Let us look at European equities |

The rotation within US equities continues, NDX finished about 1.5% lower while the SPX was little changed and the DJIA finished up by around 0.6%. In Europe, equities were fairly strong with the French CAC and the German DAX both up 1.5%. |

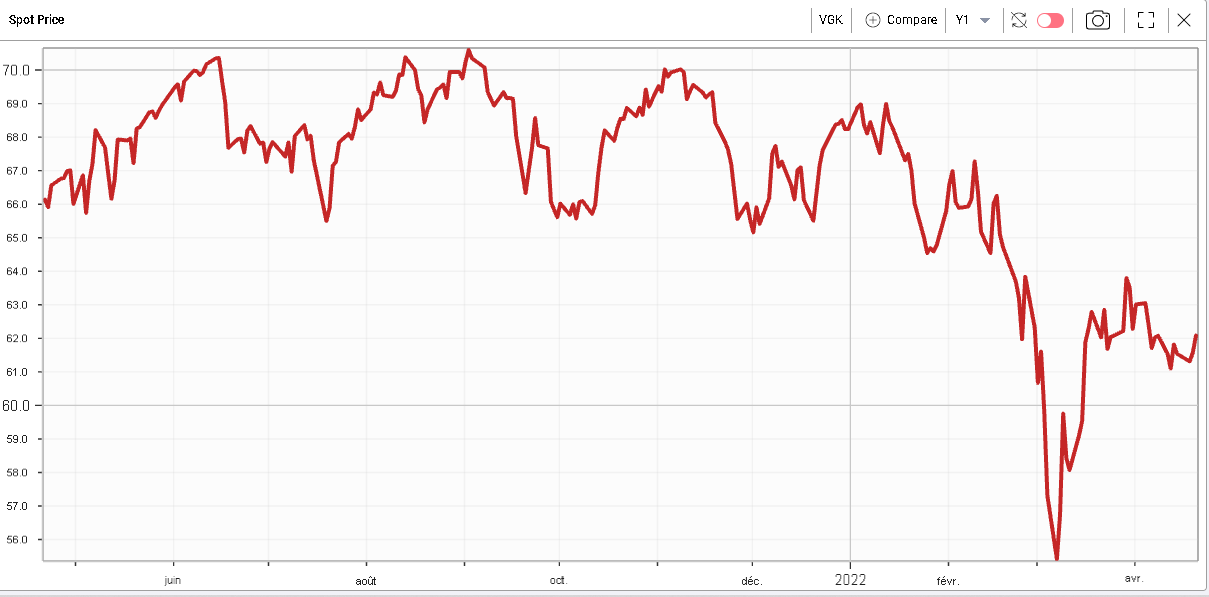

European equities have bounced from the lows reached early March with the VGK, an ETF replicating the performance of the FTSE Developed Europe All Cap Index being down less than 10% on the year after being down 20%. |

|

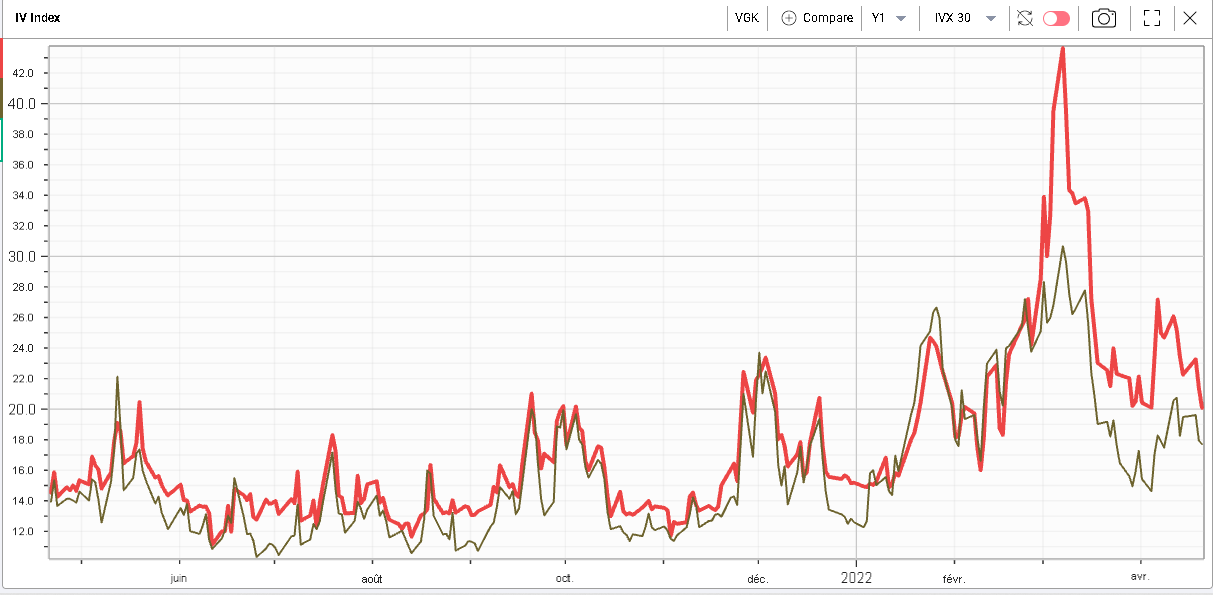

Implied volatilities have also compressed with VGK trading around 3 vols higher than the SPX, compared with a peak of almost 15 vols early March. |

|

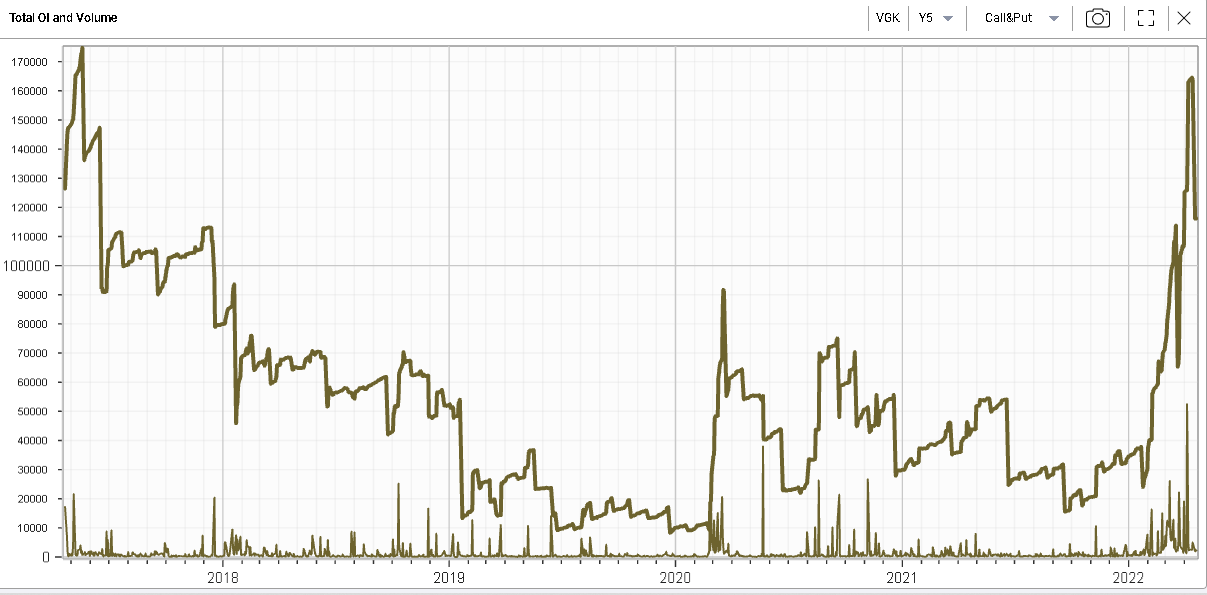

It is also interesting to note that VGK has seen its options open interest increase significantly in 2022 reaching pretty much its highest level over the past 5 years. |

|

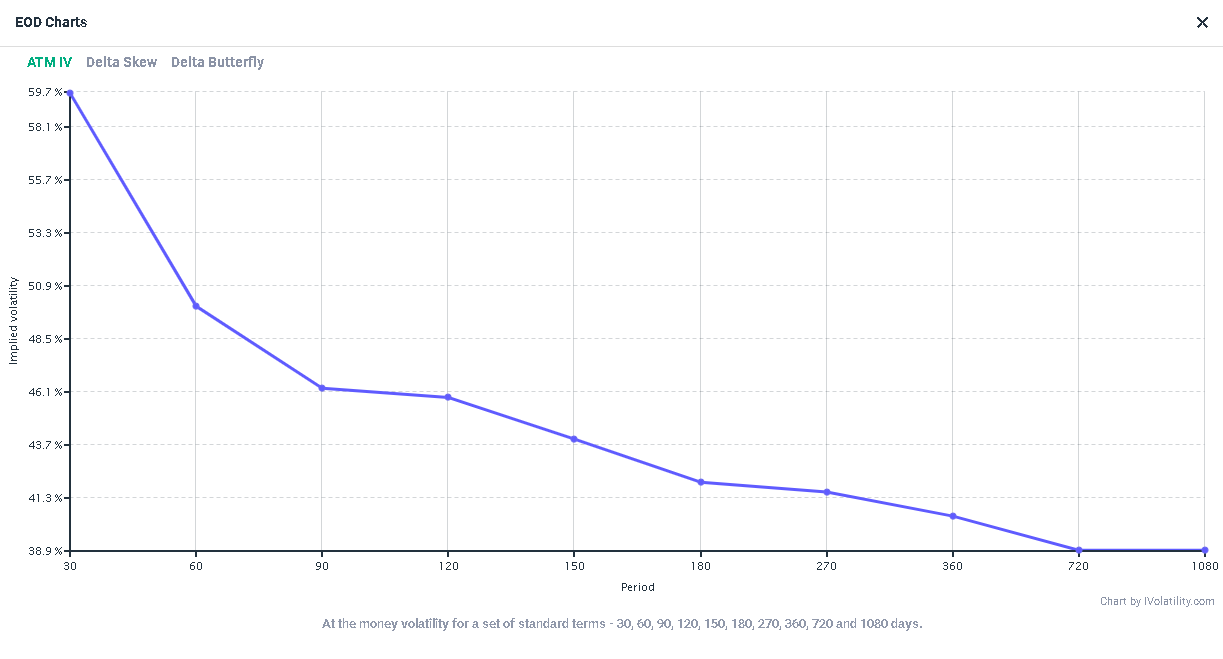

Using the RT Spread Scanner we search for naked calls in order to understand the sort of risk/reward offered by European equities on the upside.The RT Spread Scanner is a service that allows user to search for the best strategies (based on criteria you define) on a given underlier or a group of stocks. Feel free to give it a try with our 3 weeks free trial, more info HERE |

We get the following list ranked by Risk/Reward: |

|

We can see in particular that the Sep’22 68 calls offer a risk/reward of around 8.14%. This calculation is based off a 2 standard deviation move in the underlying. In other words, for a possible loss of $75, the trader stands to make a 2 standard deviation profit of $921.39. |

Back in the US, the moves at the sector level were pretty muted. The communications sector finished more than 4% in the red as NFLX closed about 35% lower following earnings. |

Within the space, FB also had a fairly bad day closing almost 8% lower. GOOG finished 1.75% lower and DIS closed 5.6% lower on the day. |

META is expected to report earnings on the 27th Apr’22. The term structure (shown below) remains fairly inverted and the stock is expected to move around 11.3% by the 29th Apr’22, a sign that traders are approaching the upcoming numbers with caution. |

|

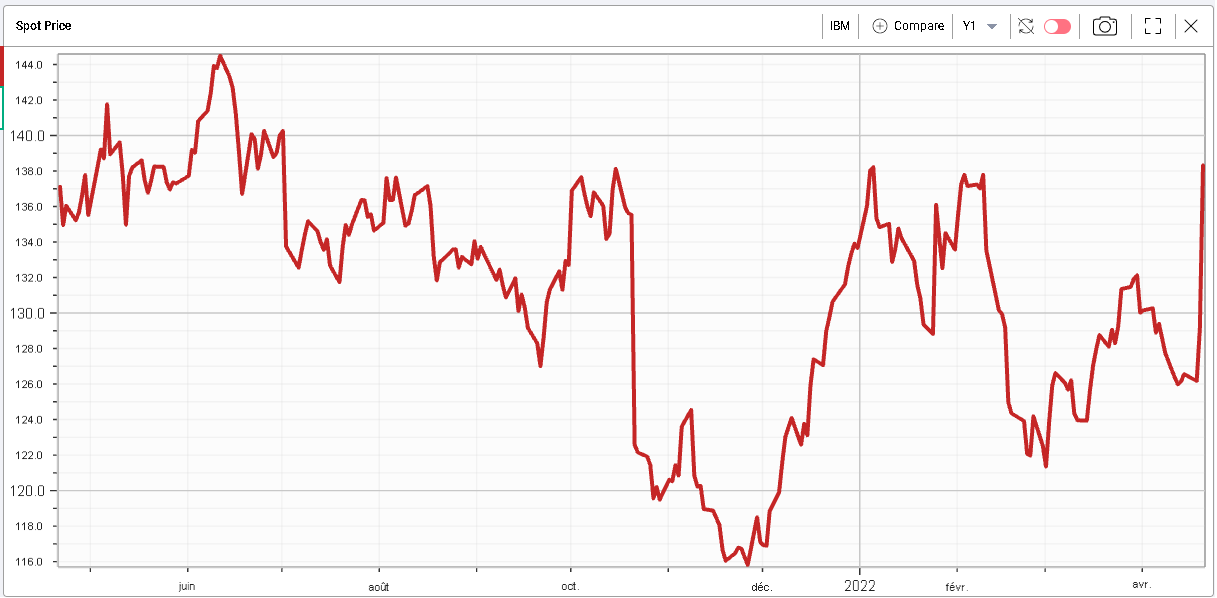

On a positive note, for the Tech sector, IBM gained around 7% yesterday as the company reported earnings that were better than anticipated. |

The stock had been trading sideways so far in 2022 but yesterday’s price action has seen the stock get back to its 2022 highs. |

|

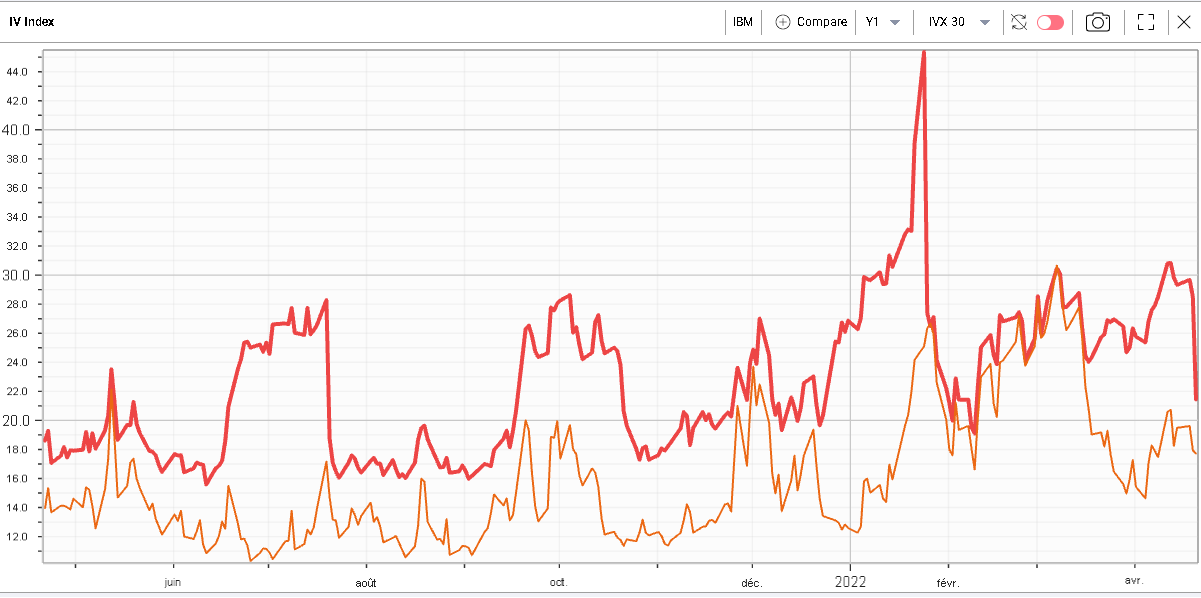

Implied volatility measured here using our proprietary measure the 30d IVX has been crushed following the release and is now back to trading around 3 points above the SPX 30d IVX, pretty much in line with the average spread seen over the past 12 months. |

|

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |