Will Tesla Sober up the Market?

January 25, 2024

The Markets at a Glance

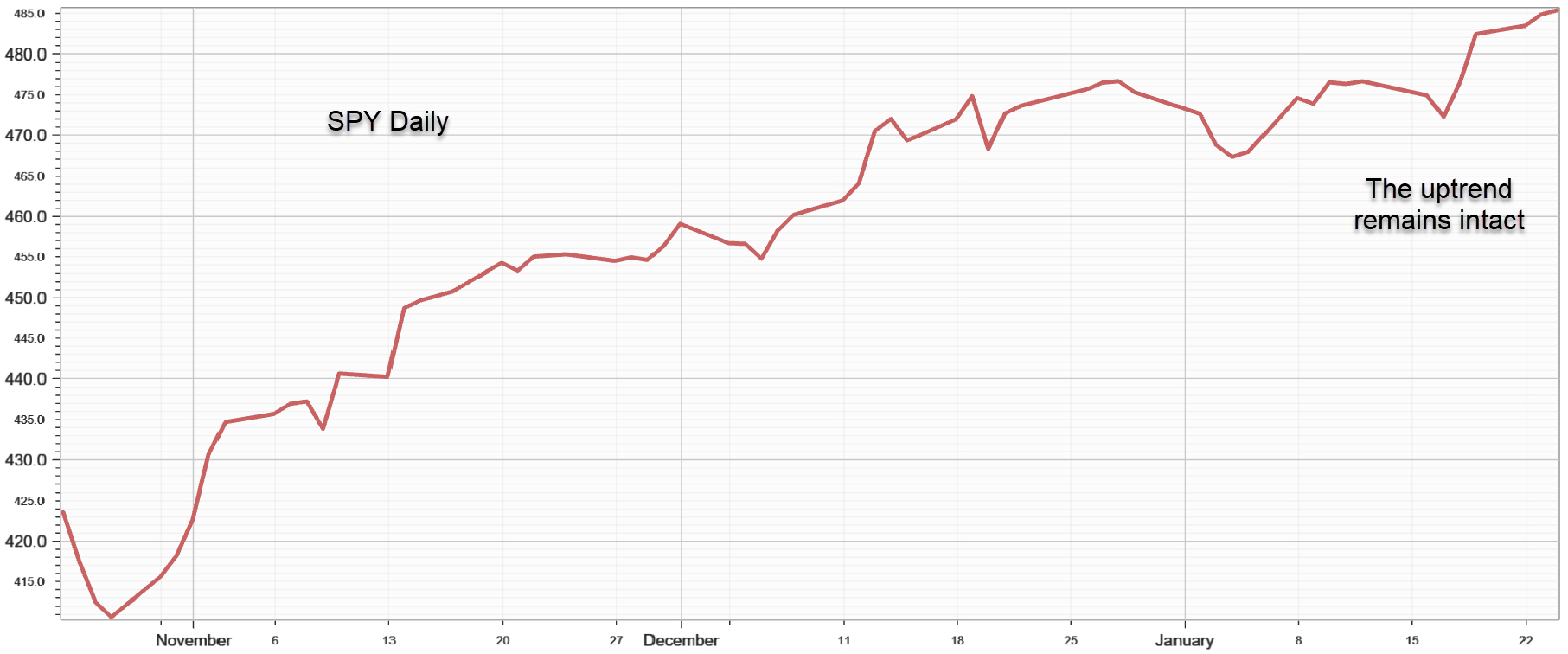

The S&P 500 (SPY)

SPY closed on Wednesday at 485.39 after setting yet another new intraday high at 488.77, keeping the trend from October '23 intact. In the absence of any major new economic news, the market appears to be moving up largely on the momentum brought about by the resilience of the economy, the performance of the "magnificent 7" stocks, tamed inflation, and lower oil prices.

In addition, the end of January does tend to be a seasonally strong period. One reason (that does not get a lot of press) is the fact that year-end bonuses and 401k contributions are heavier than any other time of the year and a lot of that money flows directly into the markets. That should tail off by the end of the month, taking at least some of the upward momentum out of the market.

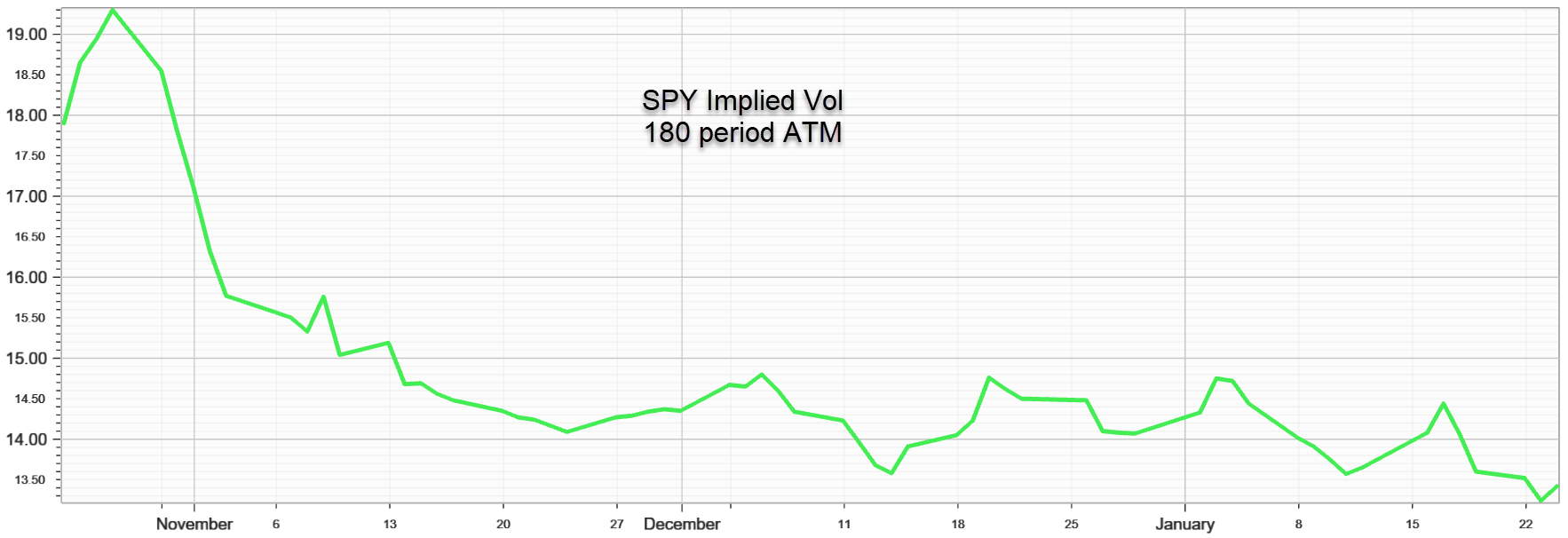

Option Volatility on SPY

As the SPY rose to another new high, its implied volatility fell back to the low 13s, yielding no indication of a top just yet. This continues to suggest that option prices are relatively cheap on SPY and on its main components.

Will Tesla Sober up the Market?

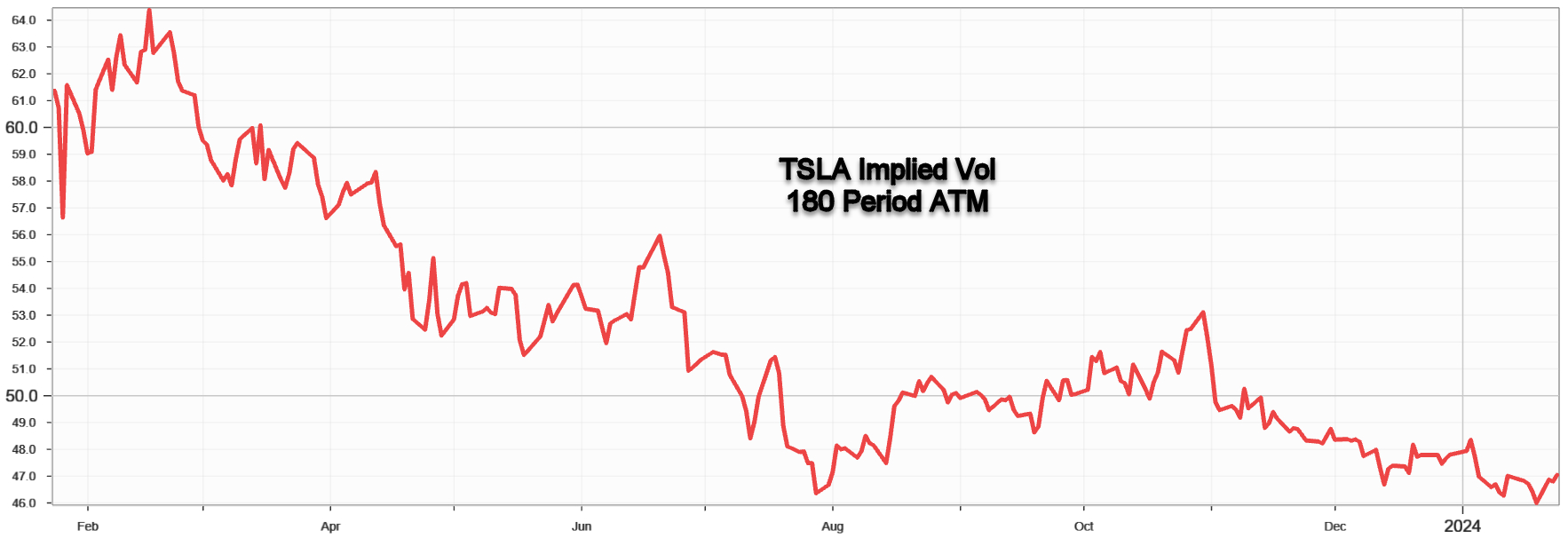

• TSLA peaked in July 2023 and has had two successively lower peaks since then. Earnings were announced after the close Wednesday, sending the stock down to the low 180s on Thursday. That represents about a 40% drop from that July peak. Given its disappointing earnings, its lower growth projections, its stiffer competition, and the general malaise in EV sales, the growth party in TSLA may be over for a while until the next big new development comes. But Musk himself is saying that might be a while - like another 18 months.

• TSLA's implied volatility has likewise been falling but remains in the high 40s. That's down considerably from the 60s a year ago, but even the big tech companies don't have IVs quite so high. Here are some comparisons:

| Symbol | Implied Vol |

| GOOG | 25.7 |

| AAPL | 20.6 |

| MSFT | 23.4 |

| AMZN | 29.4 |

| META | 33.2 |

| NVDA | 39.8 |

| TSLA | 47.1 |

• TSLA's rather steep decline over the last six months coupled with bad growth and earnings news raises the possibility of using hedged strategies for capturing premium on TSLA, but also raises even bigger questions about whether an earnings disappointment on a high-profile stock like TSLA can spook the market into a brief pullback. I will be looking at both TSLA's reaction and at the broader market over the next couple of days to see what opportunities turn up.

Strategy tip: Diagonal spreads

• Calendar spreads are generally thought of as neutral strategies that use the same strike prices in different expirations to capture the difference in time value. But they can be made bullish or bearish when using different strikes, turning them into diagonal spreads. I consider only those that are debit spreads, so there is no margin required. That means the more distant option covers the closer one by being more in the money.

• Diagonals can use either puts or calls and can use any two expirations. I typically make the long option about 2-10 weeks away and the short option the closest available - usually a weekly, but sometimes a daily if there is one available (as on SPY or QQQ). I also make my long side an ITM option and my short side an ATM or OTM option. That way I pay relatively little time value and sell as much time value as I can get.

• These parameters are just examples - you can use whatever strikes and expirations suit you best. If you are doing bullish diagonals with calls, you can view them as you would covered call writes, with the long option simply substituting for owning the stock.

• To take an example, use ARKK, which I mentioned in last week's newsletter. A short-term bullish diagonal on ARKK (45.98) could be:

Long 1 ARKK Feb 16th 40 Call @ 6.50

Short 1 ARKK Feb 9th 46 Call @ 1.65

Net debit = 4.85

If the stock is over 46 on Feb 9th, the strategy returns at least 6 points for a 24% return in 9 days. A more aggressive approach is to sell a 46.5 or 47 call for Feb 9th and a longer-term strategy could purchase a March option, allowing for several potential rolls if the stock is moving up.

Previous issues are located under the News tab on our website.