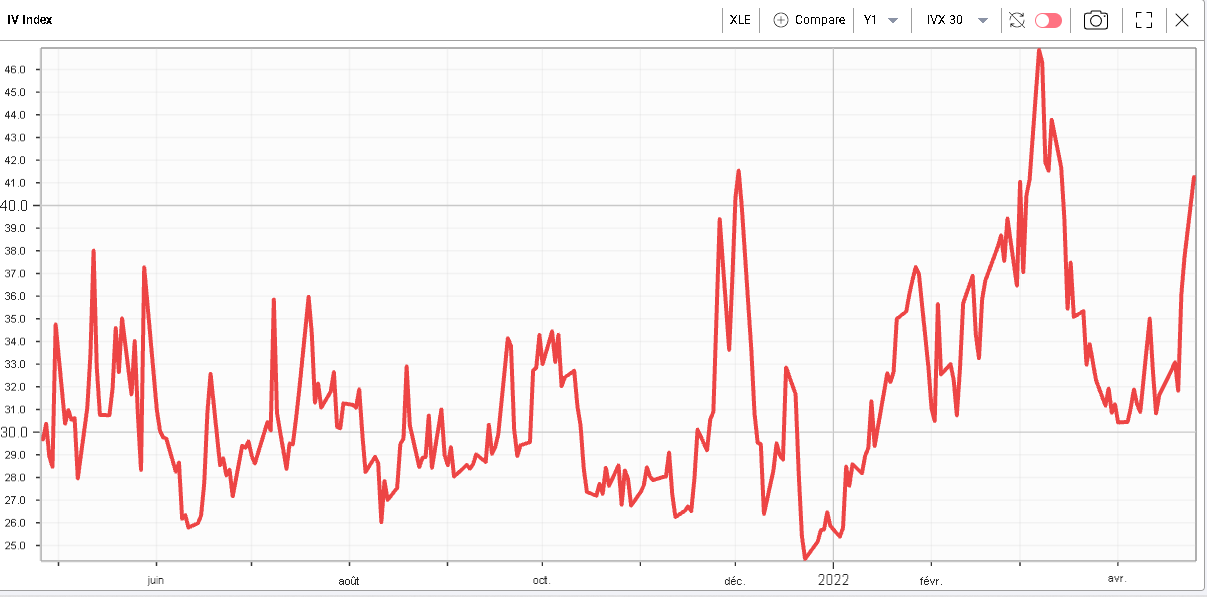

Looking at sectors, the energy space continues to deflate and has now lost close to 10% from its highs. Interestingly the volatility market remains very concerned about elevated volatility and the 30d IVX has started to move higher again as shown below. |

|

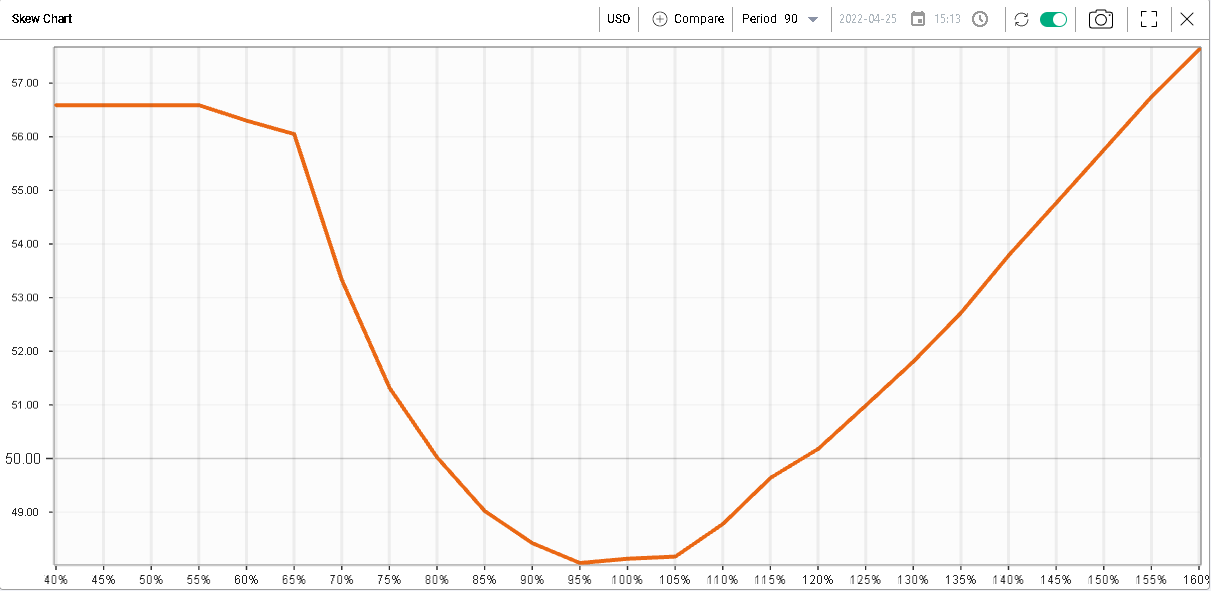

The uncertainty stemming from a possible Chinese slowdown may open up the possibility of a large correction in commodities while at the same time, a possible escalation of the conflict with Russia could trigger a large upside move in commodities. The skew in USO shows how implied volatility is getting more expensive for strikes outside of the money in a fairly symmetrical fashion. |

|

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |