The Dilemma of the First Bounce

April 25, 2024

The Markets at a Glance

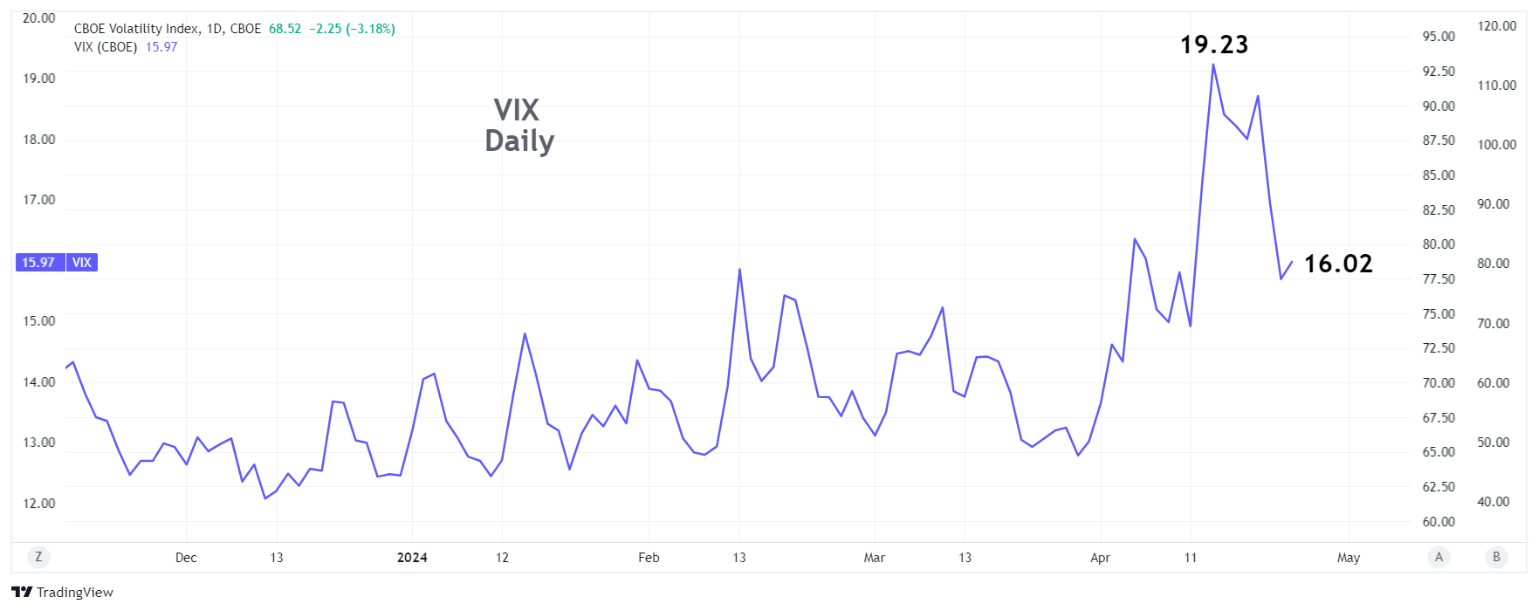

The market gives us lots of clues but it never makes them obvious except in hindsight. A down leg has now occurred with a nearly 6% drop in the SPY from April 1st to 22nd, followed by a two-day recovery bounce of around 2.3%. The drop was the largest in six months and was arguably a valid break of the trend upward since that last October. So, while the recovery bounce of the last two days was strong, and a healthy decline in implied volatility on the S&P 500 accompanied it, we are left with the dilemma of trying to guess whether the correction is over or whether we have simply seen the first leg of it.

This is a time where market technicians will apply all manner of moving averages, trend lines and channels, wave counts and other methodologies to uncover additional clues. But in such situations, the data will likely still be ambiguous enough to support whatever conclusion the trader really wants to make.

From my perspective, there were strong clues that investors were getting defensive, the narrative about rate cuts was changing (to possibly not getting them at all), and institutions were beginning to take profits off the table. In addition, analysts expected earnings to have weakened this last quarter, despite the rally, which will be confirmed for us in the coming days as firms report them for the first quarter. Therefore, my leaning on the overall market here remains negative and I am viewing the bounce as a chance to open new bearish positions. However, I am also turning attention to individual stocks, with an eye toward those that may offer good entry points for long positions, combined with some attractive call premiums to sell.

In other words, this may be a good time to initiate covered call or naked put positions on good stocks that can bounce back but which will have limited downside, should the downturn continue and which offer attractive call premiums in the meanwhile.

Strategy talk: Option Strategies for a Questionable Downtrend

As I looked for such a situation, I came across Paramount (PARA). The reason I like it here is because it is "in play" and will thus likely hold up in price, even if the overall market continues lower. What's more, there is a deal on the table that could offer much more upside and, at the very least, keep the stock from falling much in the coming weeks.

PARA has been a lackluster performer, trading in a range of between 11-17 over the last year. As you can see, though, it has also been relatively immune to the market's overall moves during that time. At present, the company has received a joint bid from Sony Pictures Entertainment (SONY) and Apollo Global for about $26 billion - almost four times the current valuation. But the company's management is already entertaining an offer from Skydance Media for $5 billion, which is lower than its current valuation.

Normally, it would seem like a no-brainer for shareholders to drop the current deal and take the much more generous one from Sony/Apollo. But it's more complicated than that for Paramount, where the Redstone family controls 77% of the voting stock and favors the Skydance deal.

To me, this presents a stock with limited downside risk, potentially significant upside opportunity, and a relatively immune posture to the rest of the market. That spells a covered call, diagonal call spread, or short put strategy.

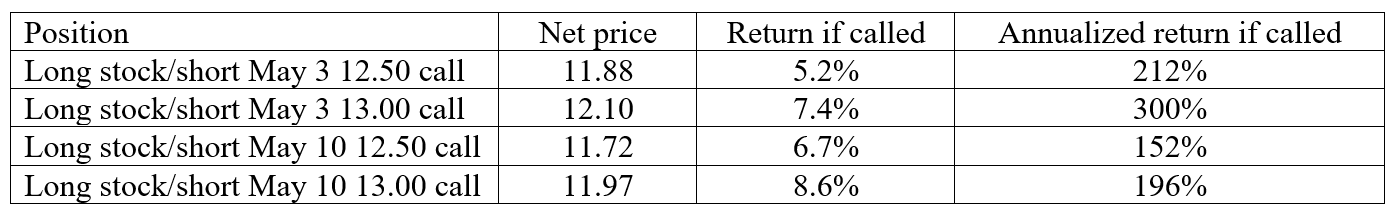

At Wednesday's closing prices a few of the potential covered call writes using slightly in or out-of-the-money strikes look like this:

These are the conservative, short-term call writes. Should the Redstones even consider the Sony/Apollo bid, the stock could trade considerably higher. So, a mix of covered writes at higher strikes might be well worth a shot as well.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.