IV INDEX…IVX: real-time VIX-like measure for each US security |

|---|

|

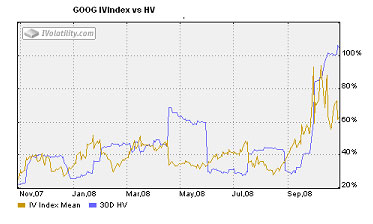

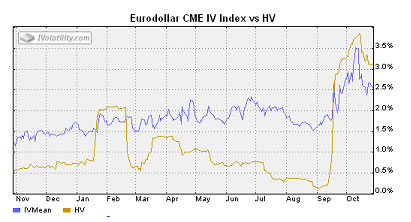

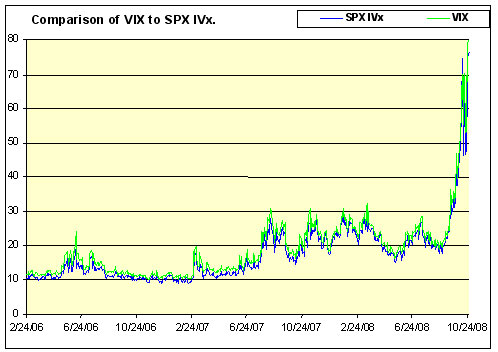

Informed traders and investors need to know the market's implied volatility of the instruments they trade. Many need to know it intraday, on demand, anytime. IVolatility.com, a market leader in providing historical and intraday data, analytical services and tools for the derivatives world, introduced Implied Volatility Index (IVX) almost 10 years ago. The fundamental nature of IVX is the same as VIX, despite differences in the methodology and calculation. "New" VIX (introduced in 2003) is calculated as a weighted average of option prices, using all available range of strikes, thus it is independent of the model used to derive implied volatilities. This technique works well if we have a thick grid of actively traded strikes. This, of course, is true for the S&P 500 and other indices, but not for the majority of optionable stocks. That's why we stick to our way of calculating IV Index - it allows us to calculate this measure for each individual stock, not just for the market in general. The IVX is calculated by using a proprietary weighting technique factoring the Delta and Vega of each option participating in IVX calculations. In total, we use 4 ATM options within each expiration to calculate the Implied Volatility Index of each stock. This IV Index is normalized to fixed tenors (30, 60, 90, 120, 150, 180, 360, 720 days) using a linear interpolation by the squared root of time. Like the VIX, our IVX is an expected stock volatility over a future period. But unlike VIX, we provide an IVX number not just for key stock indices but for each optionable name in US, Europe and Canada. Below is an example of VIX and similar IVX calculated from the S&P500 options volatilities over the last 3 years. As you can see, they perfectly correlate and track each others movements. There is very little difference between them.  Key features of our IVX

IVX is a registered trademark of IVolatility.com |

Please update your credit card details in the Account Details tab within 24

hours to prevent a suspension of your IVolLive account

Update Card Details