Market Update: 2022-02-11 |

If you want to discover our unique analytics solution for volatility with global coverage, please click here |

A late day move lower pushed major indices in negative territory on the back of hawkish commentary by St Louis FED President James Bullard indicating that the FED should raise rates by 100bps by the beginning of July and suggesting that one of those hikes should be of at least 50bps. |

Headline indices had felt some early pressure in the day following the higher-than-expected inflation numbers but markets managed to bounce back. Inflation numbers were touted to be the highest since 1982 with CPI increasing 7.5% year over year. |

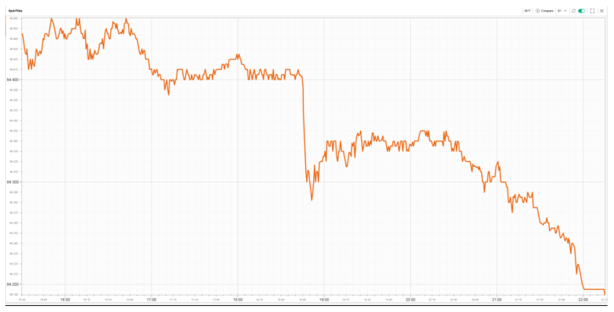

As one could expect, rates started to move back up on both news. The SHY ETF tracking 1-3y US Treasuries sold off aggressively on the day as 2-year rates climbed almost 25bps on the day reaching 1.6%. |

|

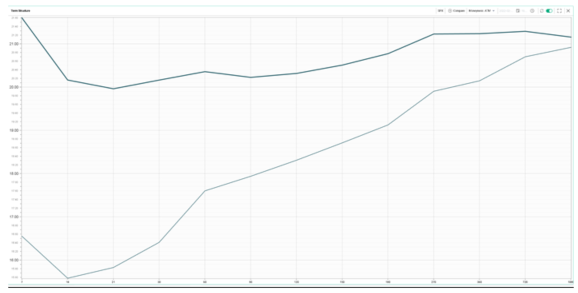

Longer dated bonds also sold off with 10y yields up 8 basis points on the day. Below we show the TLT ETF tracking 20y US Treasuries. |

|

Traders are worried that the FED is behind the curve and may have to speed up the tightening process to stem inflation. The NDX closed down 2.33% on the day after a highly volatile intraday session with an opening print around 14760 and a high point reached above 15000. |

Looking at implied volatilities, we witnessed a very aggressive move higher across all major indices with 30d IV up more than 3 points in the NDX and more than 3.5points in the SPX. In the DOW 30d IV was up almost 3 points. |

The entire IV curve was up for the three large indices in the USA. The front-end of the SPX curve inverted slightly more while IV ranging from maturities 21 days to 150 days are pretty flat. |

|

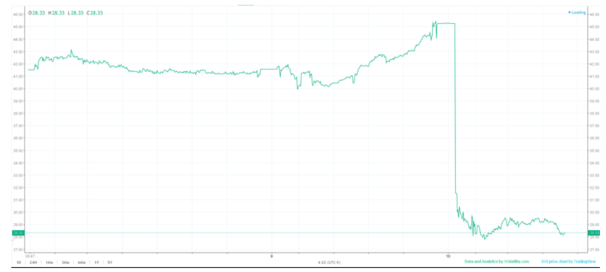

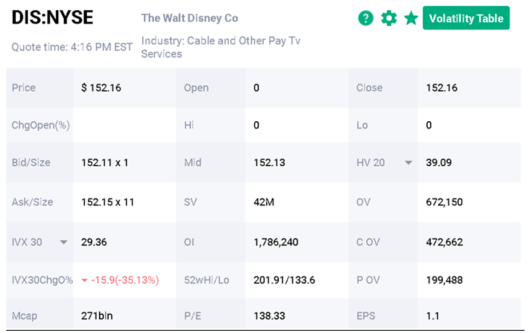

As discussed yesterday, DIS earnings were seen as generally positive by the street and the stock closed up around 3.5%. Implied Volatility got crushed post earnings with 30d IV down more than 15 points on the day. |

|

Volume in the name was significant with 670k options trading on the day, about a third of the outstanding open interest. The majority of the action happened on the call side with around 472k calls trading on the day. |

|

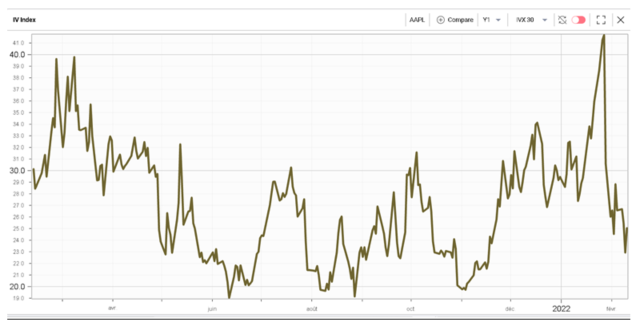

Despite all the worries happening around the tech sector and Apple being down 2.4%, its implied volatility remains subdued. 30d IV was up 2 points on the day but remains far off the recent highs and over the last 12 months, the 30d IV for Apple sits around its 30th percentile. |

|

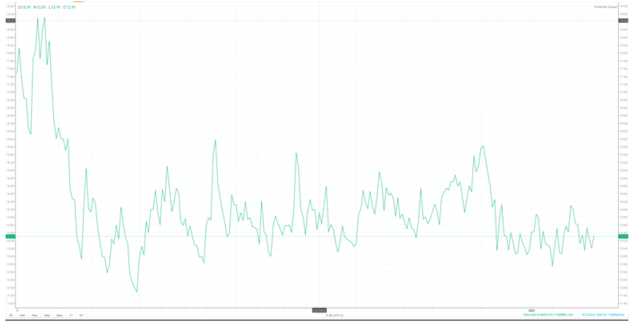

In the Commodities space, Gold continues to struggle against the dollar and finished the day down 0.5% despite worries about inflation coming back to the forefront. Implied Volatilities in GLD have certainly failed to catch a bid off late in the ETF. Gold 30d IV is trading in its 24th percentile of the last 12 months in a sign that market may not be that concerned about inflation and quite possibly sees the FED managing to keep things under control. |

|