Lessons on Implied Volatility from Expedia

February 15, 2024

The Markets at a Glance

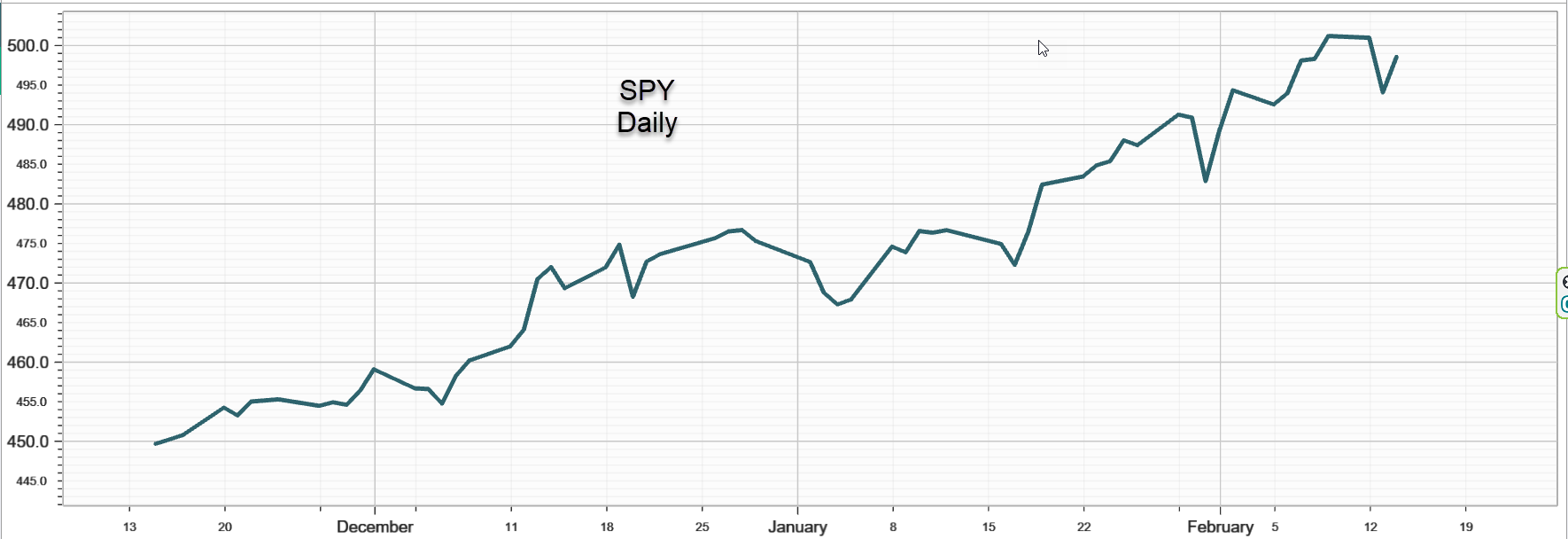

The S&P 500 (SPY)

SPY closed on 2/14 at 498.57, which is nearly where it closed at the same time last week. The inflation numbers that came in earlier in the week were firm, suggesting that the Fed may have good reason to keep rates where they are for now. The market reacted a bit negatively to that news in the same way it reacted negatively when the Fed announced it would not lower rates in March. Neither of these little dips change the trend from last October, which remains up in the broad market.

However, I have seen data from several sources who point out that market internals are weakening (such as number of new highs, breadth, etc.) and that defensive sectors are beginning to see some strength. So, the market appears to be able to hold its ground, despite the delay on anticipated rate cuts but it remains vulnerable to any negative developments.

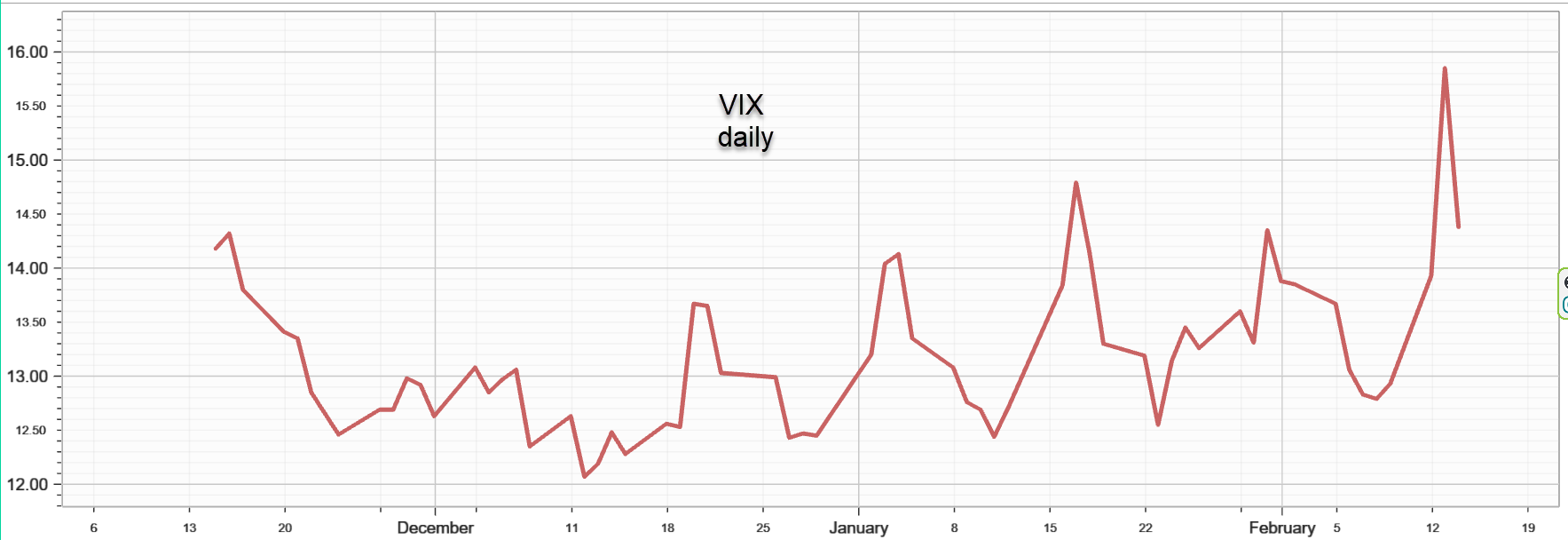

Option Volatility ($VIX)

Implied volatility on the S&P 500 index ($VIX) spiked to nearly 16 before falling back toward 14. The intraday high near 16 was the highest level this year, suggesting that put buying is picking up as a market hedge now. The fact that VIX is rising even as the market hits new highs is a sign that the market is getting closer to a potential trend change.

Strategy tip: Lessons on Implied Volatility from Expedia

Understanding implied volatility is critical to option traders. A rise or collapse in implied volatility can easily affect the profitability of a trade as much or more in some cases than the movement in the underlying stock. Ignoring implied volatility can lead to being caught in an IV trap with a long option position that can lose money even when you get the directional move right. And IV changes can offer trading opportunities to those who know how to anticipate a change in IV.

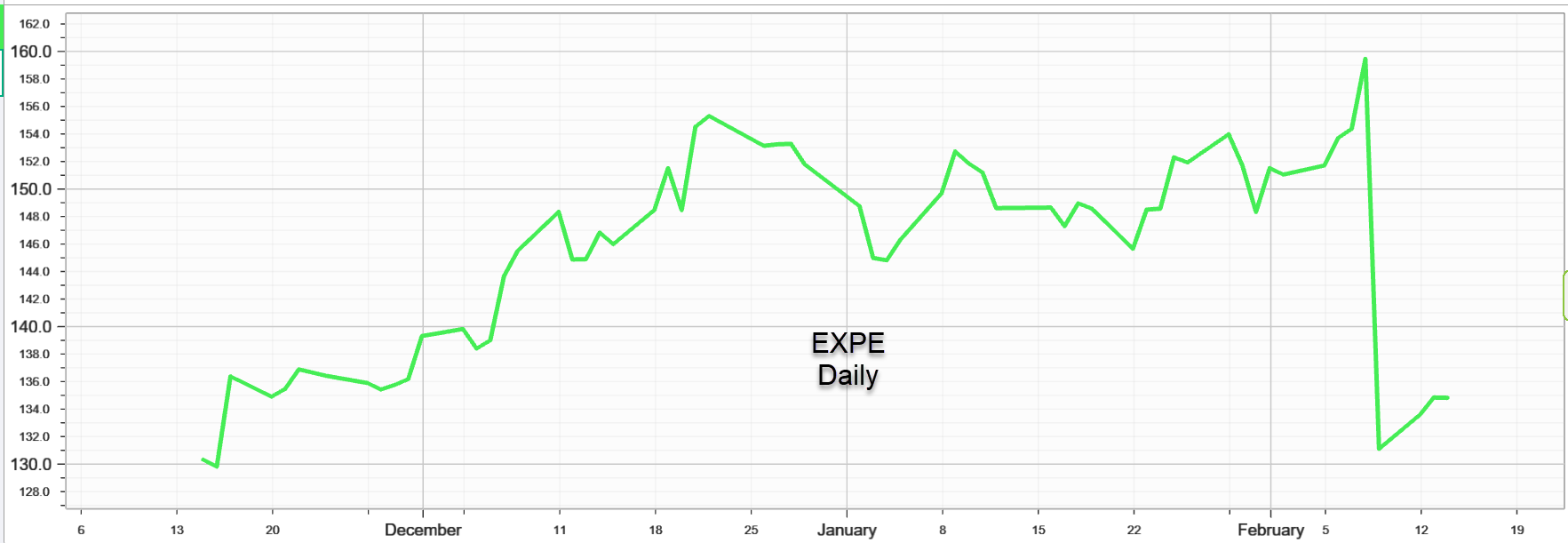

Earnings announcements can offer significant directional moves and are also a prime source of rising (and subsequently collapsing) implied volatilities in near-term options. To demonstrate how much IV can change on a given stock and how fast that change can occur, Expedia (shown below) provides a good example.

On Feb 8th after closing the day up over 5 points at 159.47, Expedia announced its earnings, which beat estimates on higher revenues. The rise in the stock price on 2/8 likely reflected the anticipation of a positive earnings report. The IV on the options expiring the next day was 240% and the IV on the ones expiring 2/16 was 94%. The IVs for the next several expirations were 77%, 61%, and 52% respectively. (The IV of the at-the-money call is used to represent the overall IV in each expiration.)

The announcement, however, contained a surprise announcement that the CEO was stepping down and a promising new business line was disappointing. The stock plummeted 20% on the opening of 2/9. By the end of the day, the options for 2/9 expired but those expiring on 2/16 saw a drop in IV to 37% and the remaining expirations had similar IVs.

With the stock closing nearly 18% below the previous day and IV dropping from 94% to 37% for the 2/16 options, long call option players would have gotten slammed by heavy losses in both intrinsic and time value. Long puts could have made money, but gains would also have been reduced by the big drop in implied volatility.

The point is that implied volatility almost always rises into an earnings announcement starting a few weeks prior to the announcement and it does not matter whether the market anticipates good or bad news. The excess implied volatility can then come out of the options in a single day. That means the options expiring one week hence shrank in value by as much as 2/3 of their time value.

From a strategic perspective the lessons from this are as follows:

1. Long puts or calls purchased before an earnings announcement should be purchased at least a few weeks ahead of the announcement, while IV is still reasonably close to 'normal'.

2. For option strategies implemented within a week of an earnings announcement, they should be made primarily with short option positions, such as short puts, covered calls, credit spreads, diagonal calendar spreads, and short straddles or condors.

3. Earnings announcements (and the attendant reactions) can be very unpredictable. The one thing that is more certain than direction is the fact that implied volatility will rise into the announcement and then collapse almost immediately afterward.

Previous issues are located under the News tab on our website.