Market Update: 2022-02-15 |

We offer multiple professional grade services to help you gain insight on volatility trading. Do not hesitate to try our products by clicking HERE |

In today’s market update, I want to take a step back and look at what has been happening so far this year. |

First, the US markets are pretty much the worst performing developed markets in 2022. The Nasdaq-100 is down almost 15% and the SPX is 9% lower than where it finished 2021. The DOW is down about 5% on the year, about the same as European indices and the NKY. The HSCEI, an index tracking Chinese companies listed in Hong-Kong, is up more than 5% this year. |

In terms of volatility moves, we have had a fairly active year as well. NDX 30d IV jumped about 12 points, SPX about 10.5. In Europe, despite local indices outperforming US indices so far, 30 days vols are up about 10 points while in the DOW and the NKY vols are up about 7 points. Finally, for the HSCEI the 30d IV is up about 5 points year to date. |

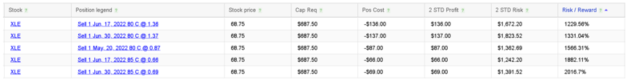

In the US, out of the 10 major sectors, 8 are lower on the year while the XLF is slightly positive and the XLE is up 25%. All 10 sectors have implied volatilities trading higher today than where they were at the end of 2021. |

For traders looking to sell calls in the XLE on the back of higher spot and volatility, the RT Spread Scanner allows to quickly locate the most attractive trades from a Risk/Reward perspective. |

|

On the opposite side, the consumer discretionary sector is down around 12.5% with 30d implied volatilities up almost 15 points year to date. Stocks like Amazon and Tesla represent more than 40% of the index. |

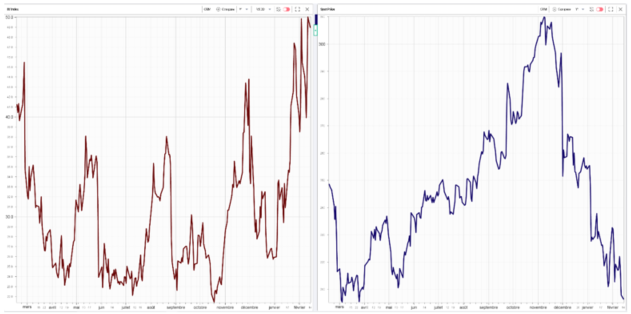

In the DOW, the worst performing stock from a spot perspective is CRM (Salesforce) down 20% on the year. It is also the underlying where 30d IV has jumped the most up almost 25 points on the year. The below chart show the 12 months spot and IVX performance for CRM. |

|

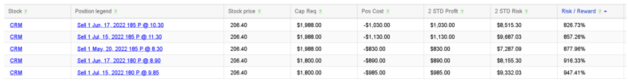

For traders looking to sell puts in the name, the RT Spread Scanner offers some suggestions. |

|

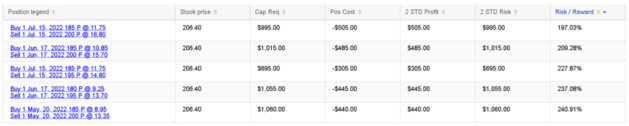

Considering the high risk of such trades, using the RT Spread Scanner to screen for bear vertical spreads shows that it is also possible to find strategies with interesting risk/reward. |

|

In the consumer discretionary space, NKE is down more than 15% in 2022 so far with 30d IV up more than 10 points while in the energy sector, CVX is up 15% with 30d IV up 10 points. |

Overall, looking at headline indices gives only a partial picture of what is really happening in the market. One could easily conclude that the market is seeing nothing more than a correction but the amount of rotation and liquidation that is happening at the single stock level is very large. |

For instance, in the SPX, we can find stocks like MRNA down almost 50% on the year, or FB down almost 40%. Other names that have been heavily sold include PYPL down almost 45% and NFLX down almost 40%. On the other hand of the scale, unsurprisingly energy names like COP and XOM are up between 25 and 30%, but other stocks have also managed to gain substantially so far in 2022. Those include WFC up 20%, DE up more than 10% or FOX up almost 15%. |

Those observations raise a very important question for market participants: are we witnessing the end of passive investing? |

In a nutshell, the basis for passive investing is to pick a well-diversified index and to simply allocate capital towards it for the long run. Active investing requires a much more technical and skillful approach with an allocation that generally target specific stock stories and includes hedging specific risks. |

While possible, that transition has been repeatedly called by observers at least for the past 3 years. Looking at the 27% performance of the SPX in 2021 paints a very different picture but so far 2022 is proving to be a very different year. |

There are several factors that could impact the passive vs active investing relative performance. |

First the FED potentially raising rates in 2022 might make equities a more dispersed asset class. In an environment of heavy asset purchases and zero interest rate, a rising tide lifts all boats and as such, owning equities as an asset class might be good enough. |

In an environment of liquidity withdrawal and rates increase, the picture might be very different. Companies might exhibit very different performance depending on their asset/liability profiles or their sectors. This could result in more dispersed performances within major indices with winners and losers showing very different returns. |

Inflation might also play a significant role breaking up companies into two categories. On the one hand, there are those that will be able to pass on the increase in costs to their customers. Various types of companies might be able to fit this description, for instance the energy sector might find it easier to pass on cost increases because people still need to drive around. On the other hand, some companies will struggle to increase prices and might have to reduce their margins. That might happen in particular in highly competitive markets with multiples players and a capacity for consumers to shift around fairly easily. |

The following quote from Netflix is particularly insightful in light of the recent stock performance: |

“Consumers have always had many choices when it comes to their entertainment time - competition that has only intensified over the last 24 months as entertainment companies all around the world develop their own streaming offering,” (source: CNBC) |

All in all, it is obviously difficult to say if the best days for passive investing are behind us or not but some traders may be happy to look at specific stock stories again. In that regard, analyzing implied volatility will provide invaluable information on the view of market participants. |

The recent webinar published on our Youtube channel echoes perfectly to that point, showing how we can use implied volatility intraday in order to assess possible turning points in spot. If you would like to watch it, please click HERE |